Shares of Netflix, Inc. (NASDAQ: NFLX) were up slightly on Tuesday. The stock has gained 15% year-to-date and 3% over the past three months. The company is scheduled to report its first quarter 2023 earnings results on Tuesday, April 18, after market close. Here’s a look at what to expect from the earnings report:

Revenue

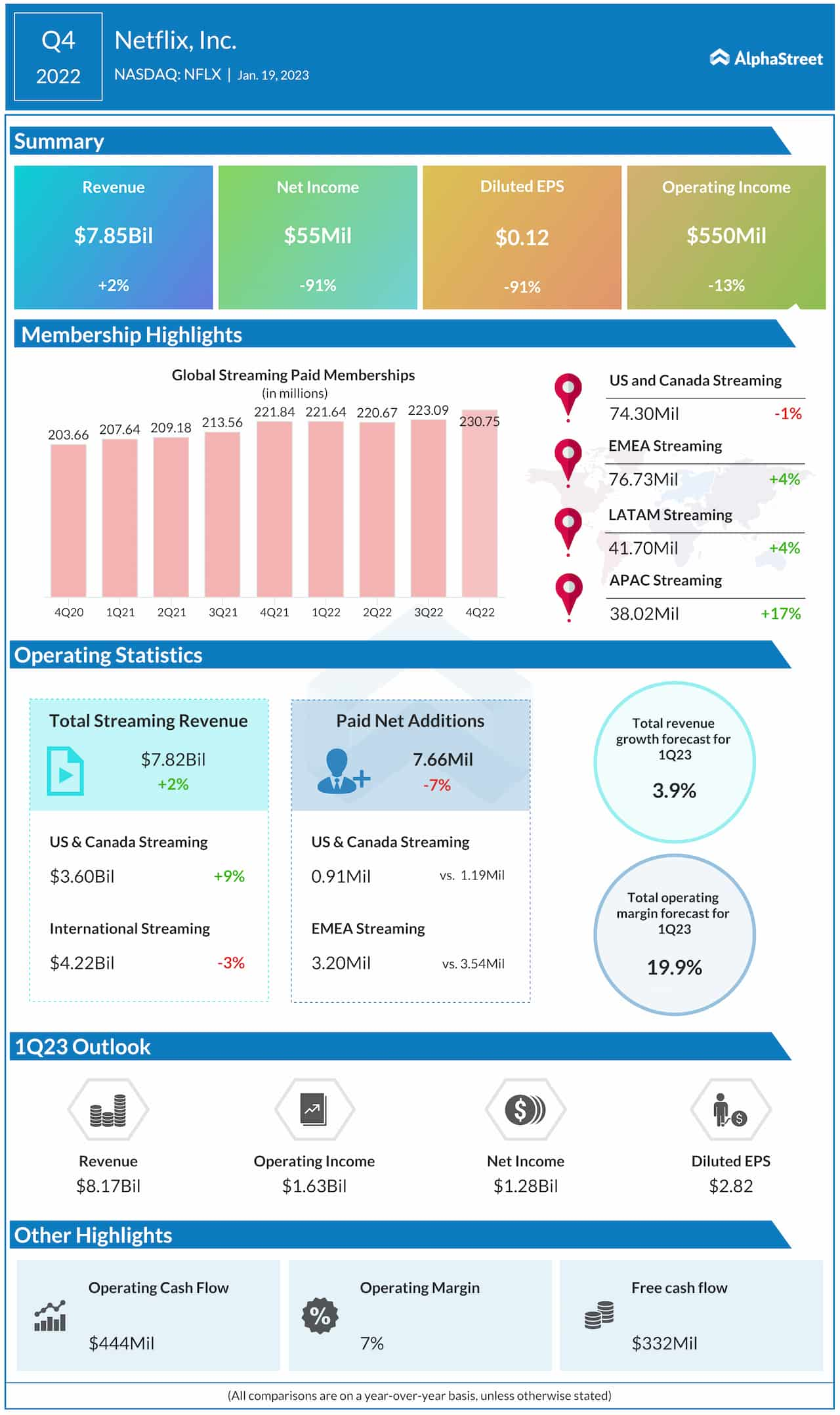

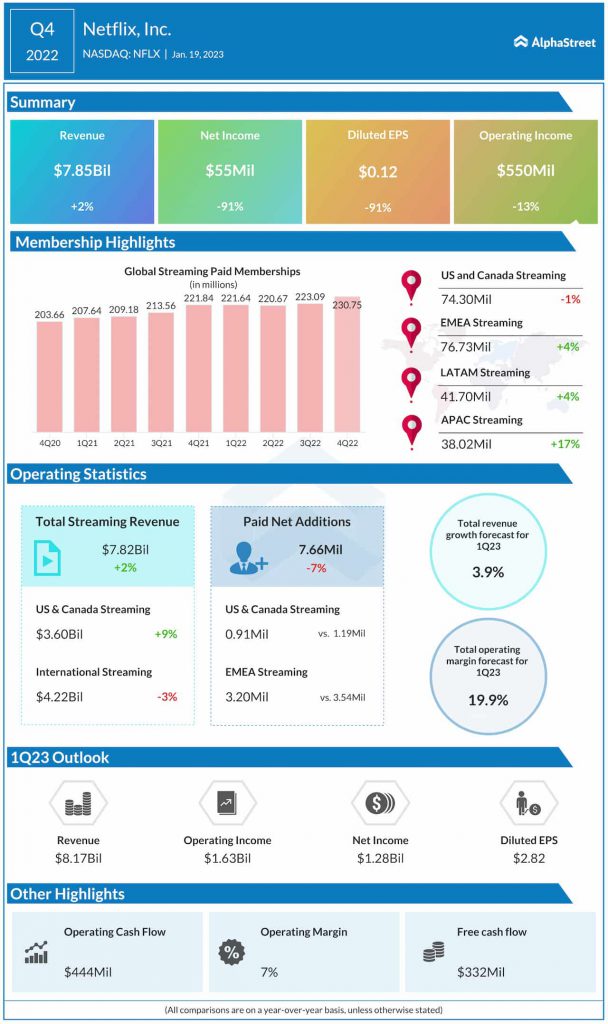

Netflix has guided for revenue of $8.17 billion for the first quarter of 2023, which represents a growth of nearly 4% from the same period a year ago. The top line estimate represents a 3.8% growth sequentially. Analysts are also projecting revenue of $8.17 billion for Q1 2023.

Profitability

Netflix has guided for net income of $1.27 billion, or $2.82 per share, for the first quarter of 2023, which compares to $1.59 billion, or $3.53 per share, reported in the first quarter of 2022. Net income was $55 million, or $0.12 per share in Q4 2022. Analysts are projecting EPS of $2.86 for Q1 2023.

The company has guided for operating income of $1.62 billion and operating margin of 19.9% for Q1 2023. This compares to operating income of $1.97 billion and operating margin of 25.1% reported in Q1 2022. In Q4 2022, operating income was $550 million and operating margin was 7%.

Points to note

For the first quarter of 2023, Netflix expects revenue to grow 8% on an FX-neutral basis, driven by growth in average paid memberships and average revenue per membership (ARM). The company expects a modest increase in subscribers for Q1 2023 which compares to a decrease of 0.2 million subscribers in Q1 2022.

The streaming giant added 7.7 million subscribers in the fourth quarter of 2022 and therefore expects fewer paid net adds for the first quarter on a sequential basis due to some of the growth likely being pulled forward from Q1.

Netflix also had plans to expand paid sharing into more markets during the first quarter of 2023 and it expects this will change its quarterly subscriber growth pattern completely in 2023. The company believes paid net adds might be higher in Q2 2023 than Q1 2023.

Netflix also expects member growth in the near term to be impacted by some cancellations as it rolls out paid sharing in each market but as borrowers sign up for their own accounts and as extra member accounts are added, overall engagement and revenue are expected to improve.