Shares of Nio Inc. (NYSE: NIO) were down 1.4% in afternoon hours on Wednesday, despite the company reporting pretty good results for the third quarter of 2020 a day ago. Nio’s stock has jumped over 1,000% since the beginning of this year and has gained a staggering 226% over the past three months.

Nio reported strong growth in sales and deliveries, narrowed its losses meaningfully, expanded its margins and provided an upbeat outlook. Its peers XPeng (NYSE: XPEV) and Li Auto (NASDAQ: LI) also reported strong results recently explaining the general enthusiasm over the electric vehicle market which is boosting these stocks.

Sales and deliveries

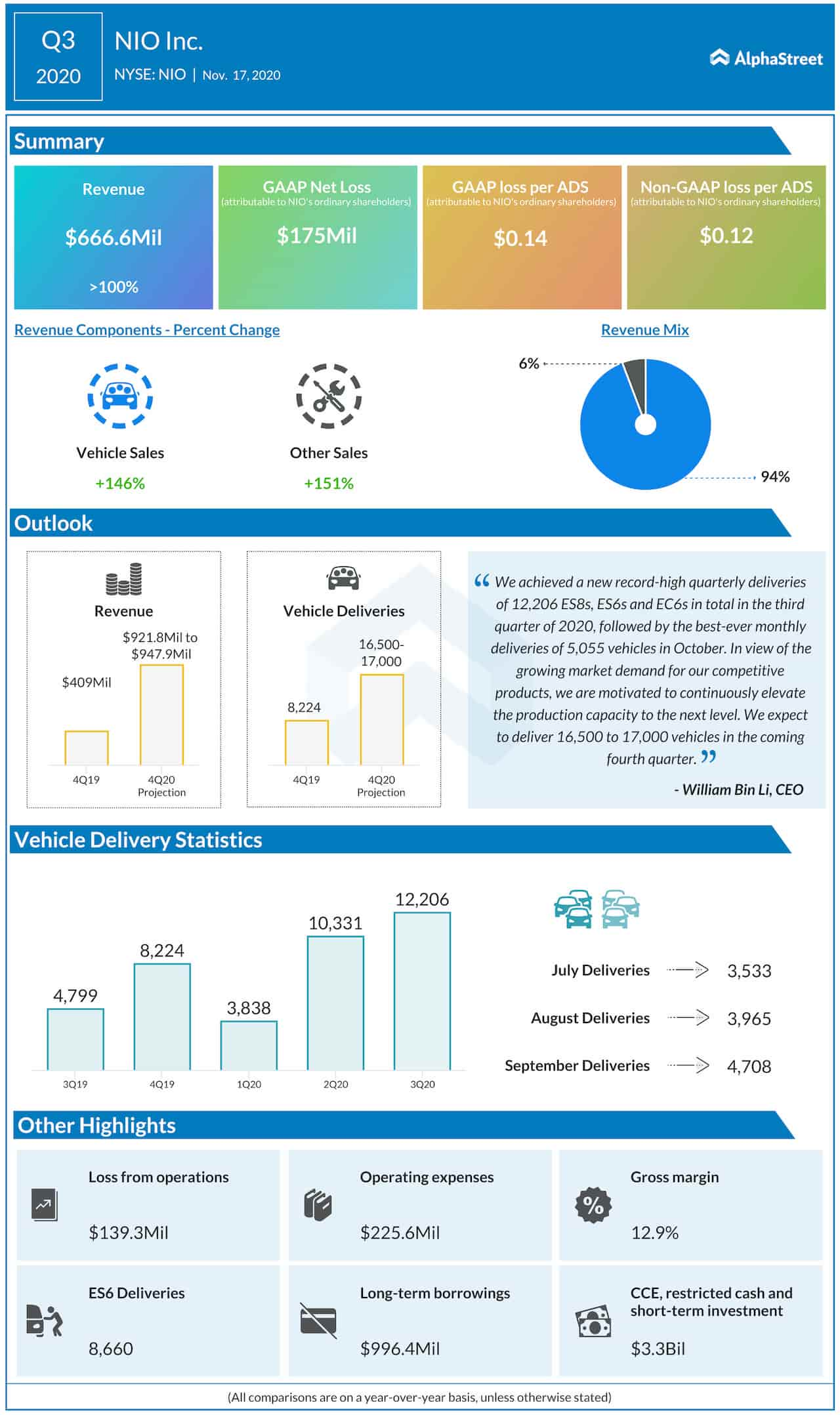

Nio’s revenues increased 146.4% year-over-year and 21.7% sequentially to $666.6 million in the third quarter. Vehicle sales rose 146% year-over-year and over 22% sequentially helped by higher sales of ES6 and ES8.

The company delivered 12,206 vehicles during the quarter, reflecting a growth of over 154% YoY and 18% QoQ. In October, deliveries doubled year-over-year to 5,055 vehicles.

Narrow loss, high margin

Nio managed to narrow its losses significantly compared to the previous year. On a reported basis, net losses were down 53.5% year-over-year. Adjusted net loss per ADS was $0.12.

Gross margin in the quarter was 12.9% versus negative 12.1% in the prior-year period. This growth was fueled by higher vehicle margins which in turn were driven by lower purchase price of materials and lower unit manufacturing costs.

New features

Nio unveiled the Navigate on Pilot feature in October, increasing the competitiveness of NIO Pilot and gaining positive responses from users. Earlier this month, the company launched a 100-kilowatt hour battery pack with battery upgrade plans and a 37% higher energy density than the 70-kilowatt hour battery pack. Its deliveries will start in December. The company will also provide permanent and flexible upgrades to users of the 70kWh battery pack.

Outlook

For the fourth quarter of 2020, Nio expects total deliveries to increase approx. 100.6-106.7% YoY and 35.2-39.3% QoQ to 16,500-17,000 vehicles. Total revenues are expected to grow 119.7-126% YoY and 38.3-42.2% QoQ to $921.8-947.9 million.

What made Nio’s earnings report special is that the company seems to have hit all its marks and its outlook too remains favorable. However, it remains to be seen how long the EV-maker can maintain this triple-digit growth over the coming quarters and this point casts a slight shadow over all the sunshine.

Click here to read the full transcript of Nio’s Q3 2020 earnings conference call