The San Jose, California-based tech firm sees an improvement in operating conditions and issued stronger-than-expected guidance for the latter part of the first half. However, some experts have taken a skeptical stance, citing the company’s lackluster performance at a time when the sector is witnessing a boom, thanks to the widespread digital transformation.

New Biz Model

Currently, the company is counting on its ongoing shift to the software-and-subscription model to drive future growth. It has been providing solutions to help customers operate efficiently in multi-cloud environments, through the Cloud onRamp for SaaS offerings.

Read management/analysts’ comments on Cisco’s Q1 earnings

“Our focus is on winning with a differentiated innovation portfolio, long-term growth, and being a trusted technology partner for our customers. Over the last few quarters, we’ve successfully adjusted to new demands by making necessary changes and shifts within our business. We remain closely aligned with our customers to provide them with the mission-critical technology they need to stay resilient and move towards adopting new hybrid work models,” said Cisco’s CEO Chuck Robbins while addressing analysts at the post-earnings meeting.

Growth Opportunities

However, the continuing slowdown in orders might remain a hassle for the company to regain its past glory, though demand from commercial customers has improved recently. The sustainability of the rebound would depend on tackling competition effectively and realigning the portfolio with focus on emerging areas like hybrid cloud and 5G. Enterprise spending on IT infrastructure is estimated to gather pace next year and that bodes well for Cisco. In short, the company has what it takes to come out of the pandemic stronger and retain the recent momentum.

Mixed Q1

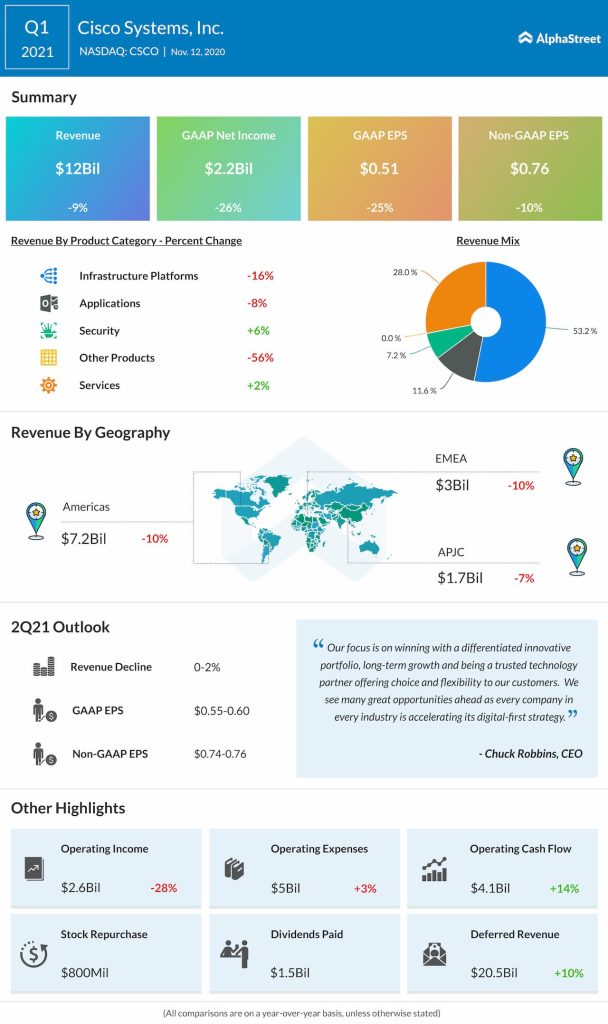

In the first three months of fiscal 2021, Cisco’s core business segment registered a double-digit decline in revenues, resulting in a 9% decrease in total revenues to $12 billion. Consequently, adjusted earnings dropped 10% annually to $0.76 per share. But, the results surpassed the consensus estimates. The bright spot was the positive full-year guidance, which can be linked to the ongoing digital adoption across industries.

On pricing, I’d say, our Q1 pricing is in our normal range from a product gross margin walk perspective. The rate impacts, the number that we usually talk about, it was down 1.8 points, which as you know, is in our normal kind of operating range. And just as a reminder, we’ve annualized all of the price increases we did a year ago for the list for tariffs. So now, this is kind of where we’re stated.

Kelly Kramer, Chief financial officer of Cisco

ADVERTISEMENT

Cisco’s stock got a solid boost from last week’s stronger-than-expected earnings report and maintained the momentum since then. Earlier, it had experienced volatility since the beginning of the year and lost about 8% during that period.