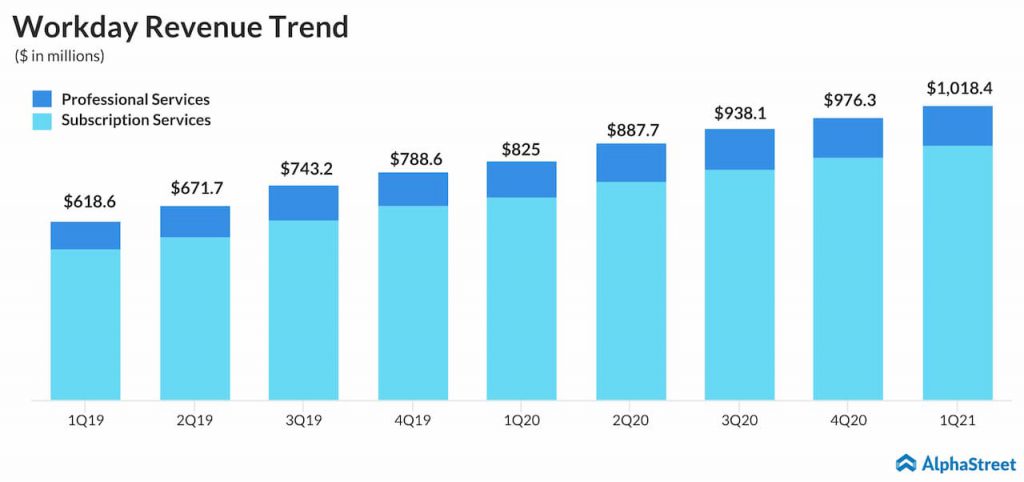

While remaining well-positioned for the long term, the company is lowering its fiscal 2021 subscription revenue guidance to account for the near-term impact from COVID-19. The subscription revenue outlook is cut to the range of $3.67-3.69 billion from the prior range of $3.755-3.77 billion.

The company lifted fiscal 2021 non-GAAP operating margin guidance to 16%. Workday remains confident in the fundamental strength of its business model and plans to operate with agility while continuing to drive innovation to support sustainable, long-term growth.