Revenue

Earnings

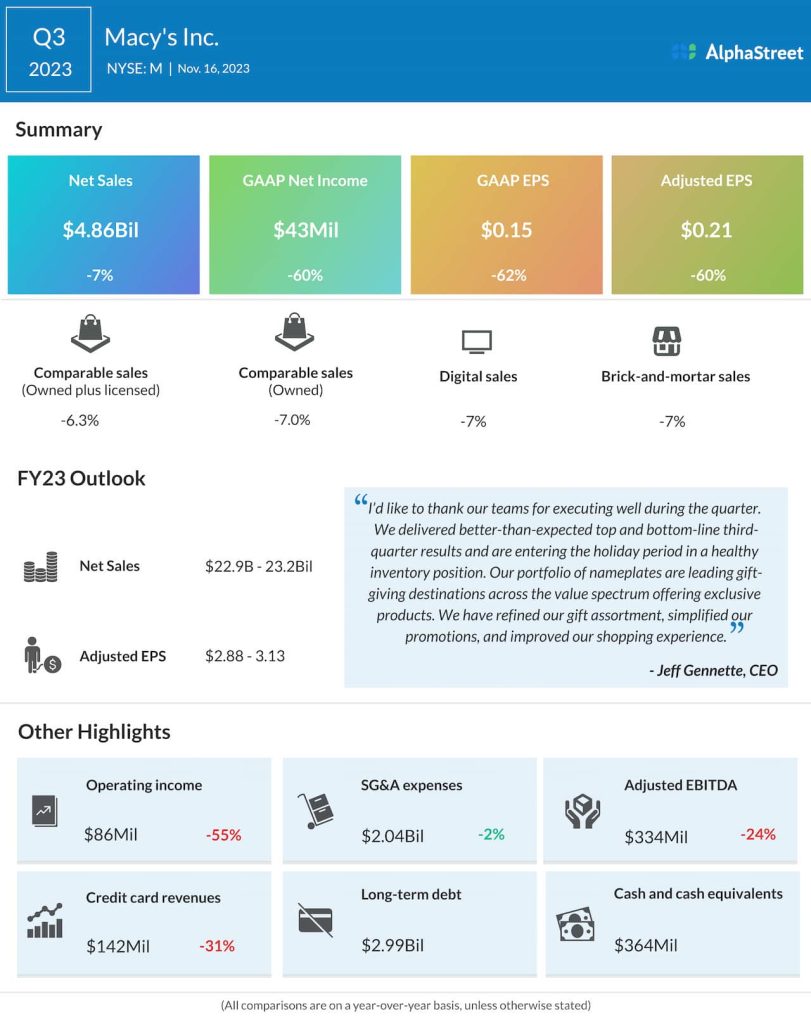

Macy’s has guided for adjusted EPS of $1.85-2.10 for Q4 2023. Analysts are predicting EPS of $1.96 for the fourth quarter. This compares to adjusted EPS of $1.88 reported in Q4 2022. Adjusted EPS was $0.21 in Q3 2023.

Points to note

Last quarter, Macy’s comparable sales declined 7% on an owned basis and 6.3% on an owned-plus-licensed basis. Comparable sales were down across its nameplates as well, barring Bluemercury, which saw a rise of 2.5%. On its Q3 call, the company said its customers across nameplates might remain under pressure and cautious in their discretionary spend during the holidays.

Macy’s gross margin rate rose to 40.3% last quarter, with merchandise margin gaining 110 basis points, helped by lower markdowns. The retailer expects gross margins for the fourth quarter of 2023 to be at least 220 basis points better than the year-ago period. In Q4 2022, Macy’s had implemented higher markdowns and promotions to deal with tough competition.

The company’s continued investments in its growth vectors like small format stores, private brands, and digital marketplace, are likely to yield benefits. Its small format stores are roughly one-fifth the size of its full-line stores and they continue to generate comparable owned-plus-licensed sales growth. Its digital marketplace continues to scale and it grew gross merchandise value by approx. 22% last quarter.

This will be the first earnings call with the new CEO Tony Spring at the helm. Updates on new plans, initiatives and changes will be worth watching.