Shares of Netflix Inc. (NASDAQ: NFLX) stayed red on Wednesday. The stock has gained 38% over the past three months. The streaming giant is scheduled to report its fourth quarter 2023 earnings results on Tuesday, January 23, after markets close. Here’s a look at what to expect from the earnings report:

Revenue

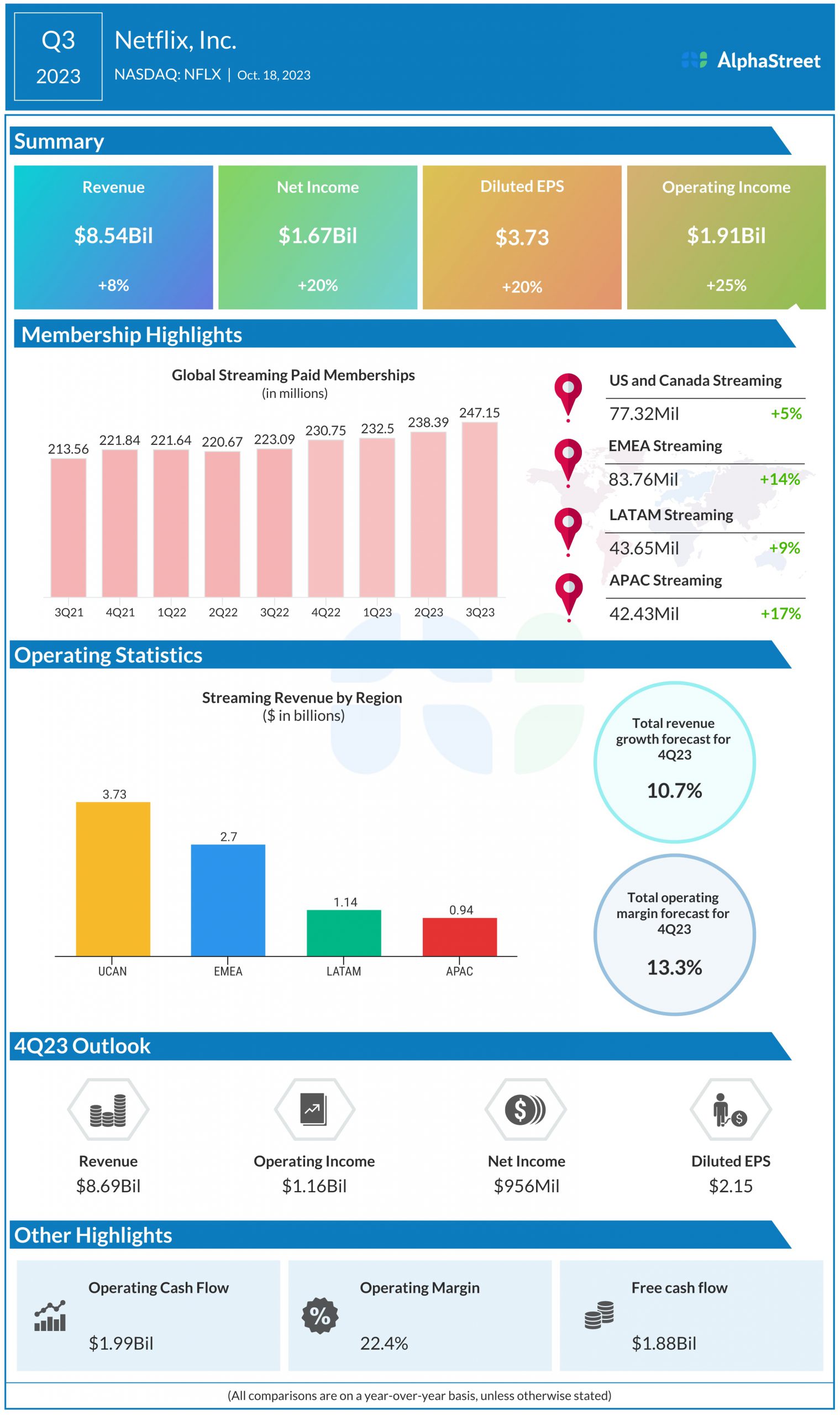

Netflix has guided for revenue of $8.69 billion for the fourth quarter of 2023, which would represent a year-over-year growth of 11%. Analysts are projecting revenue of $8.71 billion for the quarter. This compares to revenue of $7.85 billion reported in the fourth quarter of 2022 and $8.54 billion reported in the third quarter of 2023.

Earnings

Netflix expects net income of $956 million, or $2.15 per share, for Q4 2023. Analysts are predicting EPS of $2.21 for the fourth quarter. The company reported EPS of $0.12 in Q4 2022 and $3.73 in Q3 2023.

Points to note

Netflix expects operating income to be $1.16 billion and operating margin to be 13.3% in Q4 2023. This compares to operating income of $550 million and operating margin of 7% in Q4 2022. In Q3 2023, operating income was $1.9 billion and operating margin was 22.4%.

In its last earnings report, the company said it expects paid net additions for the fourth quarter to be similar to the third quarter, plus or minus a few million. Paid net additions were 8.76 million in Q3. Global average revenue per membership (ARM) in Q4 is expected to be roughly flat year-over-year, mainly due to limited price increases. The strengthening of the US dollar is expected to weigh on revenue and ARM in the fourth quarter.

Netflix has been rolling out paid sharing across all its regions and the cancel reaction has been better than expected. Borrower households converting into full paying memberships have displayed healthy retention. The company is also optimistic about the vast opportunity it sees for its ads business. In the third quarter, its ads membership increased nearly 70% quarter-over-quarter. Updates on these areas are worth watching.