Outlook

The company has a strong balance sheet, and the healthy cash flow should allow it to further expand the store network. Being the largest aftermarket auto parts dealer in the country, its long-term growth prospects are bright. In the thriving automotive market, there is a high demand for maintenance and replacement parts, which bodes well for AutoZone. The business is non-cyclical in nature, and the company has been aggressively expanding into emerging markets.

From AutoZone’s Q3 2023 earnings call:

“After the most significant product cost inflation we have seen in decades, we are seeing those trends moderate and are negotiating some cost reductions from our vendors, as both product cost and freight inflation are slowing or have subsided. Additionally, while not anywhere close to historical norms, we saw wage inflation moderate to approximately 4%. While the staffing environment is substantially improved versus this time last year, we don’t envision wage inflation pulling back much from these levels as there continues to be regulatory and market pressures.”

It is estimated that AutoZone earned $45.24 per share in the August quarter, the results for which are expected to come on September 19, before markets open. In the prior-year quarter, the company reported earnings of $40.51 per share. The consensus revenue estimate for the fourth quarter is $5.63 billion, which represents a 5.3% annual growth.

Financials

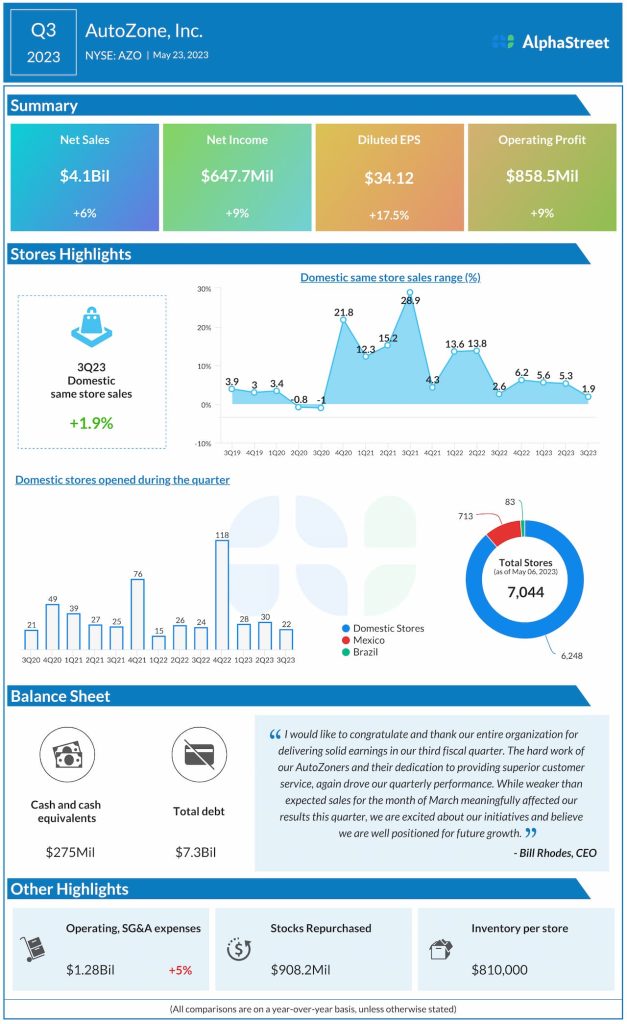

In the past three years, the company’s earnings beat estimates in every quarter, and the trend is expected to continue. In the May quarter, net sales grew about 6% to $4.1 billion year-over-year but fell short of expectations mainly due to weaker-than-expected sales in the month of March. Domestic same-store sales increased by 1.9% in the third quarter when the company opened 22 new stores in the US, six in Mexico and two in Brazil. Net income increased 9.3% to $647.7 million, and earnings per share rose 17.5% to $34.12 in Q3, compared to last year.

AutoZone’s stock, which has been declining since last week, traded lower Tuesday afternoon. But the long-term prospects look good, and the stock seems to be on track to hit a new high.