Revenue

Earnings

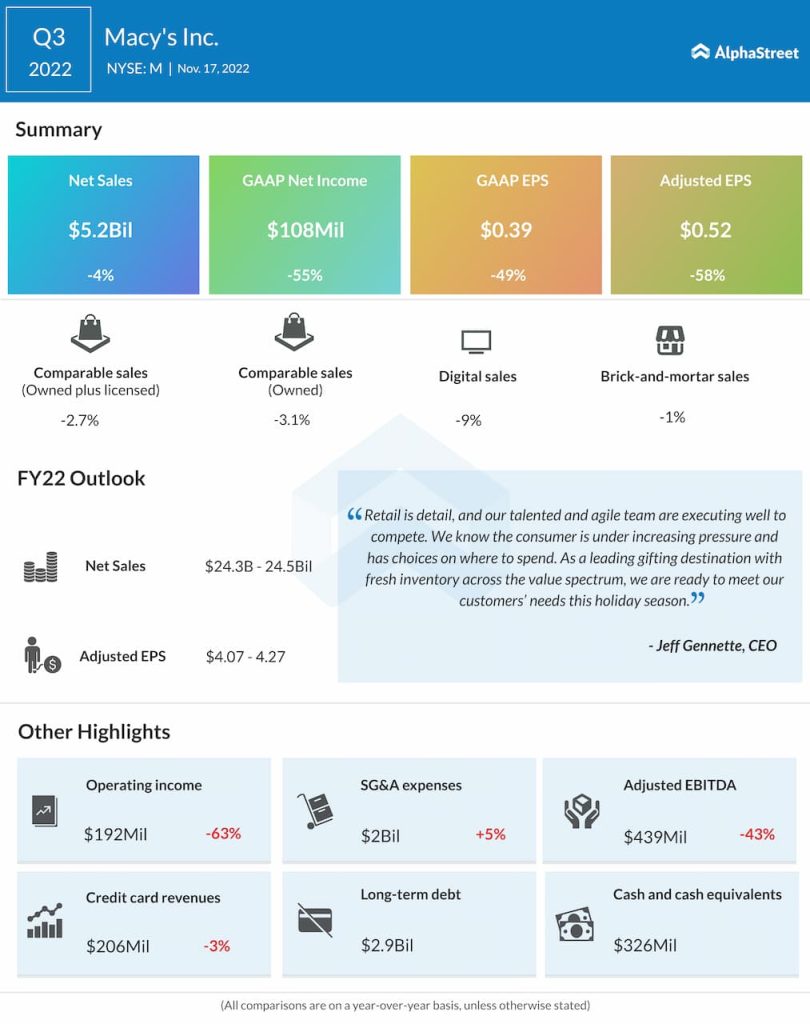

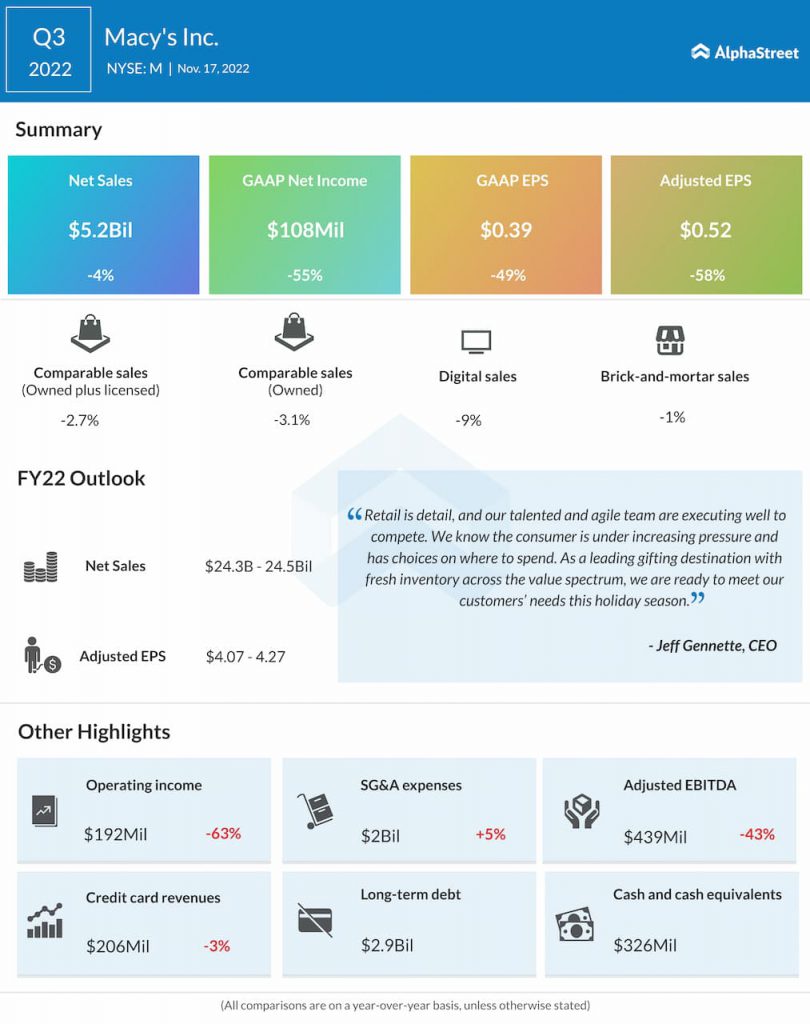

For Q4 2022, Macy’s expects adjusted EPS to range between $1.47-1.67. The consensus estimate is $1.57. The company reported adjusted EPS of $2.45 in Q4 2021 and $0.52 in Q3 2022.

Points to note

In Q3 2022, Macy’s net sales declined 3.9% year-over-year but rose 3.1% versus the same period in 2019. As customers continued to return to stores, they shifted more to occasion-based categories like dresses and luggage versus categories like casual wear and soft home that were popular during the pandemic.

In Q3, Macy’s owned plus licensed comparable sales declined 2.7% but its luxury nameplates Bloomingdale’s and Bluemercury posted comp sales growth of 4% and 14% respectively. The company sees significant long-term growth opportunity for both these nameplates.

Macy’s investments in its digital and omnichannel capabilities are likely to pay off. The company has been rolling out personalized offers and loyalty programs as well as offering a mix of private label and branded products. However, higher promotions and markdowns to push slow-moving categories have been weighing on margins. The company expects gross margin in Q4 2022 to be no more than 270 basis points lower than Q4 2021.

Through a competitive holiday season and an inflationary environment, Macy’s saw Black Friday/Cyber Monday sales in line with its expectations, with the week leading up to and following Christmas turning out better than anticipated. However, the non-peak holiday weeks remained more muted than expected.

The company saw strength in occasion apparel and its gift-giving business during the holidays and its luxury nameplates Bloomingdale’s and Bluemercury continued to outperform throughout the season.