Revenue

Profits

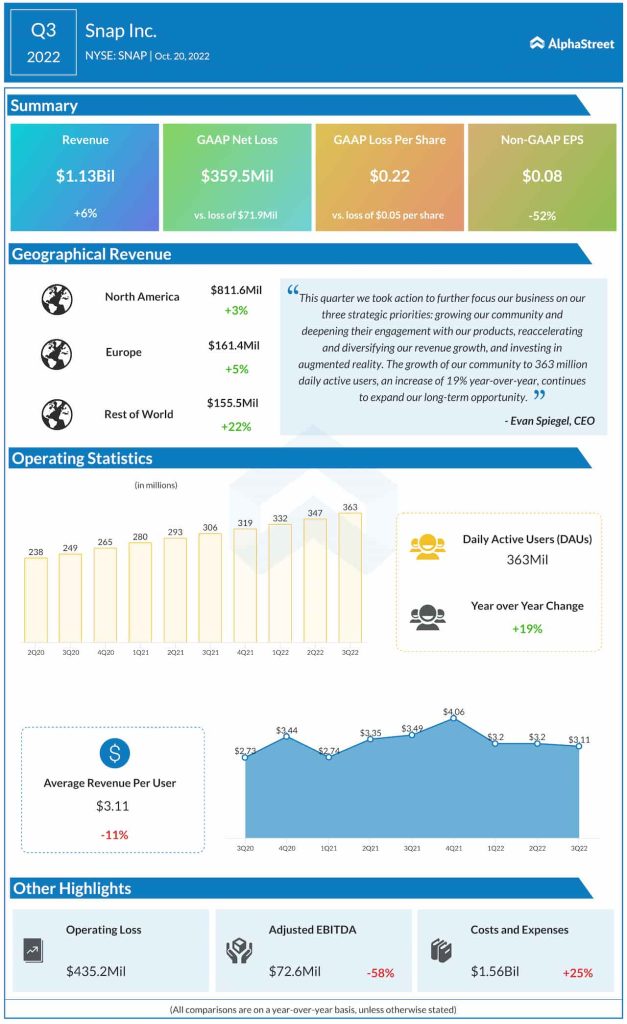

Analysts expect EPS of $0.11 for the fourth quarter of 2022, which compares to adjusted EPS of $0.22 reported by the company in the same period a year ago. Adjusted EPS was $0.08 in the third quarter of 2022.

User growth

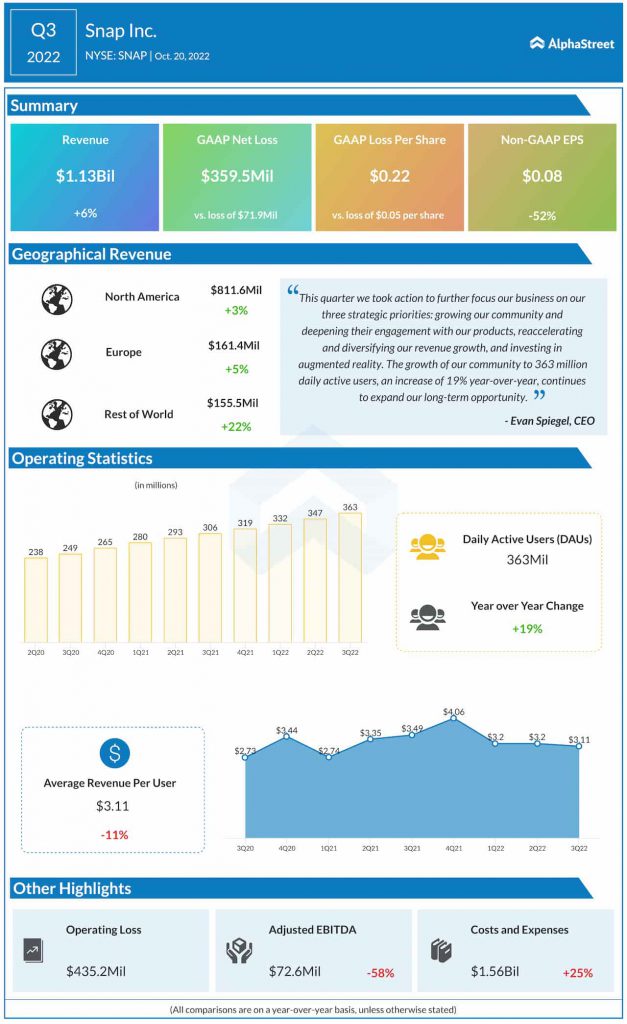

In its Q3 earnings report, Snap said it estimates daily active users (DAUs) to reach around 375 million in the fourth quarter of 2022. This would reflect a growth of 17.5% from the year-ago quarter. In Q3, DAUs grew 19% YoY to reach 363 million.

Points to note

During the third quarter, revenue growth continued to slow down as it was impacted by a challenging macroeconomic environment, platform policy changes and increased competition. The decrease in brand-oriented advertising spend affected the company’s results during the third quarter and this trend is likely to have continued into the fourth quarter as well.

Snap continues to grow its community and during the third quarter, it saw DAUs grow across all its regions. The company is rolling out new features to increase engagement on its platform. Discover and Spotlight continue to be popular among users with the company seeing a 55% growth in total time spent watching Spotlight content during Q3.

Another growth area for Snap is augmented reality. The company continues to invest in Spectacles, its augmented reality glasses, as well as Lens Studio, Lens Engine and Lens Cloud, all of which are key to giving the company a competitive edge over the years to come.

Snap continues to face stiff competition from other social media companies with regards to user engagement as well as digital advertising. As most of its revenue comes from ads, the ad spend environment and its effect on the company’s results is a key point to watch.