The Stock

The Rhode Island-headquartered pharmacy chain is preparing to release its third-quarter 2024 report on Wednesday, November 6, at 6:30 am ET. Market watchers forecast a decline in adjusted earnings to $1.53 per share from $2.21 per share last year. The consensus revenue estimate is $92.75 billion, compared to $89.8 billion in Q3 2023. In the preceding quarter, earnings came in above expectations while revenues missed.

Headwinds

In general, the retail pharmacy and health insurance industries are going through a rough patch, with higher costs eating into companies’ margins and e-commerce players like Amazon grabbing market share. CVS shut several stores in 2024 and is planning more closures before year-end. Last month, the company appointed David Joyner as its new chief executive officer, replacing Karen Lynch who has faced criticism for the lackluster performance of the business.

From CVS’ Q2 2024 earnings call:

“As we have previously discussed, we expect to see a decline in Medicare membership in 2025 driven by our margin recovery efforts. In our Commercial business, we expect membership growth in 2025 driven by new business wins and strong retention, both of which are running ahead of where we were at this time last year. Our return rate is in the high 90s with our National Accounts business. In our Pharmacy and Consumer Wellness business, we effectively navigated a changing consumer environment and delivered another strong quarter that exceeded our expectations.”

Q2 Outcome

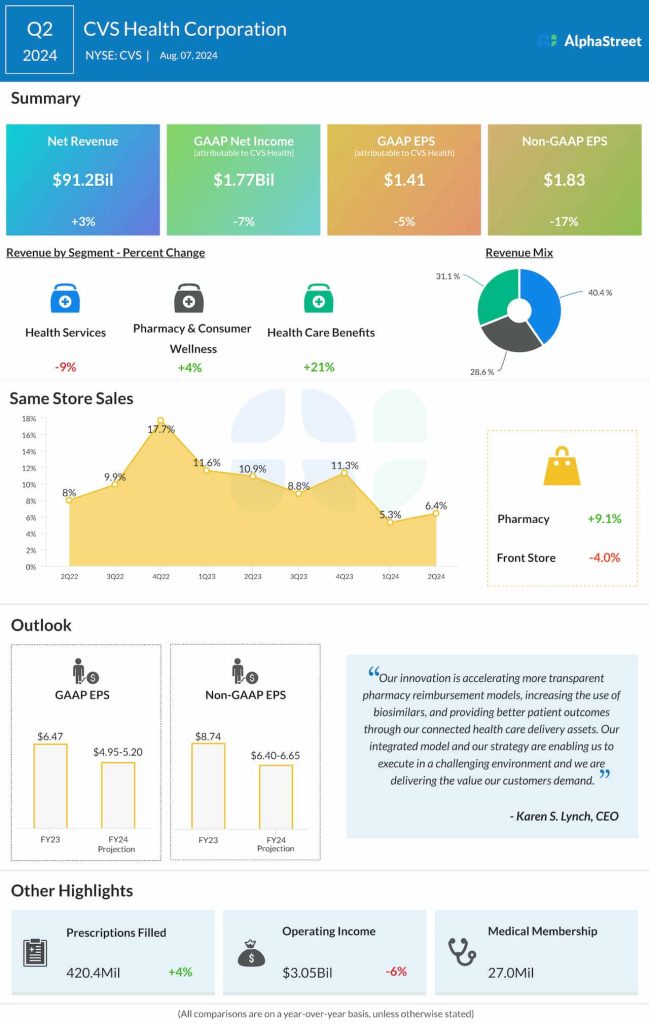

In the June quarter, adjusted profit decreased 17% year-over-year to $1.83 per share. On a reported basis, net income was $1.77 billion or $1.41 per share in Q2, compared to $1.90 billion or $1.48 per share in the prior-year quarter. Meanwhile, revenues rose 3% year-over-year to $91.2 billion. Total same-store sales rose 6.4% year-over-year during the three months.

CVS shares stayed mostly below their 12-month average in the past month. The stock traded slightly lower throughout Friday’s session.