Revenue

Earnings

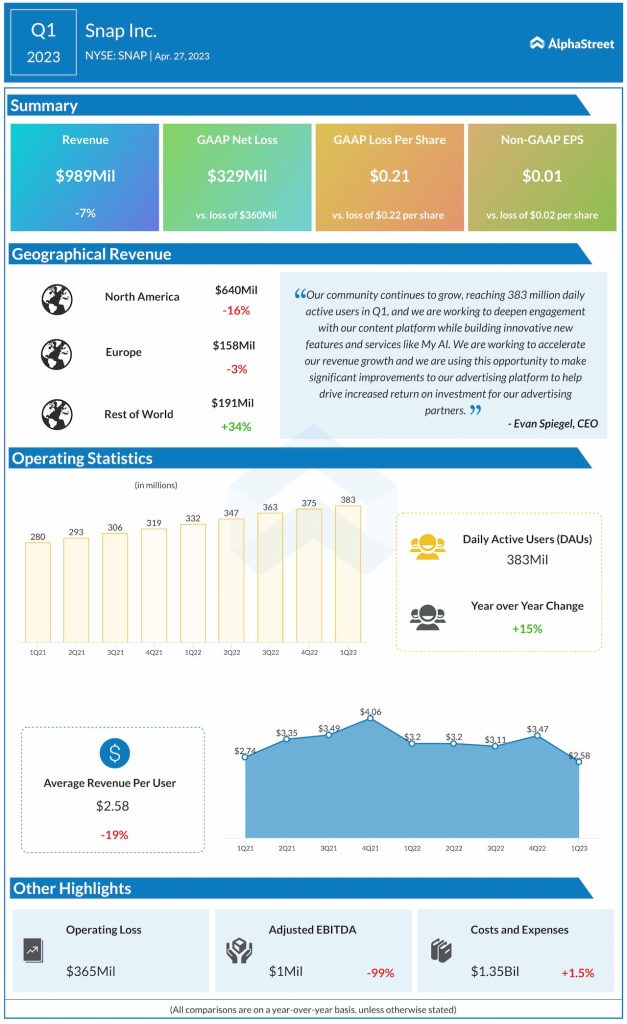

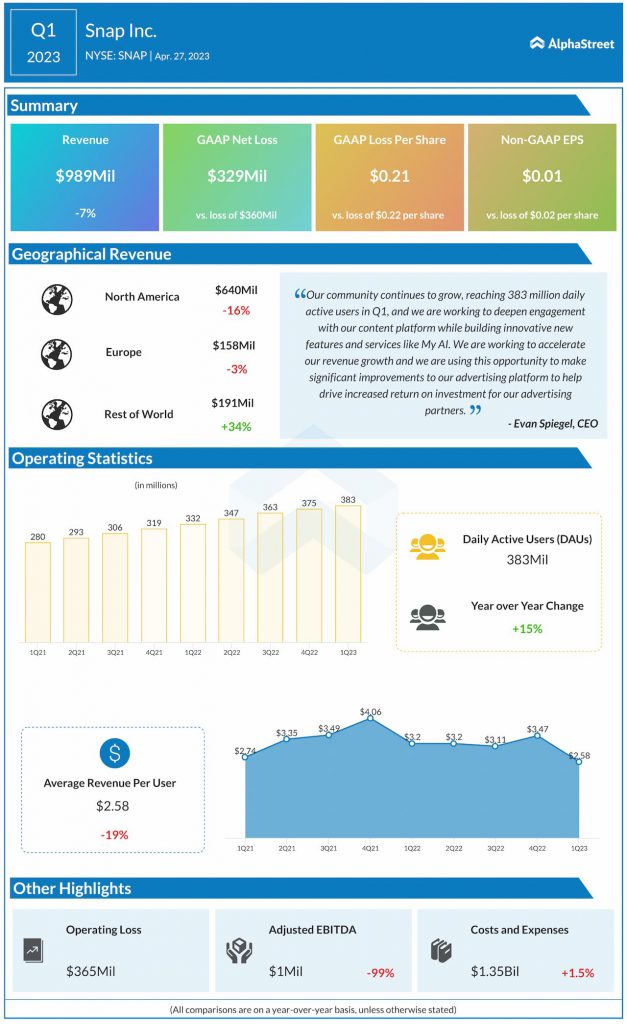

Analysts are projecting a loss of $0.04 per share for Snap in Q2 2023. This compares to a loss of $0.02 per share reported in the prior-year quarter. In Q1 2023, the company reported adjusted EPS of $0.01.

Points to note

Snap’s revenue in Q1 was impacted by a decline in its advertising business. Its brand-oriented advertising business was down 12% YoY while its direct response ad business was down 9%. The drop in the advertising business was caused by a challenging macro operating environment and the impact of advertising platform changes implemented early in Q1. As advertisers continue to navigate these changes, it has caused a disruption in demand which is expected to continue in the second quarter as well.

In Q1, daily active users (DAUs) increased 15% YoY to 383 million. DAUs grew both sequentially and on a YoY basis across all geographic regions. For the second quarter, Snap expects DAUs to range between 394-395 million.

The company also plans to make incremental investments in Q2 to improve engagement and drive revenue growth. These investments, which will be included as cloud infrastructure expenses, are expected to add 8-12 cents to its infrastructure cost per DAU in Q2. In Q1, this number was $0.59.

These infrastructure investments as well as the investments made in the Stories revenue share program are expected to put pressure on gross margins in the near term but are anticipated to be accretive over time.