Revenue

Earnings

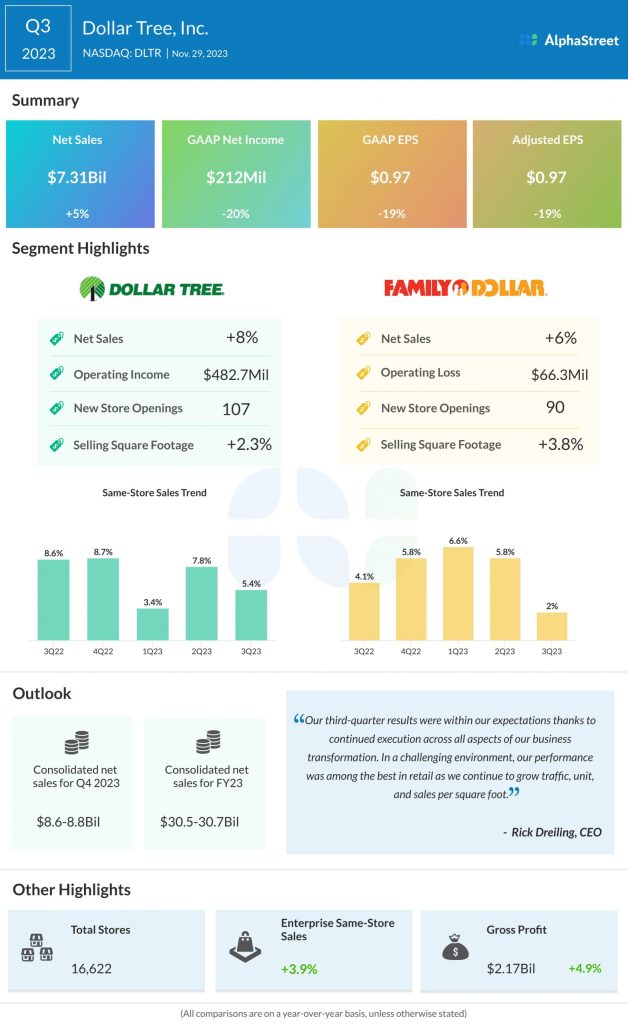

Dollar Tree has guided for EPS to range between $2.58-2.78 in Q4 2023. Analysts are predicting EPS of $2.65 for the fourth quarter of 2023, which compares to EPS of $2.04 reported in the prior-year period. In Q3 2023, adjusted EPS declined 19% YoY to $0.97.

Points to note

For the fourth quarter of 2023, Dollar Tree has guided for a low single-digit increase in enterprise same-store sales, with a mid-single-digit increase for the Dollar Tree segment. Same-store sales are expected to range between down 1% to up 1% for the Family Dollar segment in Q4. In Q3, enterprise same-store sales increased 3.9%, with growth of 5.4% in the Dollar Tree segment and growth of 2% in the Family Dollar segment.

On its Q3 earnings call, the company said it expects shrink trends to remain unfavorable in the fourth quarter. The anticipated softness in Family Dollar comps reflect an unfavorable macro environment for low-income households, continued weakness in discretionary categories, and heightened promotional activity in the market. Meanwhile, the Dollar Tree banner is expected to see continued strength on the back of a compelling value proposition and multi-price strategy.

Last quarter, DLTR benefited from a growth in traffic. The company continues to attract new customers and gain unit and dollar market share. Most of its first-time customers have become repeat shoppers and they vary across a broad range of income levels.

Dollar Tree will likely see strength in the consumables category continue in Q4 while discretionary categories experience softness. The company is also likely to benefit from its multi-price assortment, expanding private brand penetration, and its store renovations.