Overview

Supported by strategic partner 360 Group, the company offers a technology-empowered platform that allows financial institutions to connect with customers. Besides consumer finance, it also provides banking/insurance products and wealth management services. Customer acquisition, product matching, risk management, and post-lending management are the different stages of the process.

Industry & Competition

The capital-light business strategy and competitive pricing put 360 DigiTech in an advantageous position among peers in the fast-growing fintech industry. While the data-driven model attracts loan seekers to the platform, the company bets on its superior risk management capabilities to stay resilient and sustainable. It has stayed on the growth path consistently despite stiff competition and the country’s strict regulatory environment.

Read management/analysts’ comments on 360 DigiTech’s Q3 2021 earnings report

360 DigiTech’s main competitor is Ant Financial, a fintech firm promoted by Alibaba Group Holdings (NYSE: BABA) that is all set to become a public entity. The other rivals include WeBank — a subsidiary of Chinese tech giant Tencent Holdings. Yirendai (NYSE: YRD), which primarily provides education and home remodeling loans, and customer credit technology firm Qudian Inc. (NYSE: QD) also share the market with 360 DigiTech.

Financial Highlights

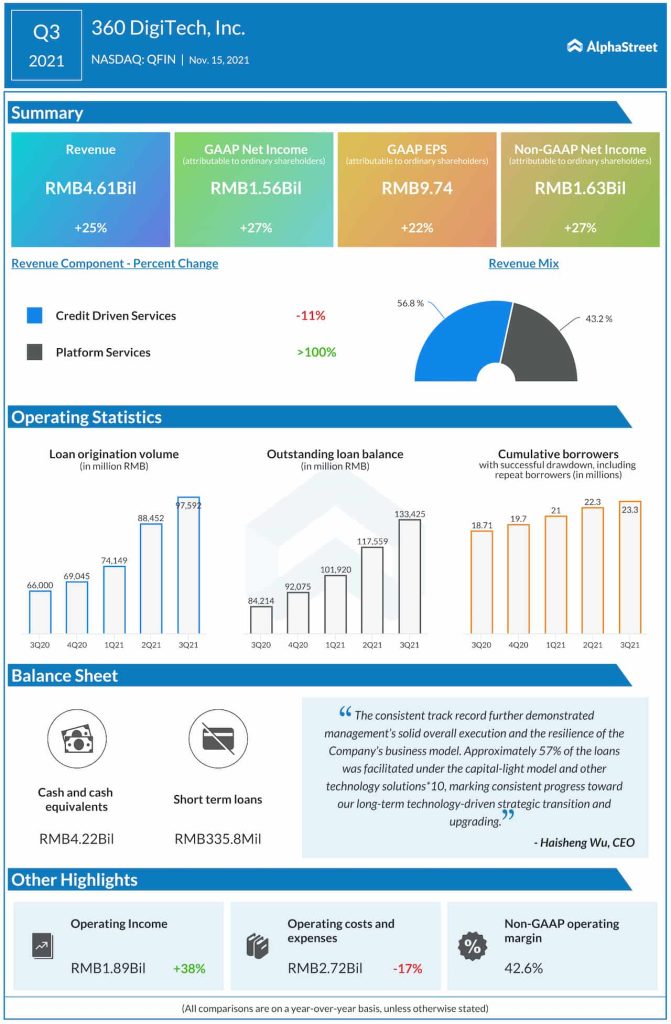

360 DigiTech has been delivering impressive top-line performance for quite some time, all along staying profitable. In the third quarter of 2021, revenues jumped 25% annually to RMB4.61 billion, with Platform Services expanding in double digits and offsetting a slowdown in Credit Driven Services. The strong performance translated into a 27% growth in adjusted earnings to RMB1.63 billion.

Loan origination volumes maintained the recent momentum and hovered near the RMB 1-billion mark, while cumulative borrowers crossed 23.3 million. Around 57% of the loans were facilitated through the capital-light model. The company ended the quarter with a cash balance of RMB4.22 billion.

Loan-loss provisions remained elevated in recent quarters, mainly due to the continuing uncertainty from the pandemic, while loan volumes and outstanding balance increased at a faster pace. It is estimated that 360 DigiTech would achieve continued healthy volume growth this year, overcoming the challenges posed by the restrictive regulatory environment.

Business Segments

Subsidiaries:

- HK Qirui International Technology Company Ltd.

- Shanghai Qiyue Information Technology Co., Ltd.

- Shanghai Qidi Information Technology Co., Ltd.

- Beihai Qicheng Information & Technology Co., Ltd.

Variable Interest Entities:

- Shanghai Qiyu Information Technology Co., Ltd.

- Fuzhou 360 Online Microcredit Co., Ltd.

- Fuzhou 360 Financing Guarantee Co., Ltd.

- Shanghai 360 Financing Guarantee Co., Ltd.

Recent Developments

In November, the board of directors approved a quarterly cash dividend policy, under which the company will declare and distribute a recurring cash dividend every quarter starting the third quarter of 2021. The dividend for the latest quarter is $0.14 per ordinary share, or $0.28 per ADS, which is expected to be paid on January 18, 2022, to shareholders of record on December 15, 2021.

Risks

Fintech being an emerging area of financial service, Chinese regulators constantly keep a tab on the industry. The businesses often face crackdowns, though the environment has become more friendly and most players find the new rules favorable. It is important for the companies to keep track of changes in guidelines and update themselves, which is probably the biggest challenge facing them.

Since the technology for digital lending is still evolving, services providers are forced to adopt effective measures to ensure low delinquency rates without affecting business growth. Another concern is the security of user data, which is highly sensitive in nature, and potential financial fraud. Also, the sector is susceptible to volatile credit cycles and macroeconomic fluctuations.

Outlook

After delivering strong results for the first three quarters, 360 DigiTech is estimated to have repeated the impressive performance in the final months of fiscal 2021, even though seasonal headwinds and unfavorable macro conditions persisted. The projected loan origination volume for the fourth quarter is between RMB90 billion and RMB100 billion, which would take the full-year number to RMB350-RMB360 billion.

Infographic: Key highlights from Citigroup (C) Q3 2021 earnings results

The capital-light segment will continue to be the key growth driver going forward, supported by the stable demand conditions and fast-paced adoption of digital services.

At Bourses

Shares of 360 DigiTech experienced volatility in 2021. After starting the year on a high note, the stock maintained the uptrend and reached a record high mid-year. However, the momentum waned soon and it retreated to the pre-peak levels in the following weeks. The stock ended 2021 slightly below $23 — which is nearly double the value recorded at the beginning of the year. It has been trading close to the 52-week average, lately.

Conclusion

Nearly two years into the pandemic, 360 DigiTech has not only navigated the crisis successfully but also benefitted from the digital transformation triggered by it. Meanwhile, the ongoing rectification process, in response to issues raised by regulatory agencies, might distract the management. Armed with cutting-edge technology and a dedicated team, the company looks poised to continue the success story in the new year and beyond.