Revenue

Earnings

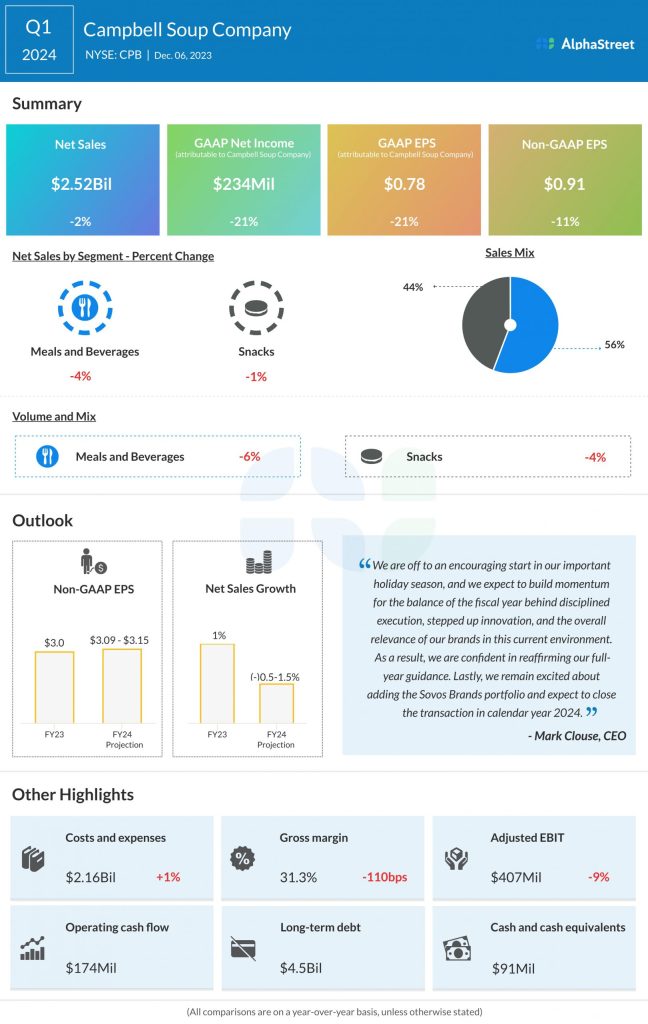

The consensus estimate for EPS in Q2 2024 is $0.77. This compares to adjusted EPS of $0.80 reported in Q2 2023. In Q1 2024, adjusted EPS declined 11% to $0.91.

Points to note

Campbell continues to operate in a challenging consumer environment, with customers stretching their budgets and looking for maximum value in their purchases. Last quarter, the company said it expects net sales for the second quarter to follow in-market trends with likely modest sequential volume improvement from the first quarter. Volume and mix are expected to remain negative.

In the first quarter, Campbell’s net sales decreased as it faced tough comparisons to the prior-year period. The company saw sales decline in its Meals & Beverages segment due to a drop in the condensed and ready-to-serve categories as customers opted for more stretchable meals versus single-serve options. However, Campbell remains optimistic about the prospects of this segment as it believes it is well-positioned to cater to the demand for affordable and stretchable meal solutions.

The Snacks business saw sales growth on an organic basis last quarter, driven by growth in its power brands. The power brands faced pressures from lower-margin partner brands and fresh bakery, which are more susceptible to private label and consumer trade-down. These trends are likely to continue in Q2.