Hongyi Zhou, chairman of the board of directors, said, “As we maintained strong growth momentum in recent years, a significant and increasing proportion of our business has already been derived from technology enabling services that we provide to our institutional partners. This proposed name change reflects such trend and better represents our long term strategic positioning in the market.”

According to Zhou, the new name stands for ‘digital technology in all angles.’ The company’s operations as well as the rights of shareholders will not be affected by the name change. August 12, 2020, has been set as the record date in order to determine the shareholders entitled to receive notice of the EGM.

“Holders of the Company’s ordinary shares whose names are on the register of members of the Company at the close of business on the Record Date are entitled to attend the EGM and any adjournment or postponement thereof in person,” said the statement.

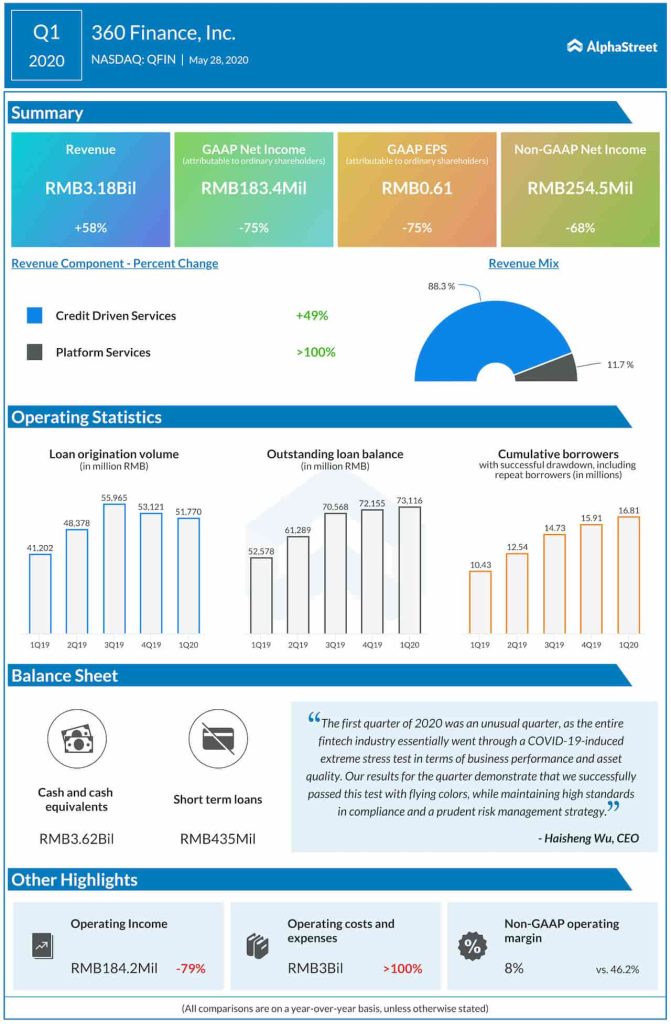

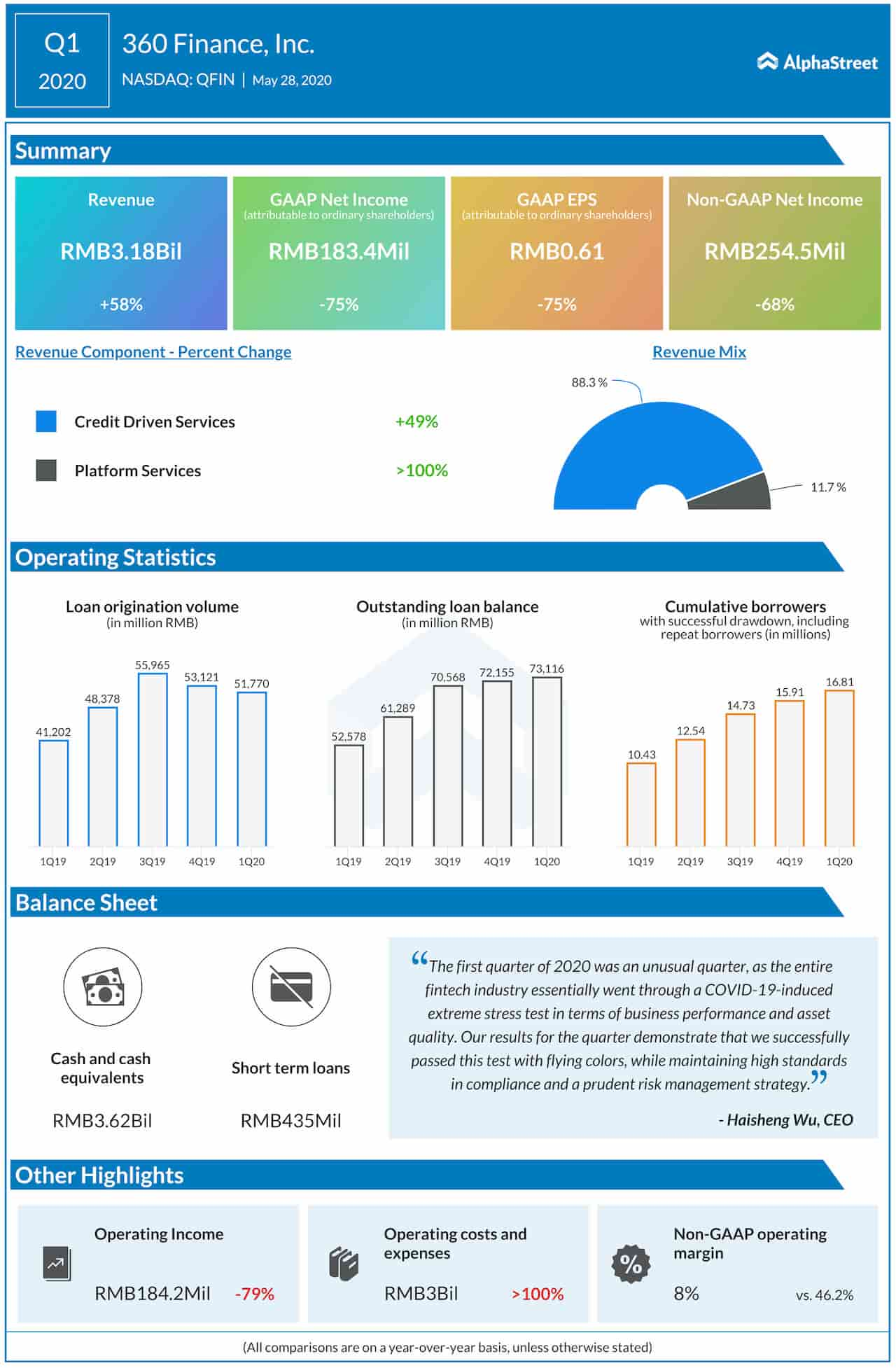

Incorporated in 2016, 360 Finance provides credit to underserved borrowers in collaboration with funding partners and connects more than one billion mobile devices, offering various products through a process supported by effective risk management. The core product is mostly used as a supplement to credit card debt.

In the first quarter of 2020, revenues surged 58% annually to RMB3.2 billion, aided by the steady growth in both Credit Driven Services and Platform Services. However, elevated costs weighed on margins and net profit dropped 68% to RMB255 million, even as markets took a beating from the pandemic-induced disruption.

[irp posts=”62932″]