At a time when the business world is facing unprecedented uncertainty, 360 Finance, Inc. (NASDAQ: QFIN) is counting on its risk strategy and strong customer base to tide over the crisis. While the strong revenue growth in the first quarter brought cheer to investors, the growing concerns over the deteriorating US-China relations reflected in the post-earnings performance of the stock.

The markets suffered huge losses after being hit by the coronavirus, and 360 Finance was no exception. However, shares of the consumer finance platform recovered rather quickly from the recent fall, unlike most Chinese companies listed in the US. Analysts’ average price target points to a decent uptick in value in the coming months. That, combined with the buy rating, should make the stock attractive to investors.

[irp posts=”59791″]

The trade tension between Washington and Beijing has been taking a toll on investor sentiment for quite some time, and things went from bad to worse after the senate passed a bill to delist certain Chinese stocks from American stock exchanges.

Growth Target

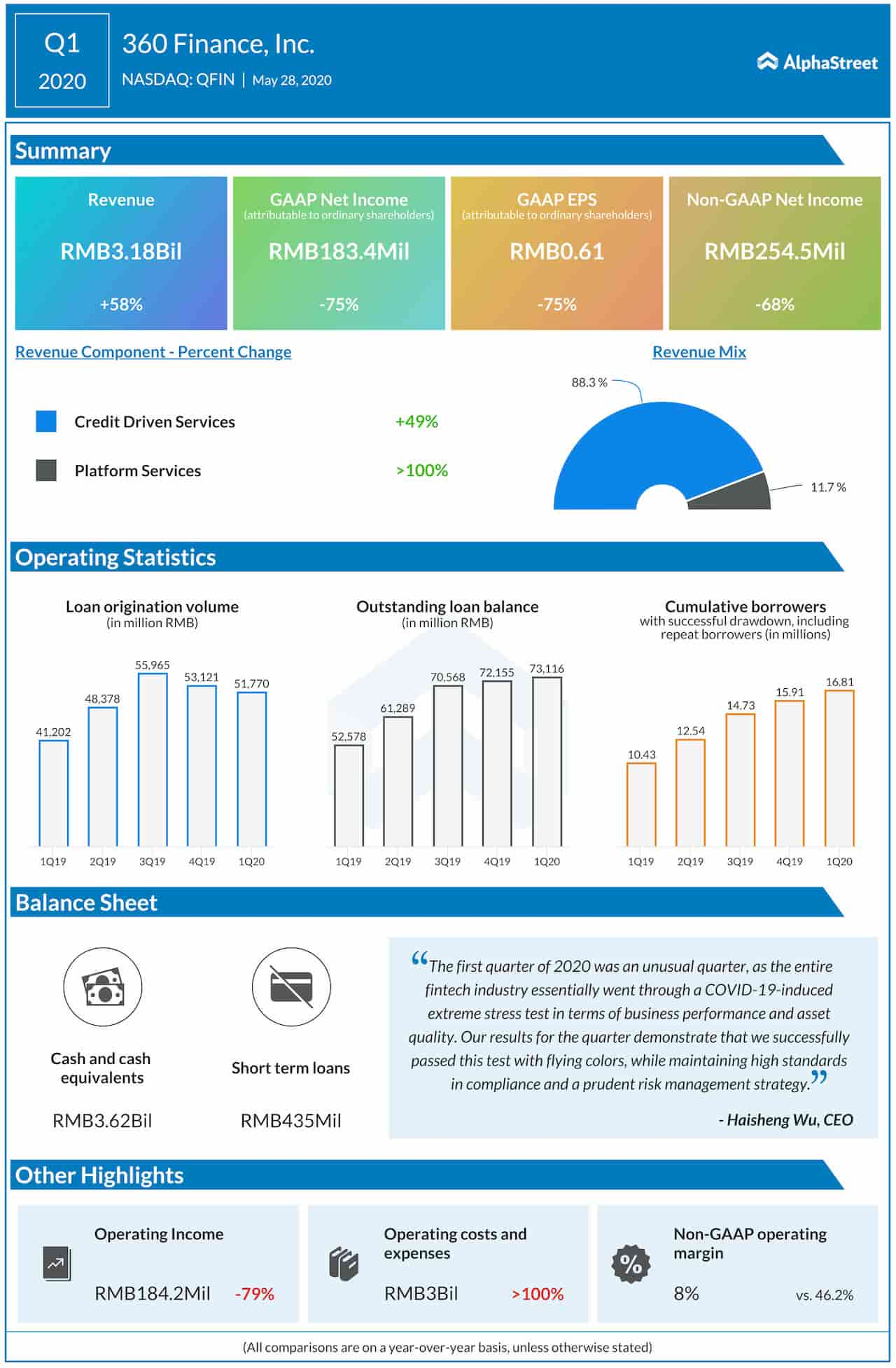

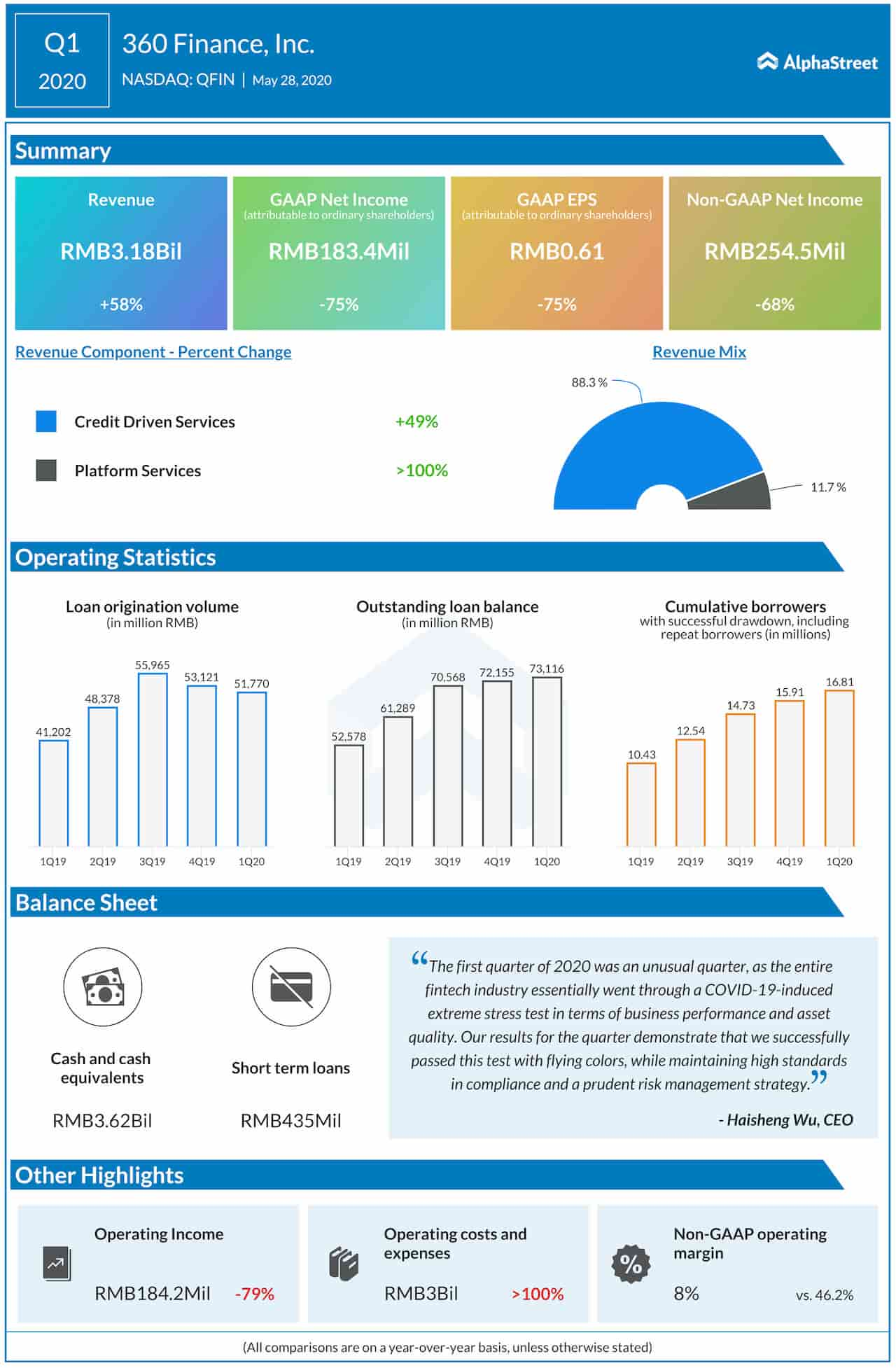

In an interview with AlphaStreet, Jiang Wu, chief financial officer of 360 Finance, said the management intends to boost the loan origination volume of the company’s Platform Services segment to 35-40% from the current 20%, thereby taking advantage of the low risk associated with that business.

Moreover, Platform Services is the operating segment most encouraged by regulators. The highly successful capital-light model, which comes under this division, assumes more importance in the prevailing situation as it does not require any significant loan loss provision.

On Partnerships

The innovative business model, which has a digital base, helps 360 Finance operate hand-in-hand with the traditional financial services institutions. It also facilitates effective partnerships with other banks, and such deals benefit from the company’s customer acquisition prowess and advanced digital platform.

“We are not direct competitors with traditional banks, instead we provide complementary value for banks in terms of online consumer loan.”

Jiang Wu, chief financial officer of 360 Finance

Referring to the full-year outlook for loan origination volume, which was reaffirmed in the RMB 200-220 billion range, the company termed it a conservative forecast based on the first-quarter loan volume of RMB 51.8 billion. But it did not provide any earnings guidance for the year. Meanwhile, the ongoing migration to the new accounting standard, as stipulated by regulators, makes year-over-year comparisons less reliable.

“We would like to highlight as all Chinese Fintech companies listed in the US market are required to adopt new accounting standards from 2020.01.01, there is no direct a like-for-like comparison. If you benchmark across the whole sector that under the pandemic impact, we accomplished this stable loan origination volume with decent risk profiles,” Wu told AlphaStreet in response to a query.

Strong Revenue Growth

On Thursday, 360 Finance reported a 58% surge in first-quarter revenues to RMB 3.2 billion, while earnings dropped to RMB 0.61 per share hurt by a sharp increase in expenses. Loan origination volumes rose from last year but came in below the levels seen in the trailing two quarters. The highlight of the quarter was the strong performance by Platform Services, with revenues more than doubling year-over-year.

New Board Member

In a separate report, the company this week said it has appointed Dan Zhao to the board of directors, effective immediately. Zhao, who held a senior executive position at Alibaba (BABA) prior to joining 360 Finance, is currently the company’s vice president.

Shares of 360 Finance, which debuted on the Nasdaq stock exchange nearly one-and-half years ago, made steady gains since mid-March after dropping to a new low hurt by the COVID-induced selloff. The stock traded slightly higher during Friday’s regular session, after closing the previous session lower.

—

For more insights about 360 Finance, read the latest earnings transcript here.