The company’s shares have long been witnessing high volatility. However, the stock has an impressive track record of bouncing back whenever they suffer big losses.

Stock a Buy?

The stock, which has gained about 9% since the beginning of the year, doesn’t seem to be in a downtrend, and the general view is that it is rightly priced. Since the company has just come through one of the most difficult phases, it is safe to assume that the stock will stabilize now. Underscoring the positive sentiment, most analysts recommend buy, making GM an investment option worth considering. The average target price of around $45 represents a 20% upside.

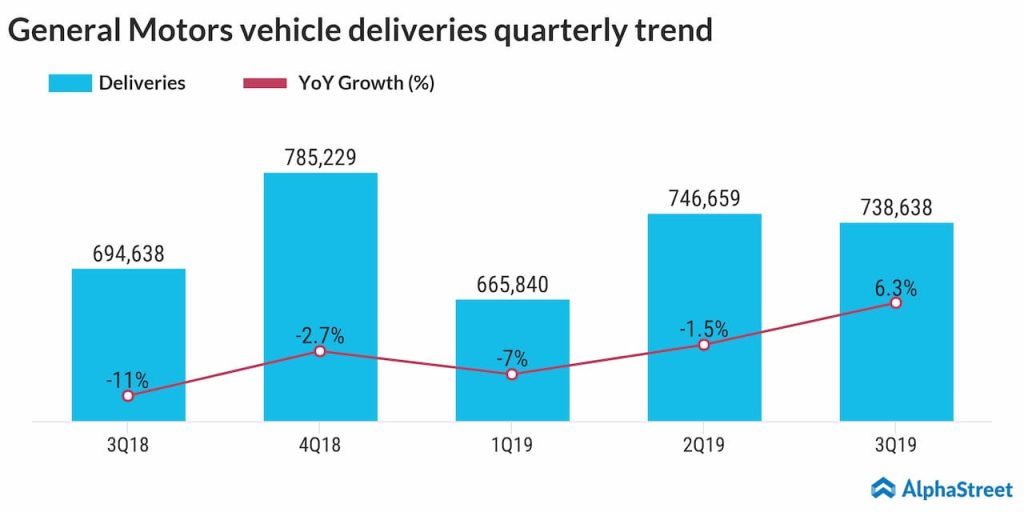

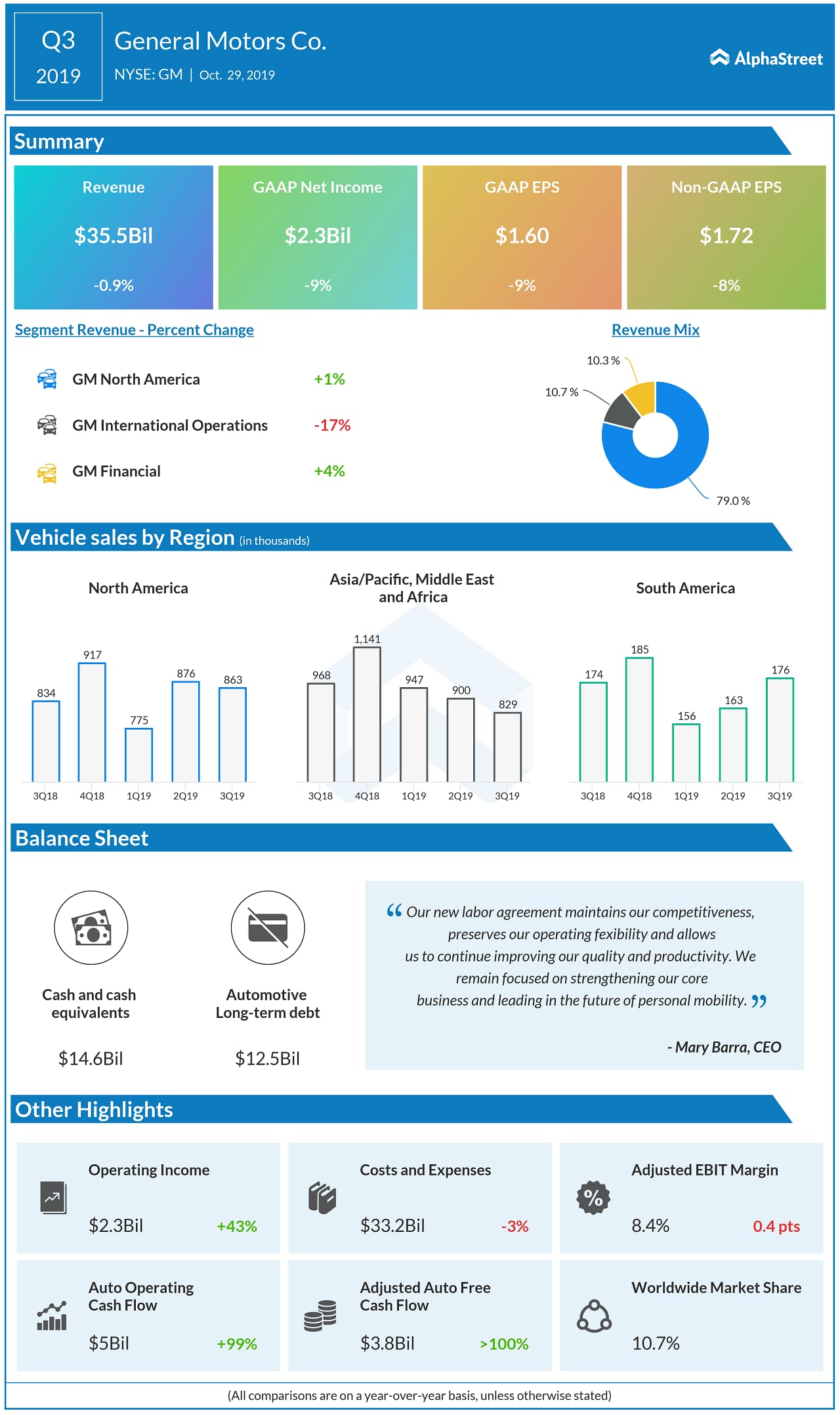

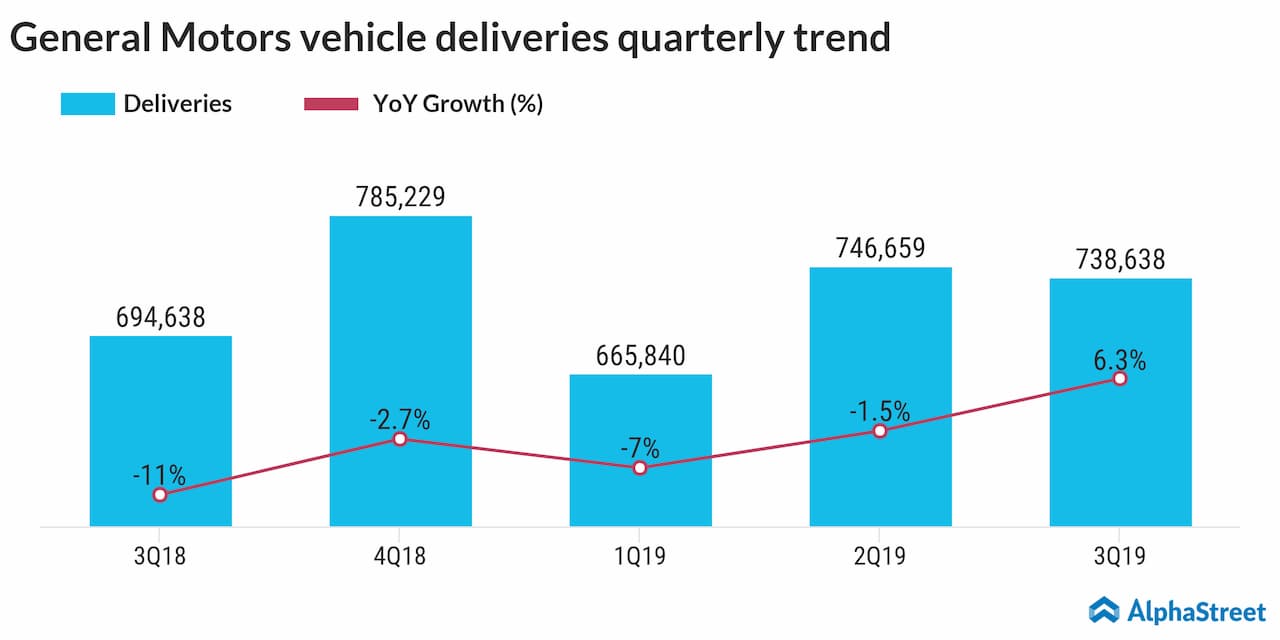

The second half of the fiscal year has been particularly discouraging for the company as far as its financial performance is concerned, with a series of worker strikes and layoffs causing significant production disruption. Earnings dropped in the third quarter amid flat revenues, hurt mainly by a slowdown in the overseas market.

A Long Way to Go

While the reorganization and management’s cost-cutting plan look promising, the related severance costs and asset write-downs that run into several million dollars do not bode well for the shareholders. In the long-term, the effectiveness of the initiatives will depend on how the company tackles competition and adapts to new trends in the automotive industry, such as technological innovation and changing customer tastes.

Outlook

The weak outlook on GM’s near-term prospects is evident from analysts’ estimates for the fourth quarter, with the majority predicting a year-over-year decline in earnings to seven cents, hurt by an estimated 24% fall on revenues to $29.14 billion. It needs to be seen to what extent the cost-cutting efforts and new launches in China, a key market where GM faces headwinds, will benefit the company.