Apple still largely dependent on the iPhone

Apple’s flagship

product is the iPhone that continues to generate a majority of the company’s

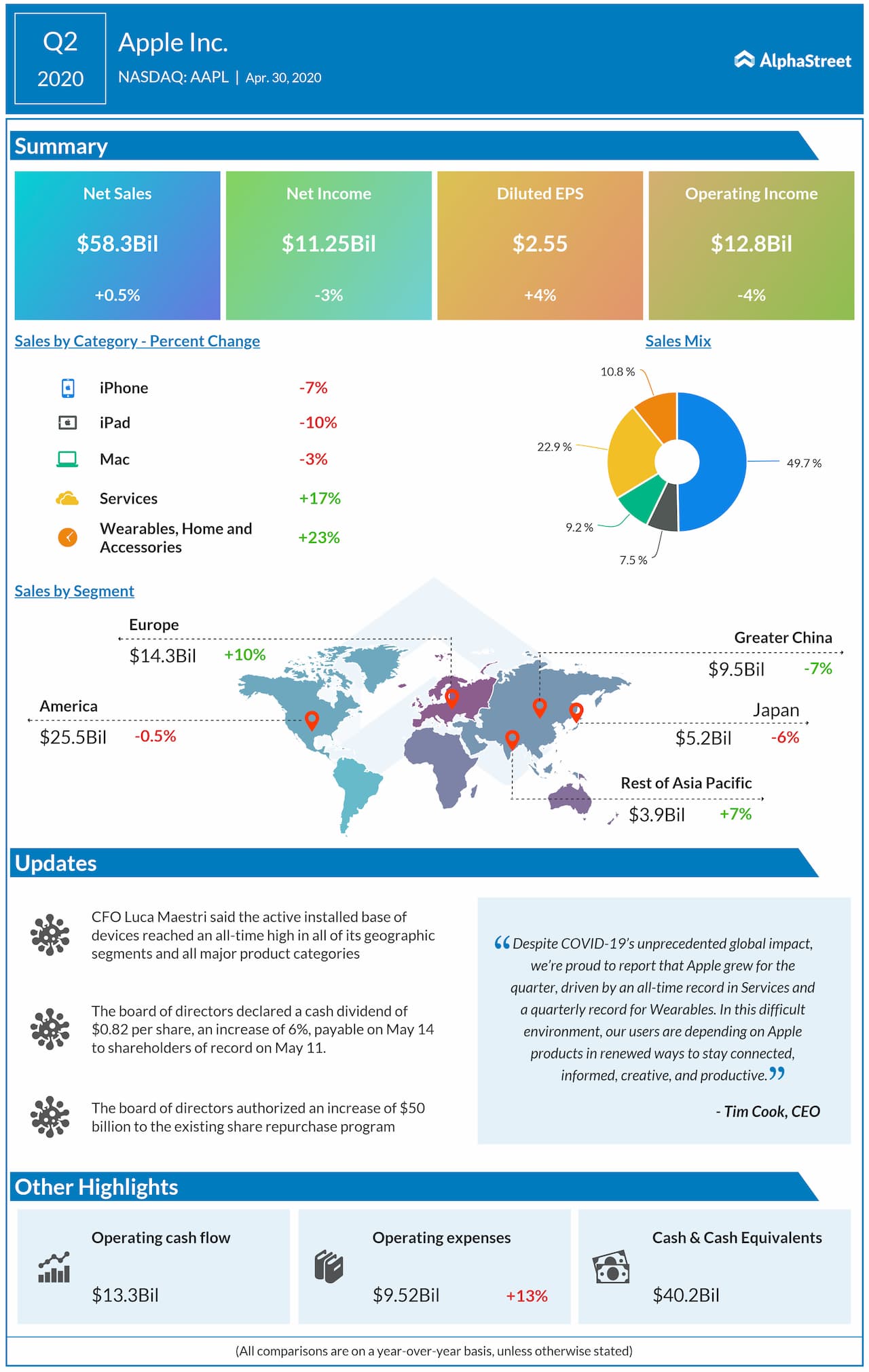

revenue. In the March quarter, the iPhone accounted for 50% of company sales, despite a weak demand

environment due to the ongoing pandemic.

The dreaded

virus first impacted Apple’s supply chain in China as well as consumer demand

in the country. This led to Apple withdrawing its guidance for the March

quarter as well as for fiscal 2020.

In the last three weeks of the March quarter, the virus spread globally and Apple shutdown its retail stores outside Greater China. This not only hurt Apple’s iPhone sales but also impacted sales of wearables such as the AirPod and Apple Watch. iPhone sales fell 7% year-over-year in the fiscal second quarter of 2020, which ended in March, compared to the 1% growth in overall sales.

[irp posts=”63727″]

Prior to the

pandemic, analysts expected Apple to experience robust demand for the iPhone.

Consumer demand for its iPhone lineup was solid and its highly anticipated 5G

device that was to launch in September 2020 was expected to push sales higher

for the next two years.

Apple stock

touched a 52-week low of $192.58 and bottomed out towards the end of March.

Apple Services will be a key revenue driver in 2020

Apple’s Services segment has been the company’s fastest-growing business for a while. For the first six months of fiscal 2020, the Services business accounted for 17.4% of total sales, up from 15.7% in the prior-year period. Further, Services sales rose 16.7% in Q1 and Q2 of fiscal 2020, compared to a paltry 2.3% year-over-year increase in iPhone sales.

Apple Services

will continue to benefit from its subscription-based offerings that include

Apple TV+, Apple Care, Apple Music and Apple Arcade. A subscription-based

business model will help the technology behemoth offset cyclicality and

generate a predictable stream of cash flows across economic cycles. Apple ended

Q1 with 515 million paid subscribers across its businesses and this figure is expected to

touch 600 million by the end of CY 2020.

During the recent earnings call, Apple CEO Tim Cook reaffirmed the company’s prior

guidance of doubling fiscal 2016 Services revenue by the end of 2020. While the

iPhone sales are expected to take a significant hit in the June quarter, a part

of this decline will be offset by strong Services sales.

[irp posts=”59851″]

As people are largely staying at home, demand for streaming and gaming services have increased at a rapid pace. These tailwinds, though near-term, may help Apple attract new customers into its ecosystem and this will benefit the company in the upcoming decade.

What next for Apple investors

Similar to most other stocks, it is extremely strange to see Apple trading at record highs in an environment where consumer demand is slowing. Analysts tracking Apple stock expect company sales to fall by 4.2% in the June quarter while overall sales for fiscal 2020 is estimated to increase by 1.4%.

While Apple stock should be on the radar of most investors given its leadership position in multiple businesses, expect short-term volatility to provide buying opportunities in the second half of 2020.

_________