Revenue

Earnings

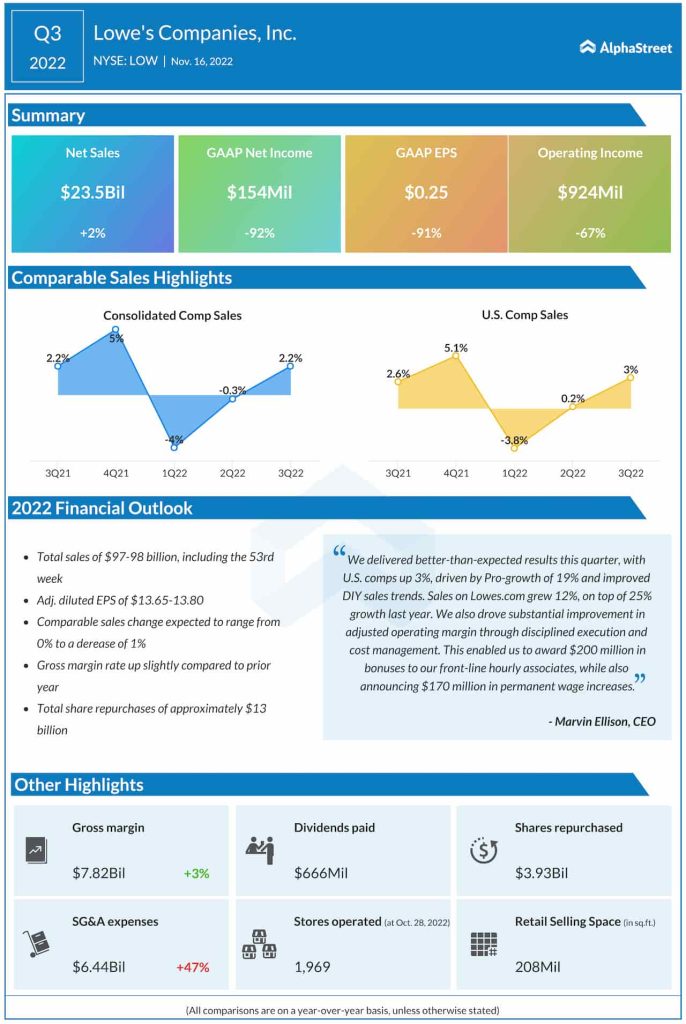

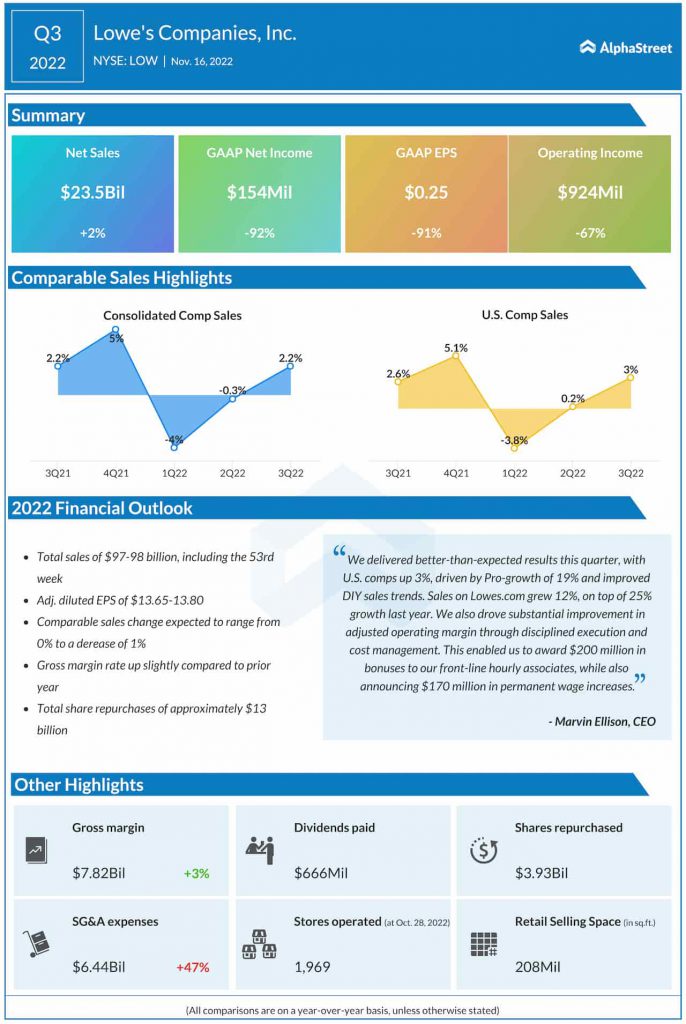

The consensus target for EPS in Q4 2022 is $2.21 which compares to adjusted EPS of $1.78 reported in Q4 2021. In Q3 2022, adjusted EPS rose nearly 20% year-over-year to $3.27.

Points to note

On its third quarter conference call, Lowe’s maintained an optimistic outlook on the prospects of the home improvement market. However, the latest earnings report from its rival Home Depot (NYSE: HD), which was released this week, paints a different picture. Home Depot’s net sales in Q4 2022 did not see much growth from the year-ago period and the company forecasted a moderation in demand for home improvement in 2023.

On its Q3 call, Lowe’s had mentioned that the average age of homes in the US is over 40 years old and this was a key reason why a large part of home improvement involved repair or maintenance projects that could not be delayed thereby making it a non-discretionary spend. The retailer also said that over 70% of its Pro customers expected to get more work in 2023 than 2022. In its Q4 report, Home Depot also stated that its Pro backlogs remain high compared to historical averages. So it is likely that Lowe’s could have benefited from this trend in its fourth quarter.

In Q3, Lowe’s witnessed broad-based growth across Pro and DIY in the millwork, rough plumbing, electrical, lumber and building materials divisions. Building products benefited from strength in the DIY category as lumber prices came down and customers picked up home improvement projects they had put off earlier. In Q4, Home Depot recorded positive comps in departments like building materials, plumbing, and outdoor garden.

Home Depot expects to see flat consumer spending in 2023 and it has hinted at the possibility of a decline in the home improvement market. It remains to be seen whether Lowe’s will follow in its peer’s footsteps or whether it stands to gain in its own right.

Also read: Home Depot (HD): Three factors that do not work in favor of this home improvement retailer