Revenue

Earnings

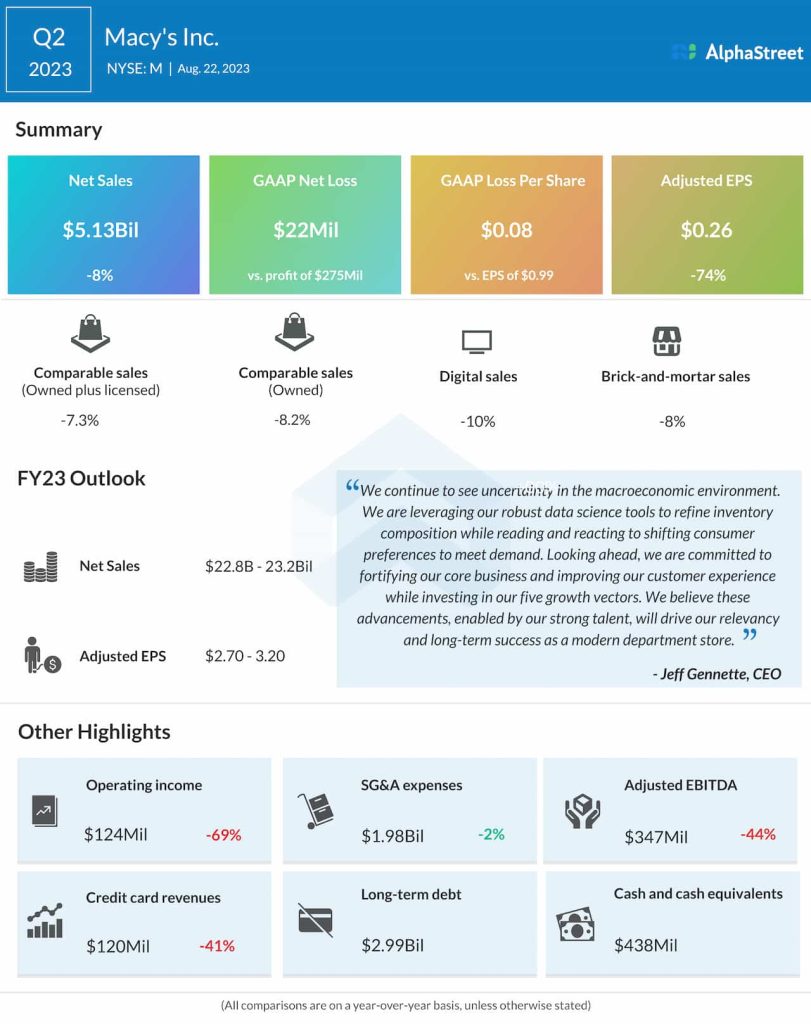

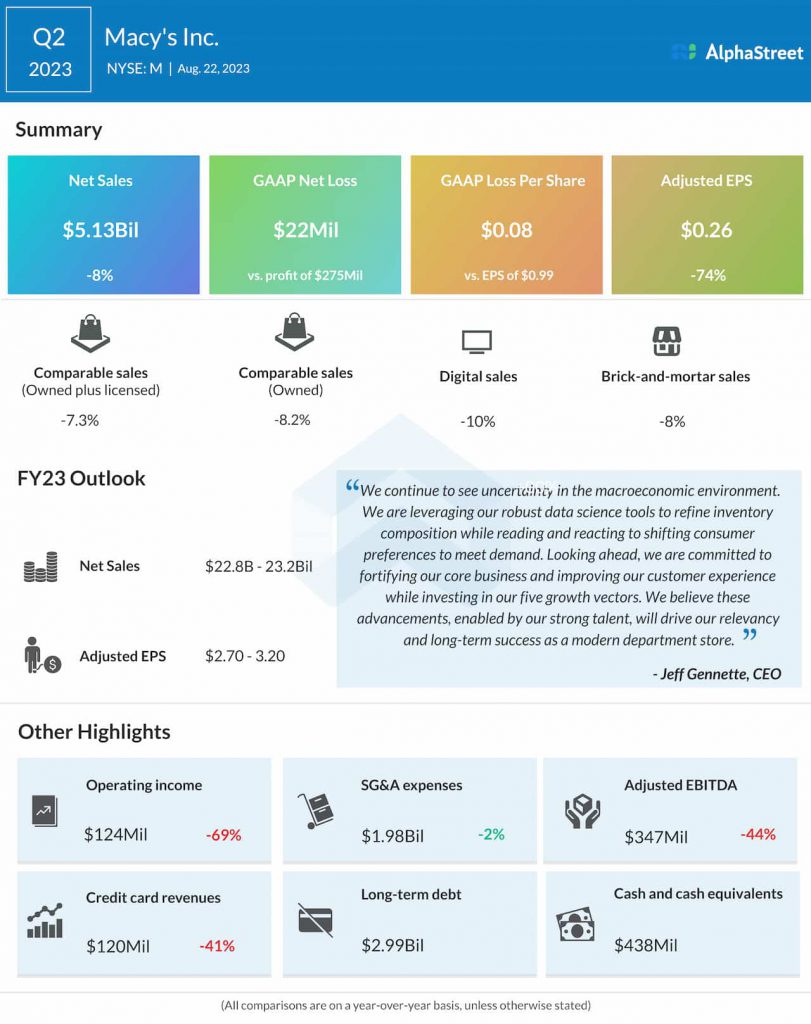

Macy’s has guided for adjusted EPS to be down $0.03 to up $0.02 in Q3 2023. The consensus estimate is for a loss of $0.03 per share in Q3 2023. This compares to adjusted EPS of $0.52 reported in the prior-year period. In Q2 2023, adjusted EPS was $0.26.

Points to note

Macy’s has been facing a challenging environment as consumer spending remains pressured. In the second quarter of 2023, the company’s top line was impacted by lower credit card revenues caused by a higher rate of delinquencies. This trend may have continued into the third quarter. In Q2, the retailer said it was maintaining a cautious outlook with regards to the consumer’s capacity to spend on discretionary goods.

However, Macy’s efforts in inventory management and its investments in stores and other initiatives could prove beneficial. Inventories were down 10% at the end of last quarter, reflecting clearance of excess spring seasonal product. The company is focusing on keeping inventories at the appropriate receipt levels based on expected sales demand.

Macy’s expects its gross margins for the third quarter to see an improvement year-over-year as last year, it had to resort to higher discounting to clear out warm weather seasonal goods and slow-moving pandemic-related categories like casual apparel. The company’s margins in Q2 were also impacted by discounting undertaken to clear out spring seasonal product.

The retailer continues to invest in its small store format. These stores are performing well and are expected to drive growth over the long term. Last quarter, the company saw positive comps at its locations that had been open for a year. Macy’s had plans to open a number of small-format stores during the third quarter and updates on this will be worth noting.