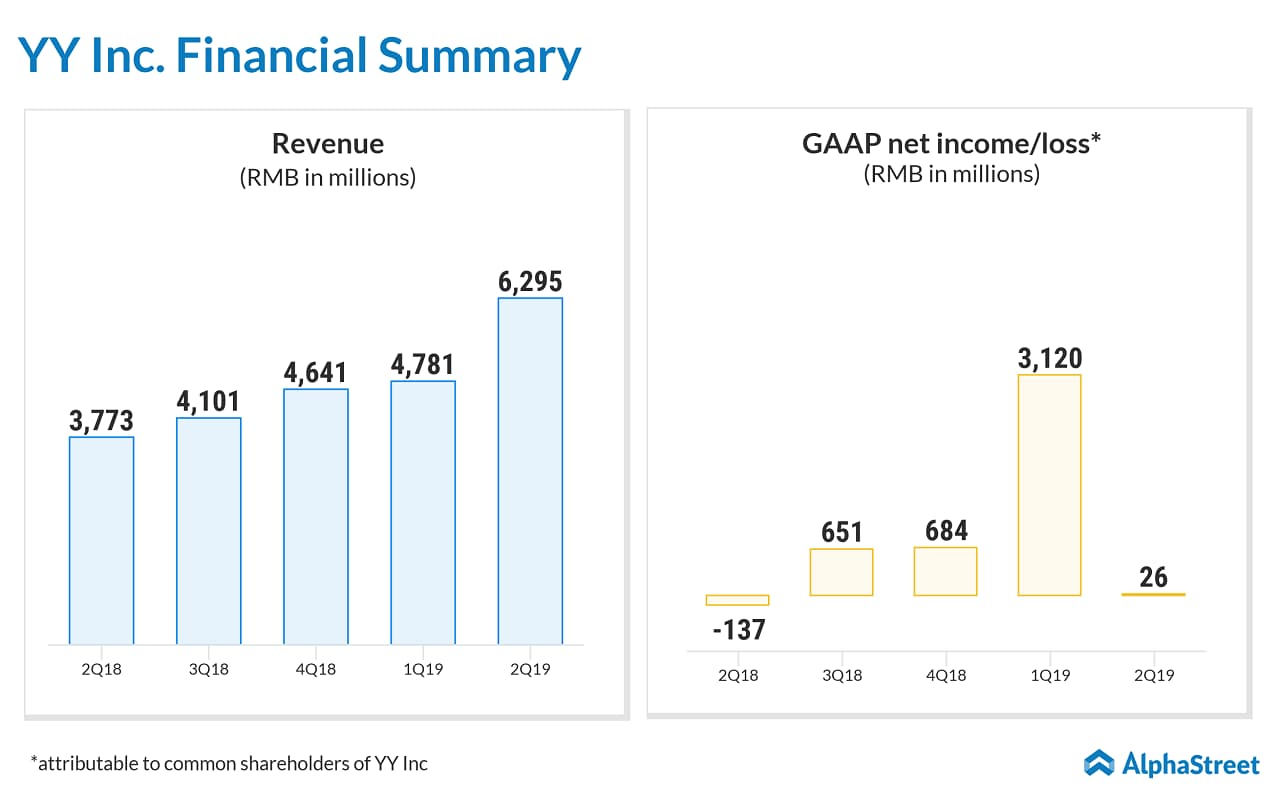

Chinese social media company YY Inc (NASDAQ: YY) reported a revenue increase of 67% to RMB6.295 billion (US$917.0 million) from RMB3,773.2 million in the corresponding period of 2018. The company had projected Q2 revenue to be between RMB6.0 billion and RMB6.2 billion. YY stock, which was trading in the postive territory in the after-hours session initially, slided to negative zone after the earnings announcement.

The increase in revenue was primarily driven by a 66.4% year-over-year increase in live streaming revenues to RMB5,922.8 million. The consolidation of Bigo fueled additional user and revenue growth.

On a GAAP basis, net income attributable to common shareholders of YY was $25.79 million versus net loss attributable to common shareholders of $136.9 million in the prior-year quarter. Non-GAAP net income attributable to controlling interest of YY Inc. was RMB424.2 million (US$61.8 million), compared to RMB910.2 million in the corresponding period of 2018, primarily due to the impact of the consolidation of Bigo Inc.

Non-GAAP net income per ADS was RMB5.14 (US$0.75) in the second quarter of 2019 compared to RMB13.75 in the corresponding period of 2018. GAAP net income per ADS was RMB0.27 (US$0.04) in the June quarter compared to net loss per ADS of RMB2.14 in the year-ago quarter.

For the third quarter of 2019, YY expects revenue to be between RMB6.57 billion and RMB6.77 billion, representing a year-over-year growth of 60.2% to 65.1%.

“After we successfully completed the acquisition of BIGO in March, the second quarter was the first time we had the full quarter consolidation of the financial performance of BIGO,” said David Xueling Li.

Global average mobile monthly active users (MAUs) reached 433.5 million, among which about 78.1% were from markets outside China. Average mobile MAUs of IMO reached 211.9 million. Average mobile MAUs of global short-form video services increased by 431.2% to 90.3 million from 17.0 million in the corresponding period of 2018.

Read: Village Farms International (VFF) swings to profit in Q2

Total number of paying users of YY increased by 19.1% to 4.2 million from 3.5 million in the prior year period.

Game streaming company Huya (NYSE: HUYA), in which YY holds a majority stake, also reported its second quarter earnings results today. Huya’s Q2 results beat expectations on solid user growth.

YY stock, which plunged to a new 52-week low ($51.00) in today’s morning session, ended up 3.61% at $53.64 when the US markets closed today.