Revenue

Earnings

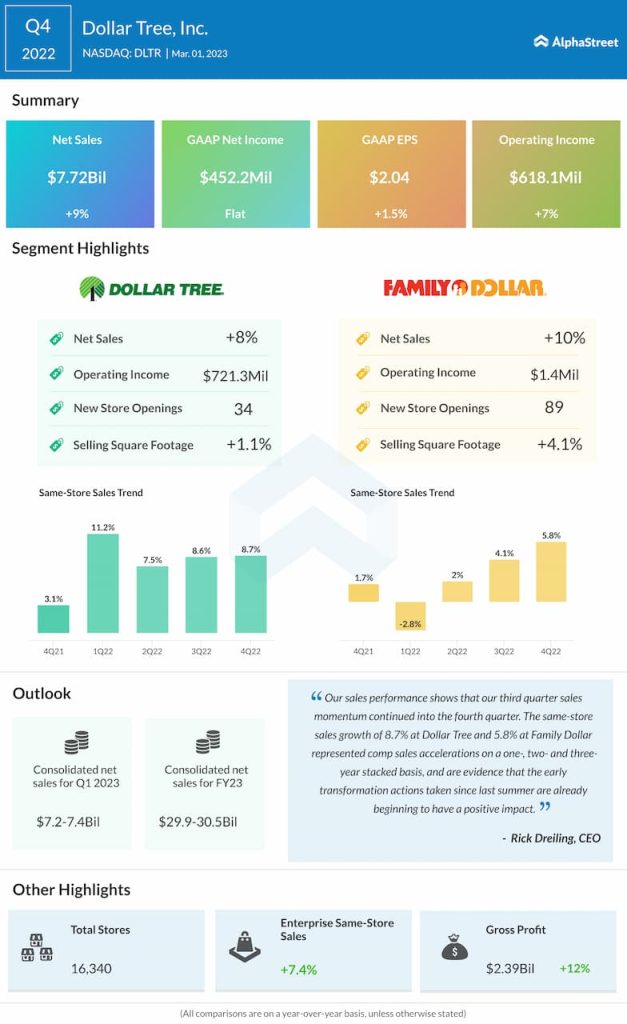

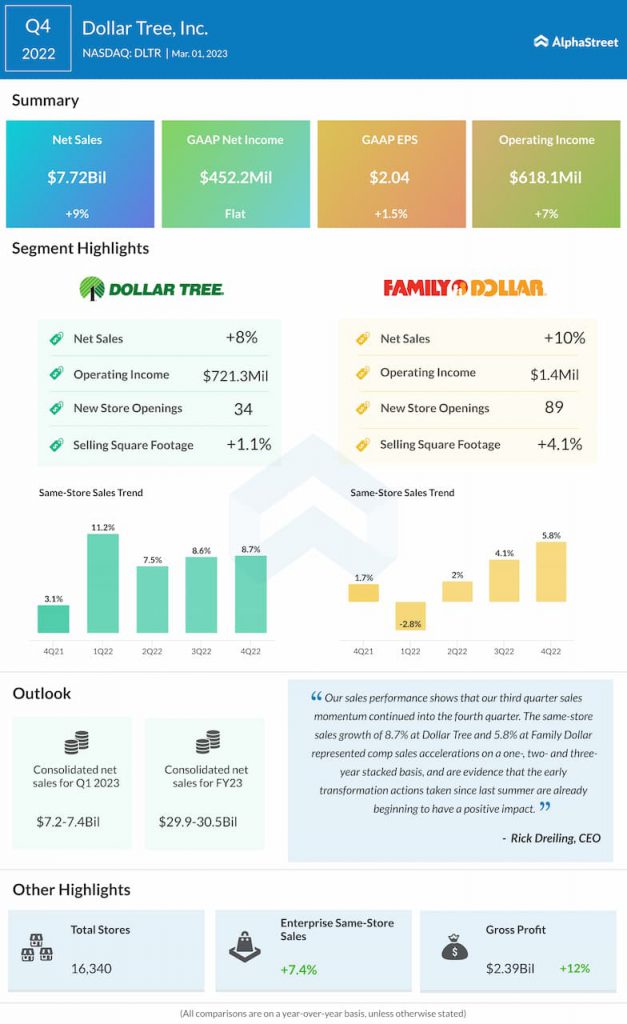

The company has guided for EPS of $1.46-1.56 in Q1 2023. Analysts estimate EPS to be $1.52 in Q1 2023 which compares to EPS of $2.37 in Q1 2022. In Q4 2022, EPS rose 1.5% YoY to $2.04.

Points to note

Dollar Tree has guided for a mid-single digit increase in same-store sales for Q1 2023, with a low single-digit comp increase at the Dollar Tree segment and a mid-single digit comp growth at the Family Dollar segment. In the year-ago quarter, enterprise same-store sales were up 4.4%, with an 11% comp increase for the namesake brand and a 2.8% decline for Family Dollar.

In the fourth quarter, enterprise same-store sales increased 7.4%. Same-store sales at the Dollar Tree and Family Dollar segments increased 8.7% and 5.8% respectively, driven by growth in average ticket.

The initiatives the company is taking with regards to its stores and merchandise can be expected to benefit Q1 results. Despite some weakness in Q4, traffic saw a sequential improvement and appears to be on a positive trajectory that is also likely to have continued into Q1.

Gross margin in Q4 improved 70 basis points to 30.9%, helped by higher initial mark-on and lower freight costs. This was offset by a shift in product mix to lower-margin consumables and higher shrink and markdowns. Margins are expected to face pressure as consumables continue to outpace discretionary sales.

Dollar Tree’s investments in its store transformation and productivity improvements are expected to drive an increase in expenses. These higher expenses are expected to take a toll on margins. The company expects to see a decline in gross and operating margins during the first half of 2023 which means the first quarter could see an impact.