The psychological effects of the pandemic-induced lockdown are visible more clearly in the retail industry than any other business, for its influence on people’s consumption habits. So far, COVID-19 had a mixed impact on American retailers, with e-commerce firms witnessing a surge in orders and traditional store operators struggling with low footfall.

In the initial days of the lockdown, supermarkets and grocers recorded a spike sales as people scrambled to stock up on essential items. But there is concern that the unprecedented disruption might change people’s shopping habits forever and set new standards for the retail landscape.

[irp posts=”54454″]

Merely surviving the pandemic would not be sufficient for retailers, who have been striving to tackle issues ranging from cash crunch to labor shortage, because the emerging economic scenario is unlikely to be very encouraging. One of the potential challenges would the falling demand for discretionary items, due to the dip in people’s purchasing power.

Blessing in Disguise?

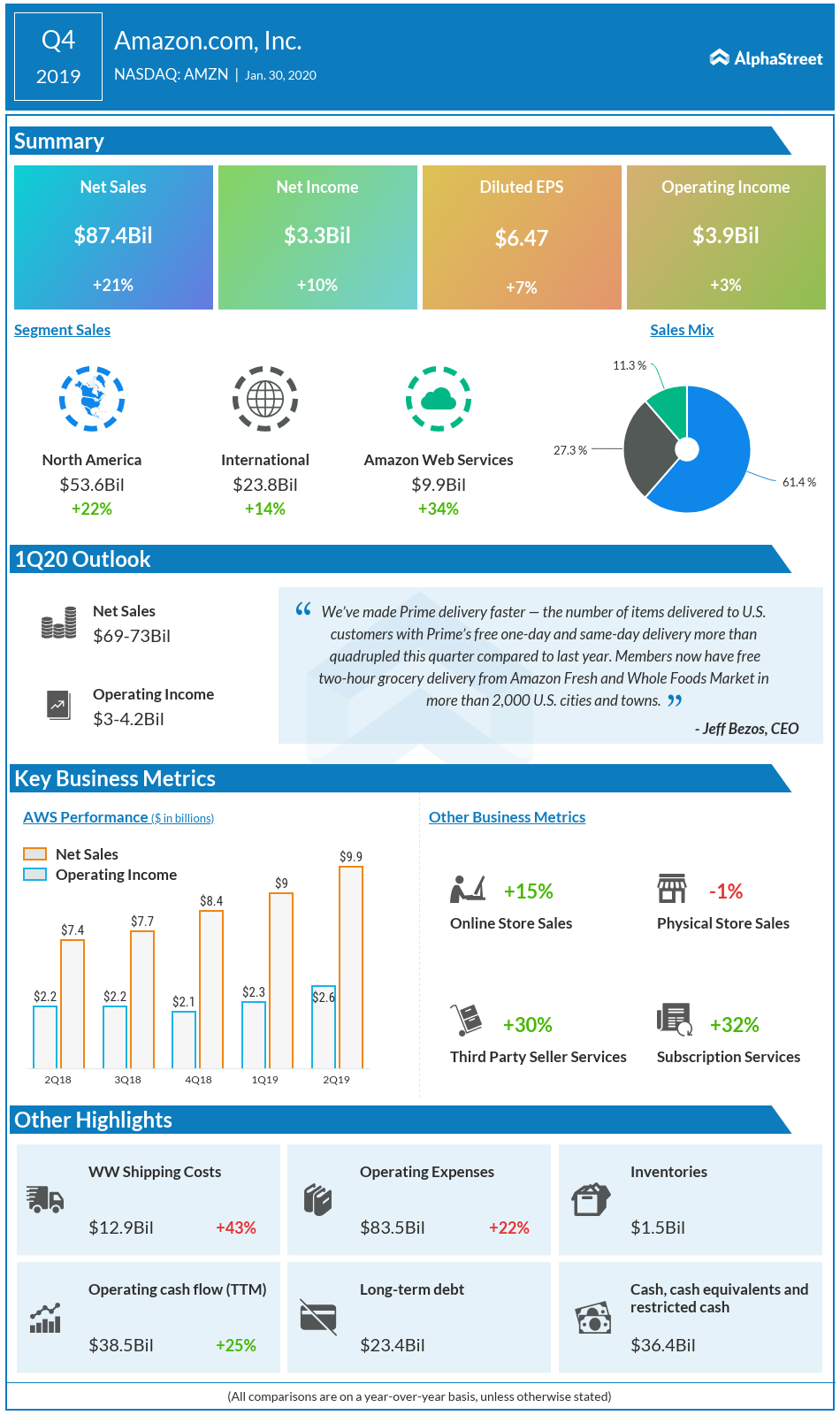

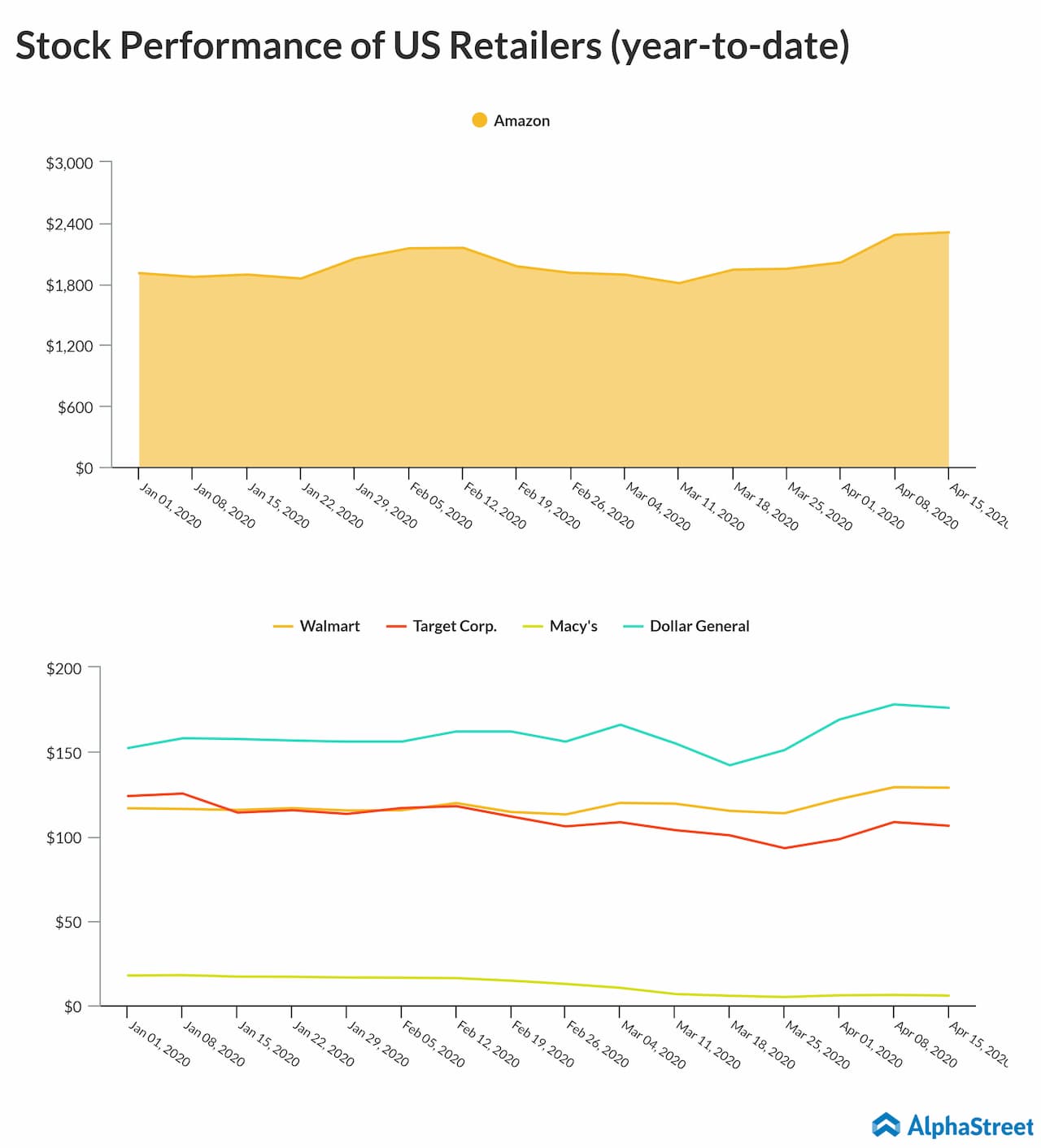

As one would expect, Amazon (NASDAQ: AMZN) sailed through the initial chaos and is currently flooded with orders. The stock made a strong recovery after losing considerable momentum in February and traded at an all-time high this week. Once again, the market value of the e-commerce giant crossed the $1-trillion mark.

While things look bright for Amazon at the moment, it needs to be seen how it will deal with supply chain disruptions and shipping delays. If the uncertainty persists for a long time, online players will also find it difficult to maintain the momentum, like their brick-and-mortar counterparts.

Short-lived Slump

The only time Walmart’s (NYSE: WMT) stock deviated from the growth trajectory in the recent past is during the pandemic-linked market selloff a few weeks ago, but it was a short-lived setback. At $129, the stock closed the last trading session at another record high.

For the company, this is the time to leverage its aggressive technology push focused on developing the highly competent digital platform. There is no doubt that the e-commerce site and facilities like curb-side pickup will play a key role in generating revenue for the big-box retailer in future.

Concern for All

But there is no guarantee that conditions would remain favorable for online players either, given the growing uncertainty in the market. Amazon was forced to scale down operations in certain regions after lawsuits were filed against it, alleging lack of proper safety measures. Though Walmart has been doing everything possible to make store visitors feel comfortable, there are concerns about the safety of customers and employees.

“Amazon aims to have 10,000 of Rivian’s new electric vans on the road as early as 2022, and all 100,000 vehicles on the road by 2030. That’s good for the environment, but the promise is even greater. This type of investment sends a signal to the marketplace to start inventing and developing new technologies that large, global companies need to transition to a low-carbon economy.”

Jeffrey Bezos, CEO of Amazon, in a letter to shareholders

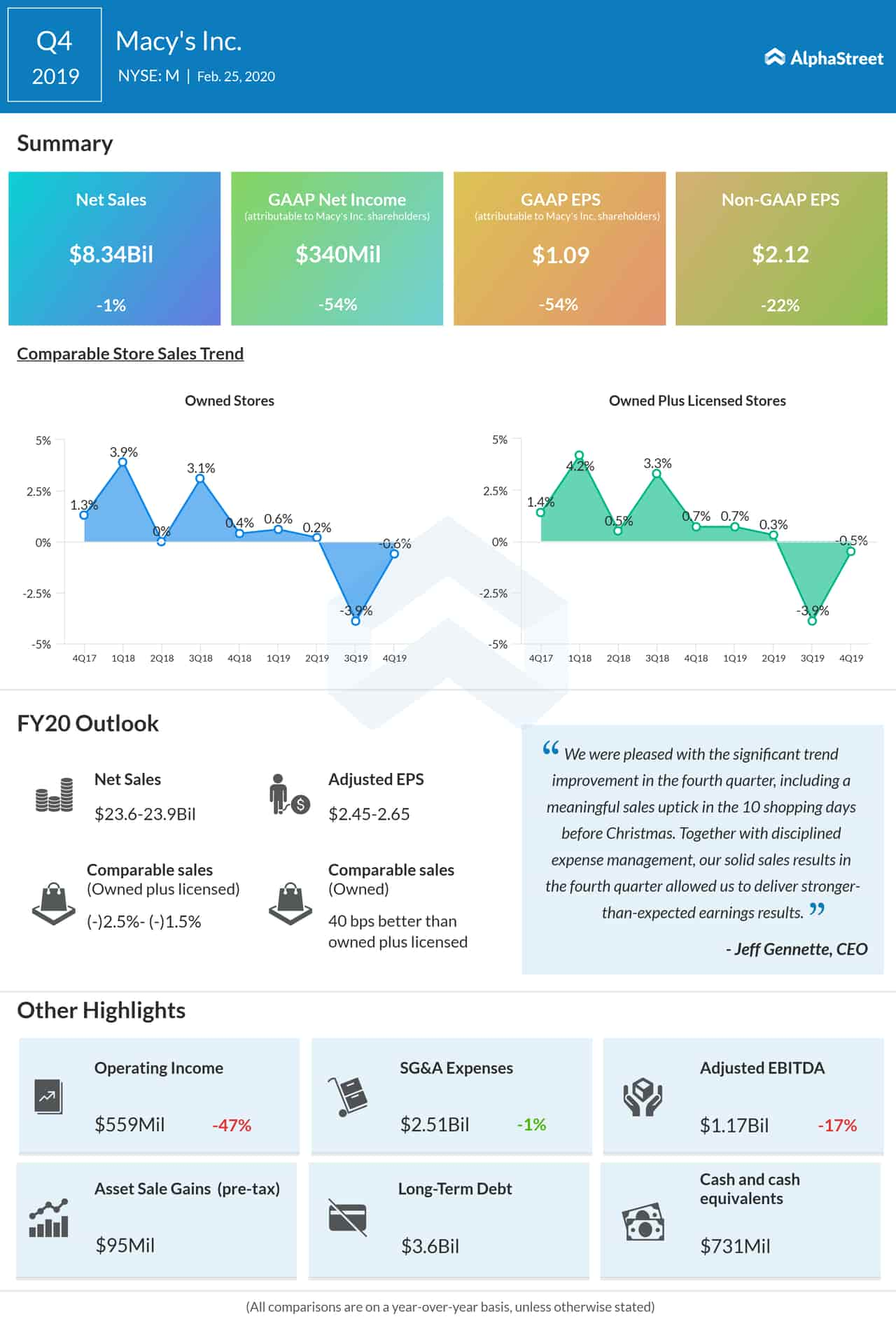

Other legacy retailers like Target Corp. (NYSE: TGT) and Macy’s (NYSE: M), with relatively strong fundamentals, were less fortunate in terms of stock market performance. Currently, both stocks are struggling to recover from the recent fall. Overall, the financial performance of American retailers was mixed in the most recent quarter.

[irp posts=”55270″]

Statistics show that traffic at department stores and specialty retail outlets declined by a fifth in the last 30 days, thanks to social distancing and safety alerts. There are indications that the downtrend would persist until normalcy returns to the markets. But, a full-fledged recovery is unlikely to happen in the near future, for it is almost certain that the economy is headed into recession.

Lingering Fear

The COVID-19 crisis will likely leave a lasting impact on people’s sentiment amid fears of recurring outbreaks. In addition, financial uncertainty, unemployment and non-availability of credit will force people to take a conservative stance when it comes to making purchases.

At the same time, it is possible that discount retailers like Dollar General (DG) would witness a spike in sales once life returns to normalcy. Recently, the market responded positively to Dollar General’s bullish financial outlook and the company’s market value rose to a new high.

Hard Times

Experts predict the high level of caution would last for a long time, which will make conventional eateries and self-service food kiosks less popular. Another vulnerable group is retailers of lifestyle products and apparels that fall under the consumer discretionary category. Also, the fact that most customers have become less brand conscious, due to non-availability of preferred brands during the lockdown, is not good for retailers who thrive on their brand power.

[irp posts=”55681″]

There was a marked increase in online grocery sales in the past two months. However, the existing infrastructure is not sufficient for supermarkets to provide a reasonably good service to shoppers. Retailers will be required to ramp up their facilities in line with the changing trend, while also ensuring that the deals are profitable.

Paradigm Shift

Since nobody knows how the economy would come out of the crisis, there is uncertainty about customers’ spending priorities and brand preferences in future. Also, consolidations and new partnerships are on the cards in the retail space as firms with weak balance sheets and high debts face risks.

In short, the concept of digital marketplace will assume more significance as people’s shopping behavior keeps changing. We are looking at a situation wherein an average consumer would prefer an e-book to a physical book.