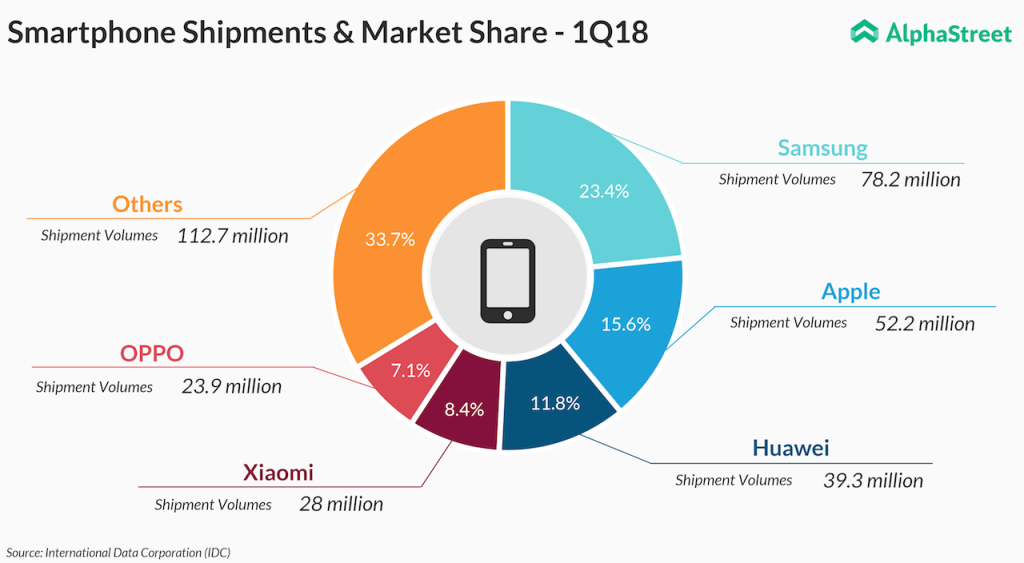

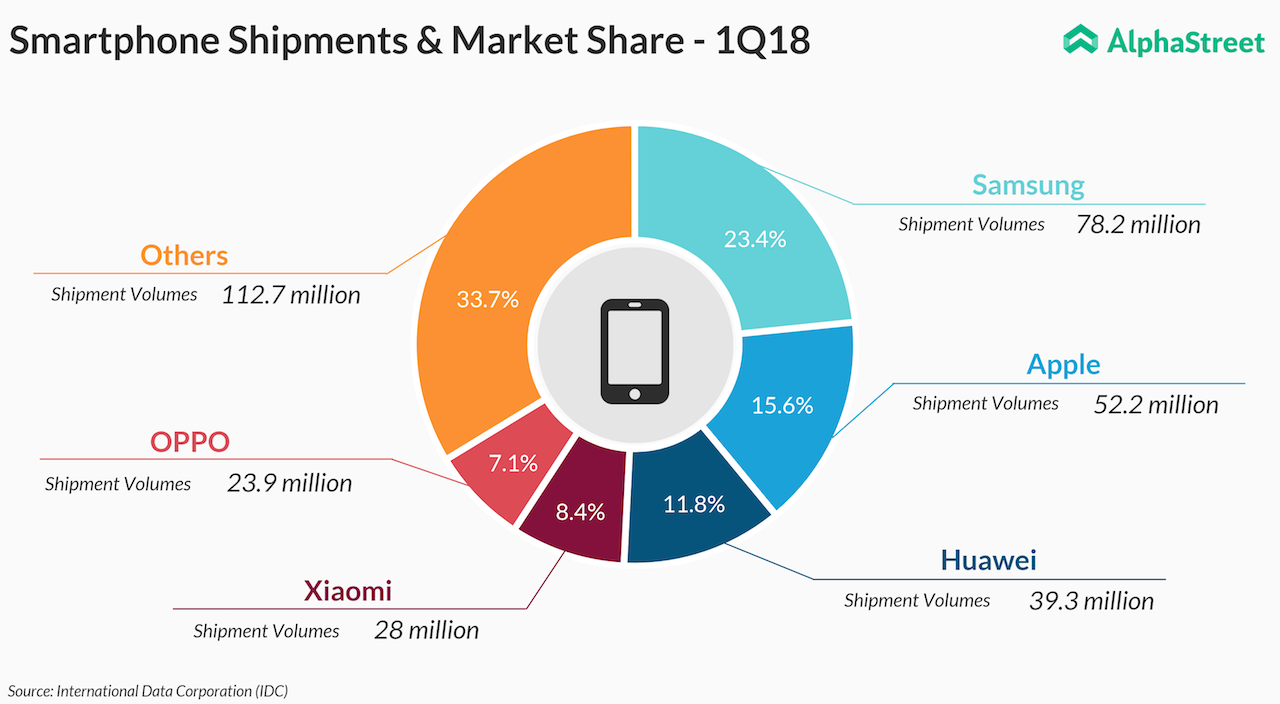

A recent report by International Data Corp. (IDC) states that Xiaomi is the fourth largest smartphone maker globally based on the shipment volume in the first quarter of 2018.

Xiaomi, whose handsets are much cheaper than Apple, reported a 67.5% revenue growth in 2017. There was a three-fold increase in its operating profit compared to 2016.

Over the recent period, Xiaomi began diversifying its business. Apart from smartphones and tablets, the Apple of China (as it is referred sometimes) has ventured into the retail and internet business. In the future, Xiaomi plans to venture into the electric-car segment too. Also, there are rumors that it plans to acquire the struggling action camera maker GoPro (GRPO).

Xiaomi smartphones have a huge demand in India. And to meet this growing demand, the company is setting up three manufacturing units in India. The internet company is slowly marching into the western markets too. Countries apart from China generate less than 30% of the total revenue for Xiaomi and China alone generates more than 70% of the revenue.

Due to this growing popularity of Xiaomi, Apple is losing the game in China. According to the research firm Canalys, Apple’s share in China has now dropped considerably to 8% compared to 13% in 2015.

In an open letter, Xiaomi’s founder Lei Jun stated, “Among the more than 70 countries and regions that we have entered, we are number one in India in terms of smartphone market share and are among the top 5 smartphone companies in 15 countries. We will continue to prove that Xiaomi’s business model can be extended globally at a rapid pace.”