Revenue

Earnings

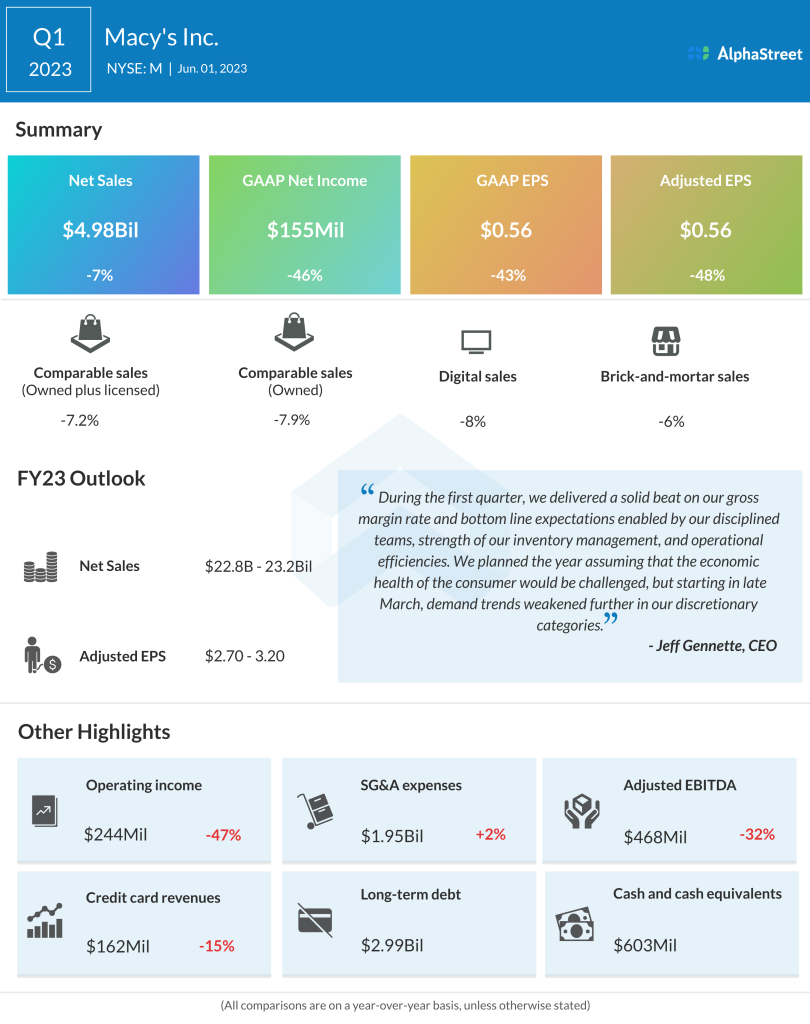

Macy’s has guided for adjusted EPS of $0.10-0.15 for Q2 2023. Analysts are forecasting EPS of $0.13 for Q2 which compares to $1.00 reported in the year-ago period. In Q1 2023, adjusted EPS fell to $0.56 from $1.08 in the prior-year period.

Points to note

Macy’s continues to be pressured by a challenging economic environment and shifts in consumer spending. Demand for discretionary categories weakened as customers moved their spending to food and essentials. Comparable sales fell 7.9% on an owned basis and 7.2% on an owned-plus-licensed basis. These pressures are expected to continue in the second quarter.

Gross margin in Q1 rose to 40% from 39.6% in the year-ago period. Merchandise margin remained flat, benefiting from lower clearance markdowns. In the second quarter, the company plans to implement deeper markdowns to clear its excess inventory, which is expected to lead to a drop in gross margin.

Macy’s is expected to benefit from its investments in private brands, small-format stores and Macy’s Marketplace. The company is seeing encouraging results from its small-format stores and remains optimistic about the opportunity in this space.