Revenue

Earnings

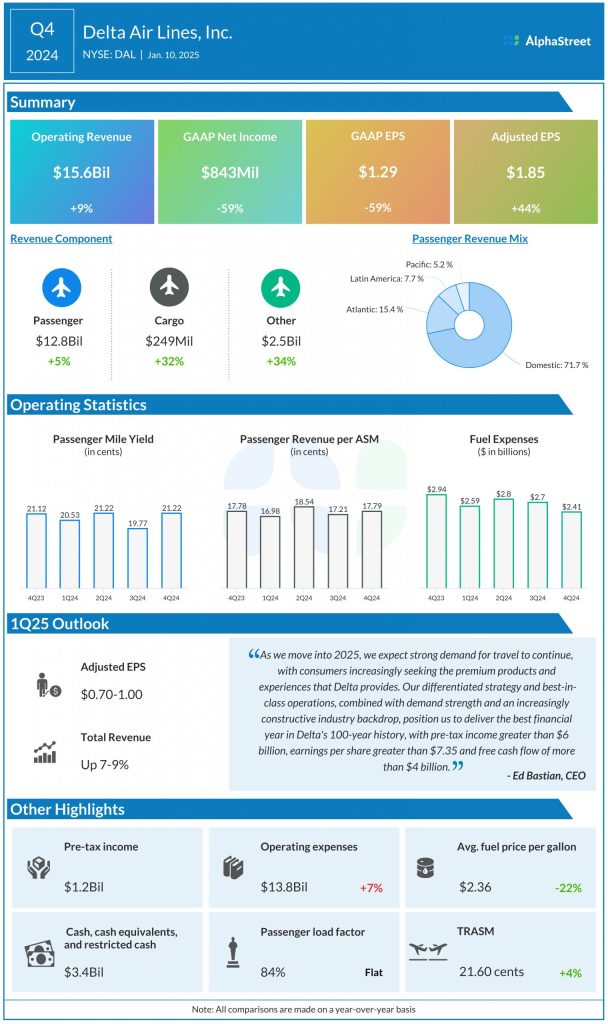

Delta has guided for adjusted earnings per share of $0.30-0.50 for Q1 2025. Analysts are predicting EPS of $0.40, which compares to adjusted EPS of $0.45 reported in Q1 2024. In Q4 2024, adjusted EPS rose 44% YoY to $1.85.

Points to note

Delta lowered its guidance for the first quarter of 2025 due to a drop in consumer confidence caused by high levels of macro uncertainty that in turn hurt demand for domestic travel. The company now expects revenue for Q1 to grow 3-4% YoY instead of its earlier guidance of up 7-9%.

As mentioned at an analyst event earlier this month, although the quarter started off in good shape with healthy booking and revenue trends, adverse weather events and aircraft safety incidents led to a fall in consumer confidence. Safety apprehensions along with economic concerns took a toll on close-in bookings. Against this backdrop, corporate revenues, which were seeing healthy growth, took a dive.

Meanwhile, premium, international and loyalty revenues have been growing in line with expectations. Delta expects adjusted revenues to range between $12.9-13.1 billion for Q1 2025. The company expects $300-400 million of adjusted pre-tax income for the quarter. Adjusted operating margin is now expected to be 4-5% versus the prior range of 6-8%. GAAP EPS is expected to range between $0.40-0.60.