Autodesk, Inc. (NASDAQ: ADSK) is a market leader in computer-assisted design software, catering mainly to the architecture, engineering, construction, and manufacturing sectors with its mission-critical solutions. The company, which is known for the highly popular AutoCAD design tool, is busy expanding its portfolio targeting other industry segments.

Autodesk’s stock suffered a setback last week after the weak guidance took the sheen off its positive third-quarter results. After recouping most of their losses since the previous earnings announcement, the shares once again slipped below the $ 200 mark. But the factors behind the management’s not-so-optimistic outlook are not specific to the company or the industry it belongs to, rather they have more to do with the macroeconomic environment.

Resilience

The cloud-based subscription model allows the company to maintain a healthy customer base, and the differentiated product line gives it an edge over others. That explains Autodesk’s resilience to the coronavirus crisis, and more recently the economic slump. It is expected that ongoing efforts to enhance the portfolio, like the recent launch of industry clouds Autodesk Fusion, Forma, and Flow, would help the company retain customers and handle competition effectively.

Autodesk, Inc. Q3 2023 Earnings Call Transcript

While experts are bullish on the stock’s long-term prospects, 2023 might not be a great year for it in terms of rewarding shareholders. That said, it is worth noting that the tech firm recently authorized a $5-billion share buyback program. Recent data shows that Autodesk’s revenue growth is decelerating, which is not good news for the stakeholders, especially at a time when the economy is going through a rough patch.

Risks

Inflationary pressures and macro uncertainties could weigh on enterprise spending, prompting customers to prefer short-term contracts over multi-year deals. The other concerns are muted growth in overseas markets and currency headwinds amid geopolitical tensions. To sum up, it would be a good idea to keep the stock on the watchlist so that one can make informed decisions when the time is ripe to buy.

When it comes to regaining the growth momentum, the management has a slew of initiatives in place like cost discipline, measures to leverage pricing power, and focused efforts to renew subscriptions.

From Autodesk’s Q3 2023 earnings call:

“We are reinforcing the secular tailwinds to our business by accelerating the convergence of workflows within and between the industries we serve, creating broader and deeper partnerships with existing customers, and bringing new customers into our ecosystem. Our strategy is underpinned by disciplined and focused investment through the economic cycle, which enables Autodesk to remain well invested to realize the significant benefits of its strategy while mitigating the risk of having to make expensive catch-up investments later.”

Results Match View

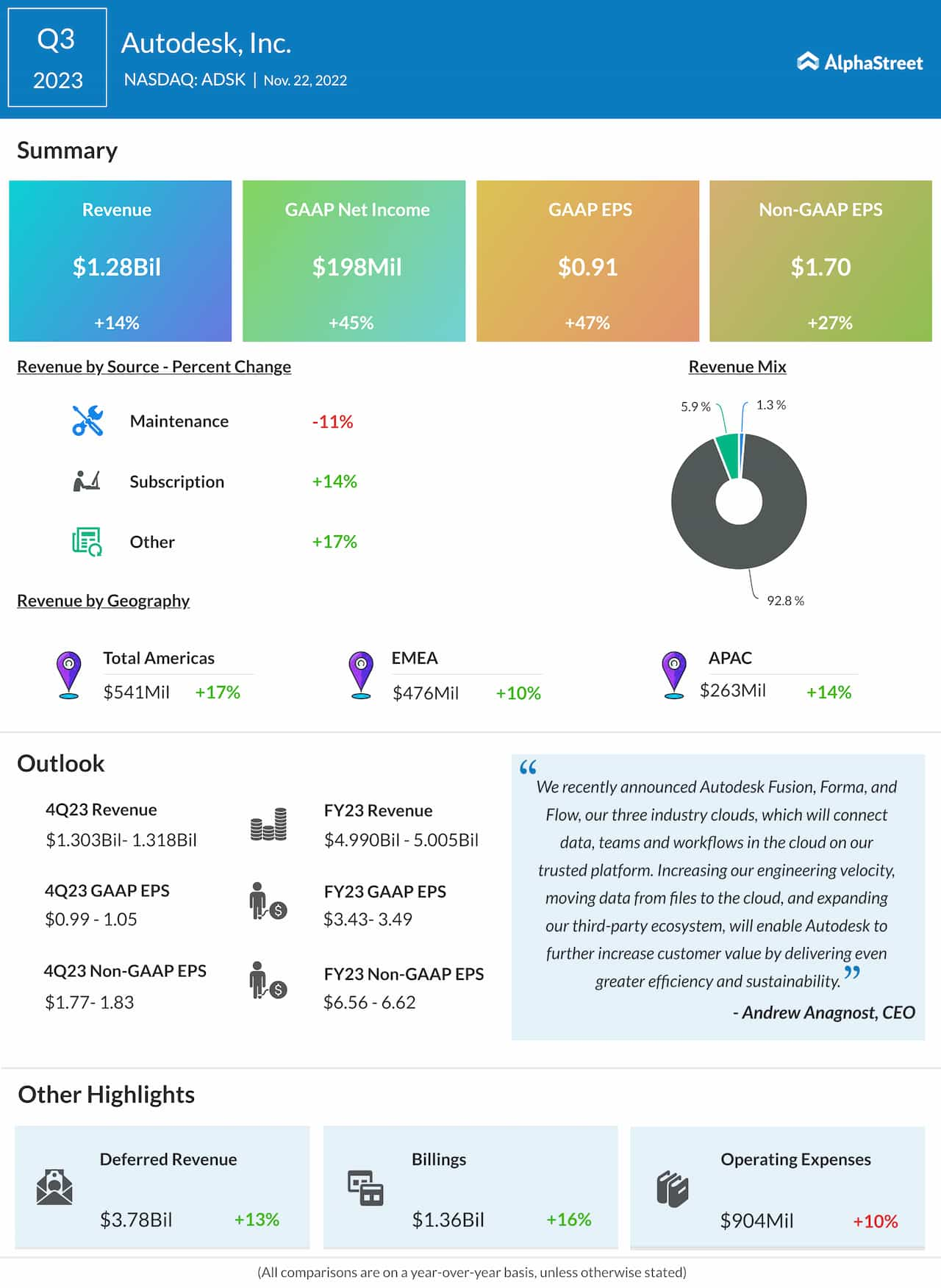

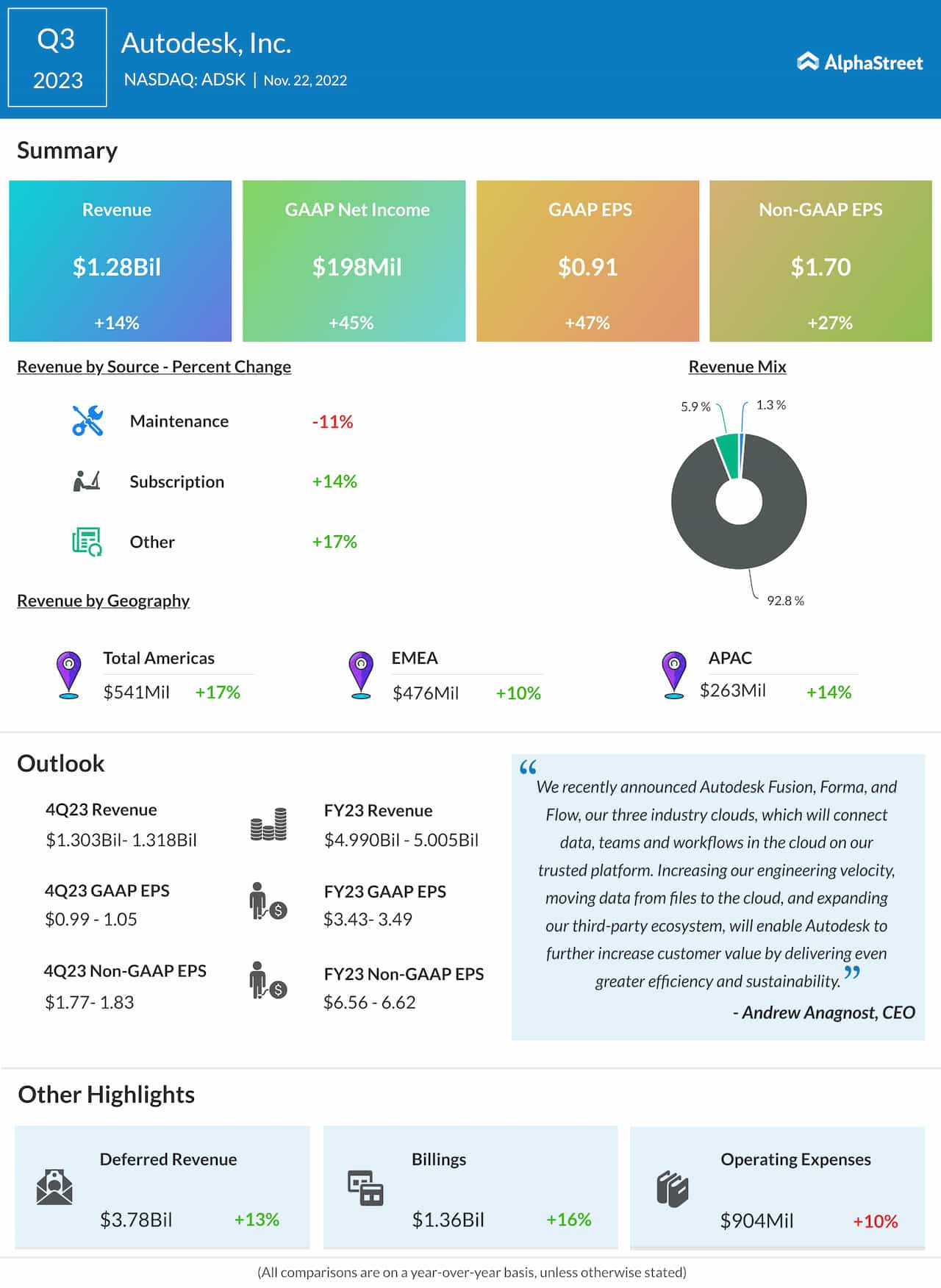

In the third quarter, earnings came in line with the Street view, after beating regularly for over three fiscal years. Interestingly, the top line also matched estimates in the most recent quarter. Revenues and adjusted earnings increased in double-digits to $1.28 billion and $1.70 per share, respectively, reflecting strong performance by the core subscription segment. While the positive trend is estimated to have continued in the final months of the year, the management’s estimates fell short of analysts’ projections.

Earnings Infographic: Microsoft Q1 revenue up 11%; earnings beat

On Monday morning, ADSK traded slightly above $200 after closing the previous session higher. The stock has outperformed the broad market quite often so far in the second half.