JPMorgan Chase & Co. (NYSE: JPM) is slated to report third quarter 2019 earnings results on Tuesday, October 15, before the market opens. The company is expected to report earnings of $2.45 per share. This compares to earnings of $2.34 per share reported a year earlier. Revenue is expected to grow 2.4% year-over-year to $28.4 billion.

The banking industry is dealing with lower interest rates which are likely to pressurize net interest margins. More rate cuts are expected to take place this year, adding to the uncertainty. Investors should watch out for updates on credit conditions as well as loan growth prospects. The general economic trends and their impact on debt repayments are also an important area to keep an eye on.

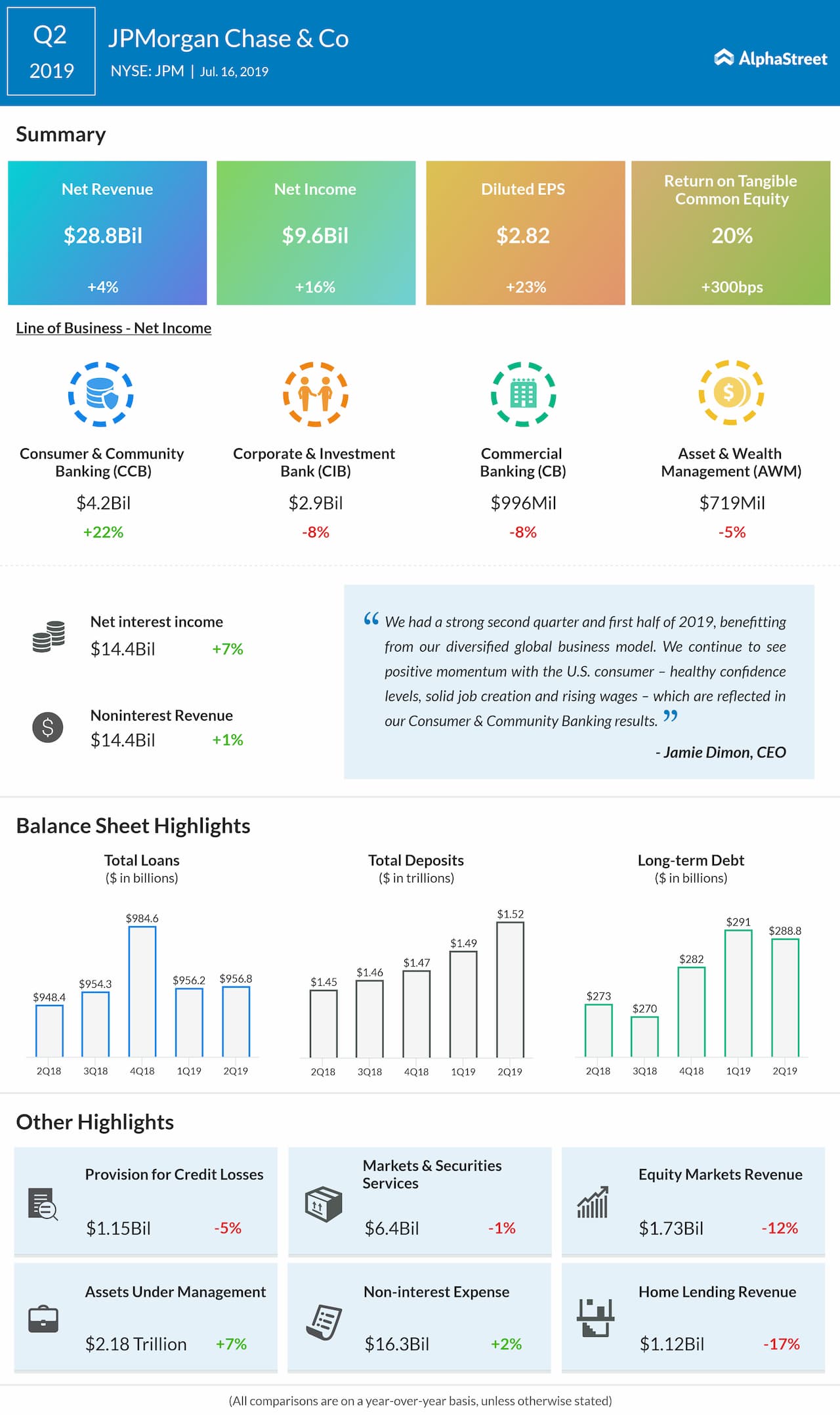

Last quarter, JPMorgan saw strength in its consumer banking

business while the investment banking and commercial banking divisions saw weakness.

Wealth management remained relatively flat due to lower investment valuation

gains. In the third quarter, net interest income might be impacted by the drop

in interest rates.

Despite the uncertain environment, JPMorgan’s quarterly results are likely to remain steady as the company continues to grow its market share and expand its footprint. The bank is also expected to benefit from its investments in building its technological and digital banking capabilities.

Also read: UnitedHealth Group Q3 2019 Earnings Preview

ADVERTISEMENT

In the second quarter of 2019, JPMorgan beat revenue and earnings estimates. Revenues grew 4% year-over-year to $28.8 billion and EPS improved 23% to $2.82. The company saw a 22% growth in its Consumer & Community Banking division while the remaining segments posted single-digit declines.

JPMorgan’s shares have gained 21% year-to-date. The majority of analysts have given the stock a Buy rating and the average price target is $122.10.

JPMorgan’s competitors Goldman Sachs (NYSE: GS) and Wells Fargo (NYSE: WFC) are also scheduled to report their earnings results on the same day.