Amazon’s (NASDAQ: AMZN) stock has increased 31% in 2019 after hitting a new 52-week low level of $1,307 mark in late December. The recovery in the share price is primarily attributed to the solid first-quarter results. The e-commerce giant is planning to report its Q2 results on July 25 after the bell.

Analysts are quite upbeat about the

e-commerce giant’s performance. Out of the 35 analysts tracked by TipRanks, 34 have

awarded “Buy” rating and 1 analyst has given “Hold” rating. They also expect

the stock price to increase 15% in the next 12 months from today’s trading

level of $1,974 mark. Investors are expecting Jeff Bezos and his team to continue

the momentum from the last quarter.

What

to Watch?

Here are the key performance indicators to watch when Amazon reports the Q2 results on Thursday.

1) Headline

Numbers: Amazon expects sales to be between $59-63.5

billion compared to $62.44 billion expected by the street. Adjusted earnings is

forecasted to come in at $5.58 by the analysts, an increase of 10% from last

year.

Even though the company hasn’t given earnings guidance, it expects operating income to be between $2.6-3.6 billion compared to $3 billion in the prior-year period. It would be interesting to see whether the retail giant is able to surpass last year’s metrics.

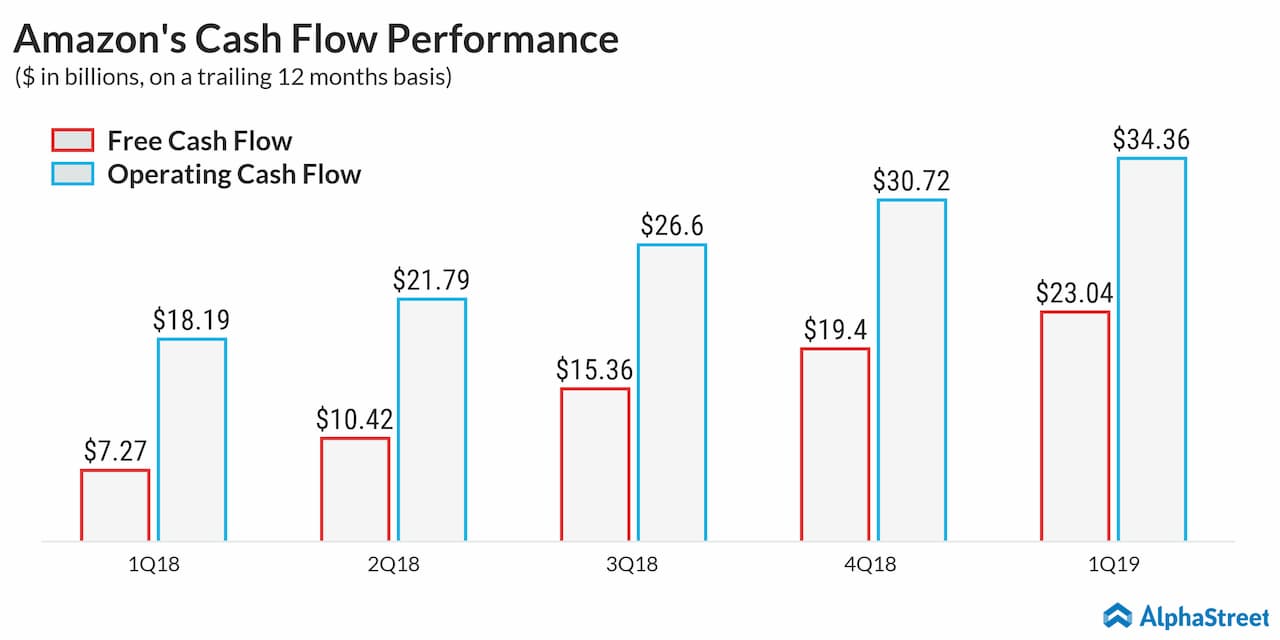

In addition to the big two numbers, cash flow trend of the retail giant is also worth to watch.

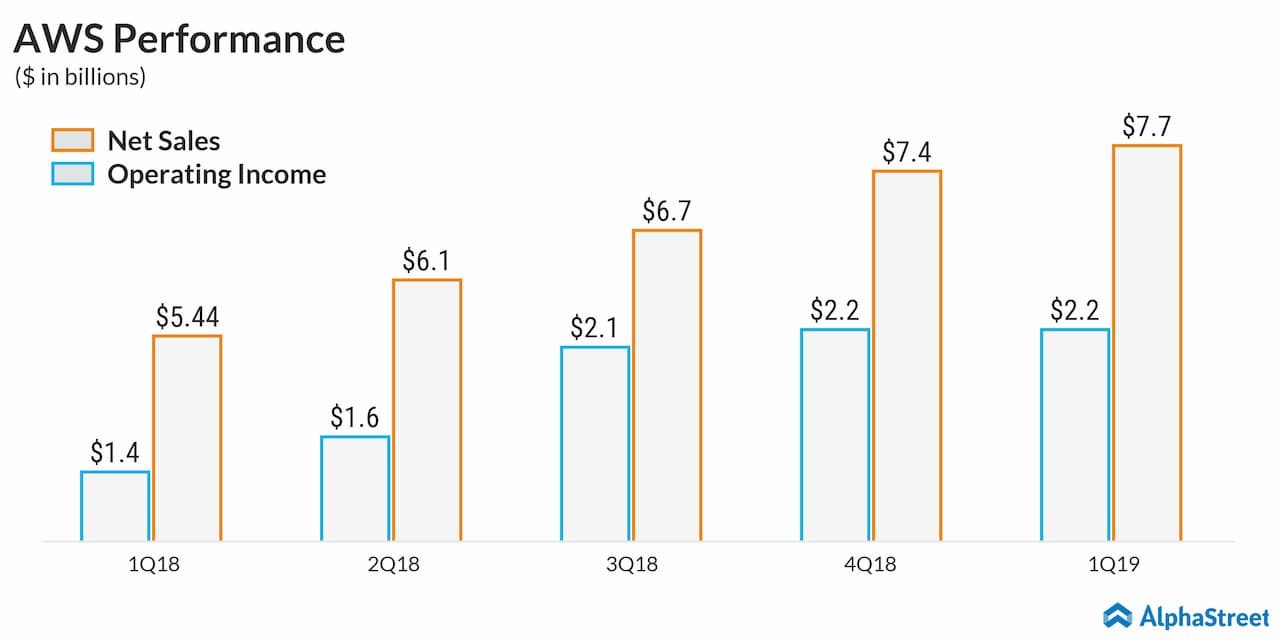

2) Segment Performance: It’s no brainer that North America brings in lion’s share of revenues (60%) to Amazon. Last quarter, Amazon Web Services (AWS) top line grew 41% contributing 13% to the total sales. The performance of both of these segments is important when it comes to top-line results.

When it comes to profitability, North America and AWS have been the money spinners for the firm as the International division is yet to make profits. In the first quarter, AWS operating income jumped 59% and the segment has been growing consistently last year. Increase in revenues is expected to give a fillip to the earnings in the second quarter.

3) Prime Day Update: The annual two-day event in July catering to its Prime members has been well received by its members. The company announced last week that the Prime Day event sales surpassed the combined Black Friday and Cyber Monday, which is a good sign for investors.

Even though the Prime Day event would not contribute to Q2 results, analysts would be expecting how the company is going to provide its outlook for the third quarter. In addition, investors would be expecting insights from the management on how the free next-day shipping for Prime members is coming along.

It would be worth to watch whether there is an increase in sales from its members taking into account a possible increase in shipping costs compared to free two-day shipping offered earlier.

Looking Forward

For the Q3 period, the street is expecting revenue to improve about 19% to $67.25 billion, and adjusted earnings to come in at $6.67 per share, an increase of 16% from last year. Taking into the account the strong Prime Day event sales, shareholders would be expecting another solid performance in the third quarter.

Get access to timely and accurate verbatim transcripts that are published within hours of the event