The company’s investments in store development, delivery

services and menu innovations are likely to help boost results and drive growth

going forward. However, the fast food chain faces tough competition from the

increasing number of delivery services that are now available in the market.

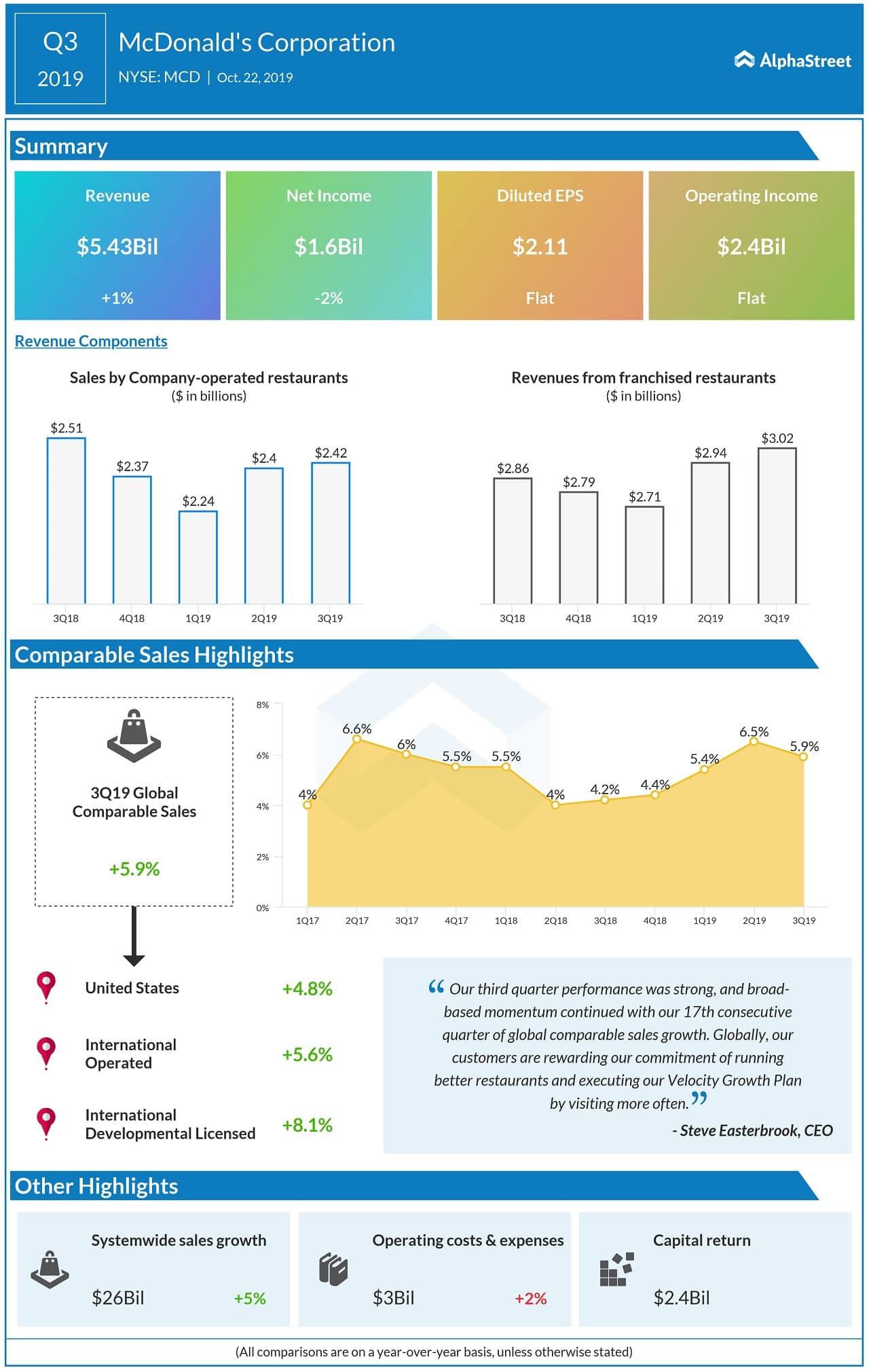

In the third quarter of 2019, McDonald’s missed revenue and earnings expectations. Revenue inched up 1% to $5.43 billion while EPS of $2.11 remained flat year-over-year. Revenues from franchised restaurants grew 5% while revenues from company outlets fell 4%.

Shares of McDonald’s have gained 13% over the past one year and 7% over the past three months. The majority of analysts have rated the stock as Buy and it has an average price target of $223.24, which represents an upside of 6% from the current price.