Revenue

Earnings

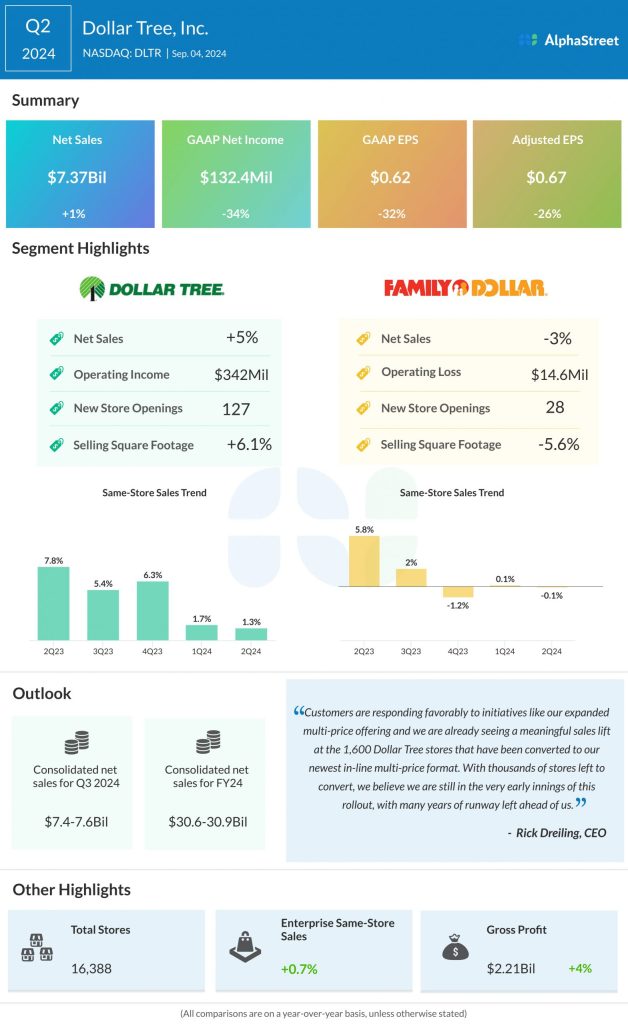

DLTR has guided for adjusted earnings per share to range between $1.05-1.15 in Q3 2024. Analysts are predicting EPS of $1.08 for the period. This compares to EPS of $0.97 reported in the year-ago quarter. In Q2 2024, adjusted EPS fell 26% YoY to $0.67.

Points to note

Dollar Tree expects Q3 2024 comparable store sales to grow in the low-single-digits for both the enterprise and its two segments. In an update earlier this month, the company stated that same-store sales tracked well through the quarter. In Q2, enterprise same-store sales grew 0.7%. Same-store sales increased 1.3% for the Dollar Tree segment but fell 0.1% for the Family Dollar segment.

Last quarter, Dollar Tree benefited from growth in traffic across both its segments as customers continued to search for value in an inflationary environment. However, these gains were partly offset by declines in average ticket. The demand in the consumables category was higher than the discretionary category but the company anticipates an improvement in its discretionary mix during the second half of the year with the arrival of seasonal items. This may have benefited Q3 results.

DLTR can be expected to benefit from its multi-price assortment, which is projected to be a major growth driver over the long term. The arrival of more multi-price offerings in the discretionary category during the latter half of the year can be expected to boost results.