Alibaba Group Holding Ltd (NYSE: BABA) is striving to regain strength after falling sharply last week, ahead of fourth-quarter earnings. The positive results failed to impress stakeholders as market sentiment was dampened by the Senate’s proposal to impose curbs on certain US-listed Chinese stocks. Also, there are concerns that Alibaba’s retail and cloud segments did not benefit as much from the COVID-related shutdown as expected.

Data shows that performance of the China-based e-commerce behemoth was slightly affected by economic headwinds related to the widespread virus attack and reduced business activity. Nevertheless, both the retail division and cloud services, the main business segments, witnessed high demand since March due to the prevailing movement restrictions, though the e-commerce platform suffered in the initial weeks of the crisis.

[irp posts=”62414″]

The highlight of the quarter was the record growth of the company’s Digital Economy, with gross merchandise volume crossing the $1-trillion mark for the first time. Encouraged by the solid performance, the management forecasts that sales would rise to $91 billion this year, which represents about one-sixth of China’s total retail sales. Of late, categories like food/grocery and education are rapidly moving to the digital platform, a trend Alibaba expects to leverage.

Multiple Streams

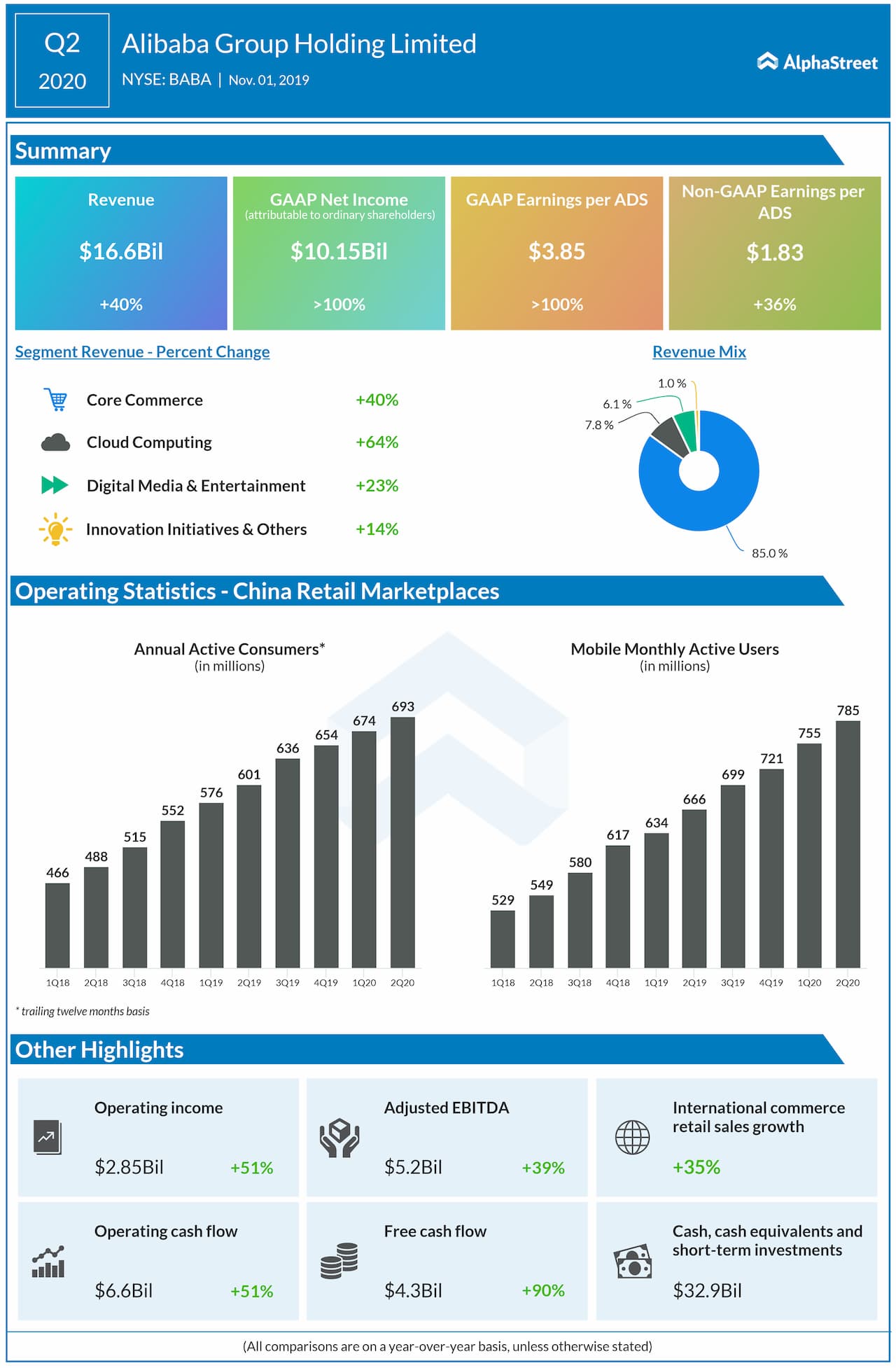

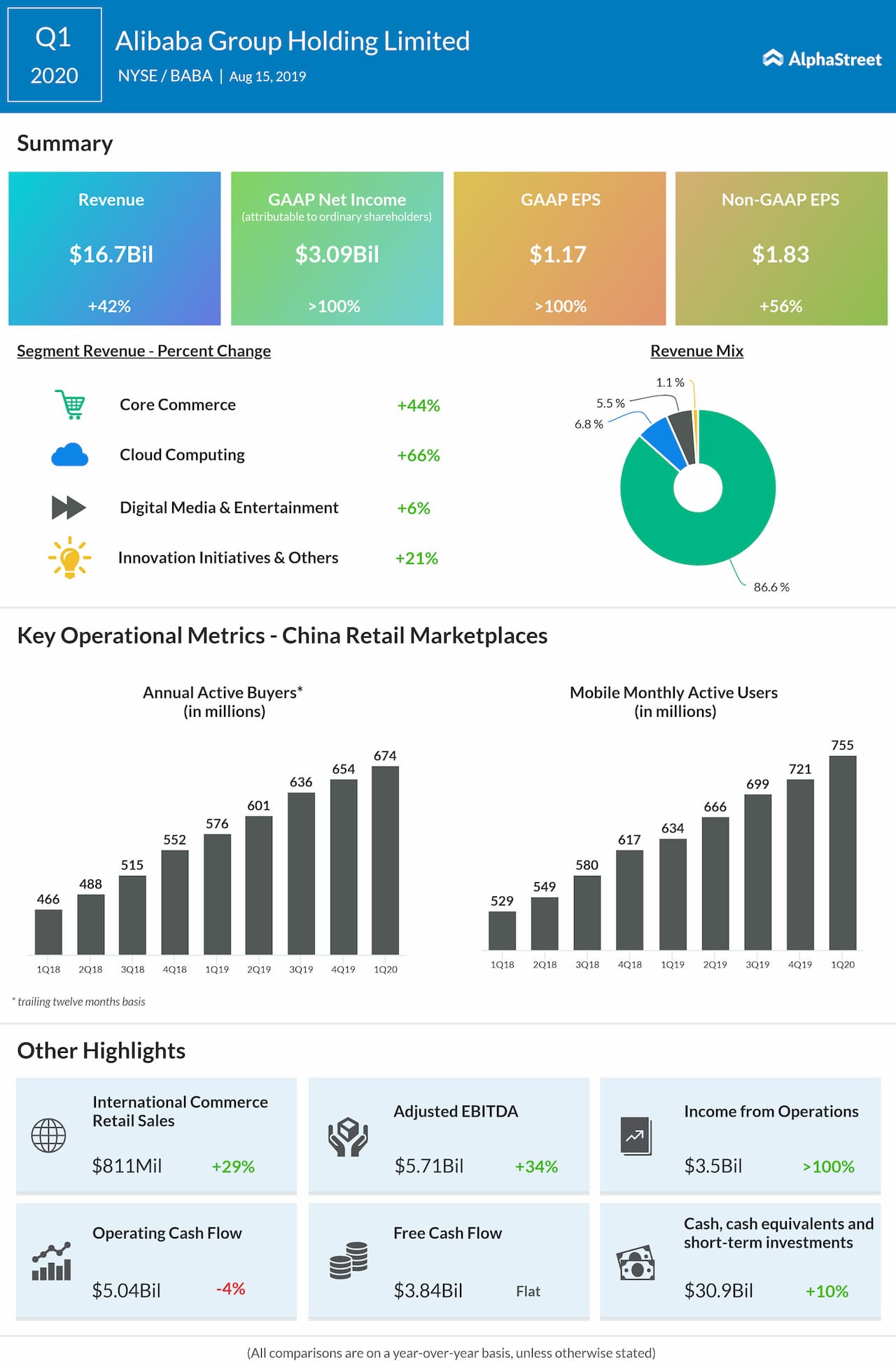

Revenues from advertising and commissions remained high in the past three years, which is a clear indication that investments in technology and innovation are yielding results. Interestingly, the management remains confident about the spending power of the Chinese people, even in these times of uncertainty, though their priorities vary.

While there is uncertainty with regard to recovery of the retail business in the international market, Alibaba executives remain bullish about the prospects in the local market, citing the changing customer behavior and rapid digital adoption in the wake of the COVID onslaught. In what can be called a two-pronged strategy, the company plans to expand into the huge untapped market in lower-tier cities and rural China by digitizing the transactions with the help of the Alipay payment platform.

Youku Shines

When it comes to the cloud segment, the main driving force has been the high consumption of video content during the lockdown, a trend that is expected to continue even after the COVID scenario improves. Alibaba’s own video hosting business Youku is expected to have a busy time ahead, churning out videos to meet the growing demand, just like communications platform DingTalk that is being widely adopted by organizations across the country.

“We believe the consumer habit of buying fresh food and groceries online will continue after the pandemic and online and offline integration will drive the new retail model to the next stage of development. We have been investing for years to build a new retail tech knowledge infrastructure, which will help us further strengthen our market leadership in this sector,” said Daniel Zhang, chief executive officer of Alibaba, while speaking to analysts at the post-earnings conference call.

Broad-based Growth

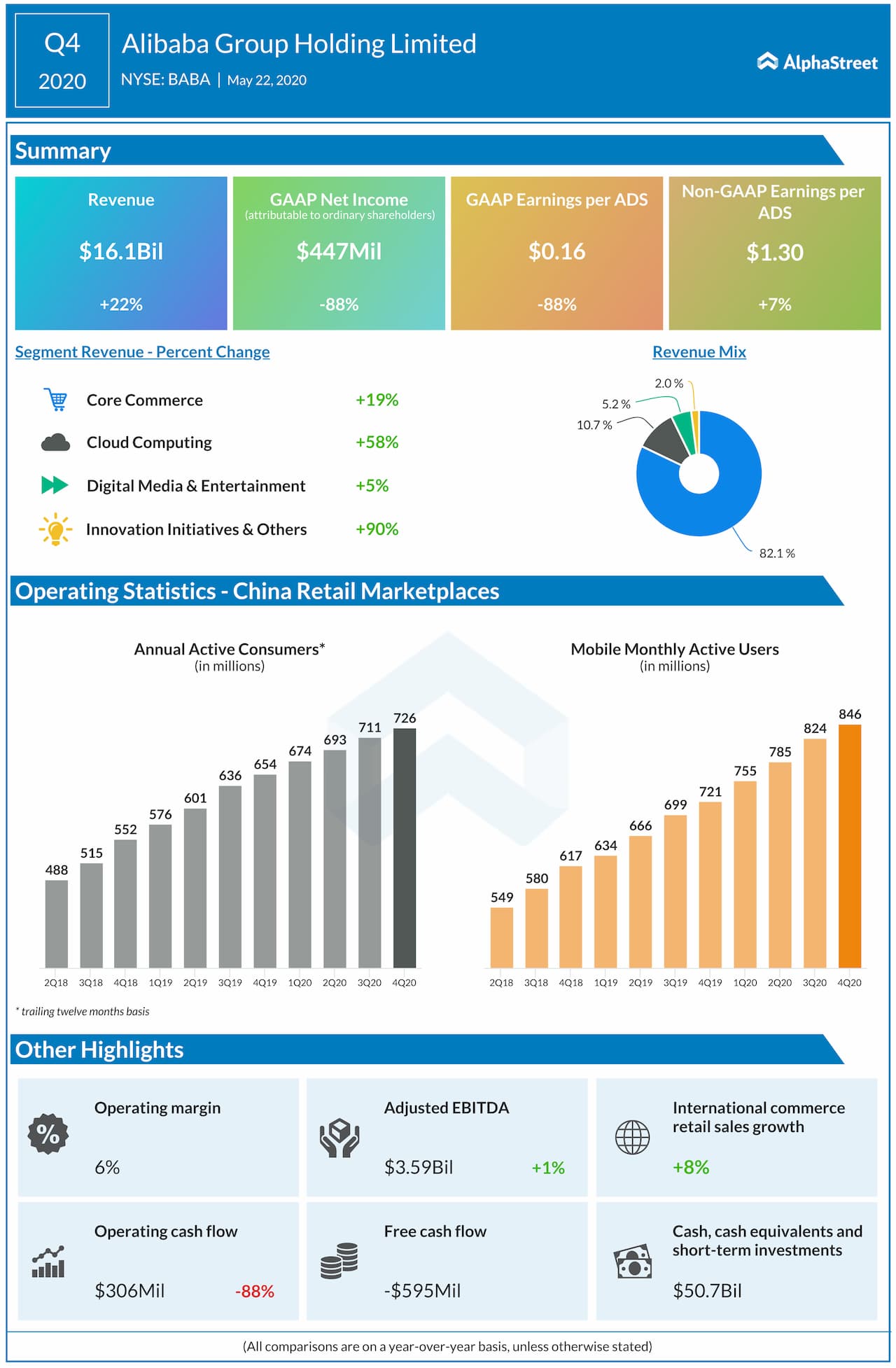

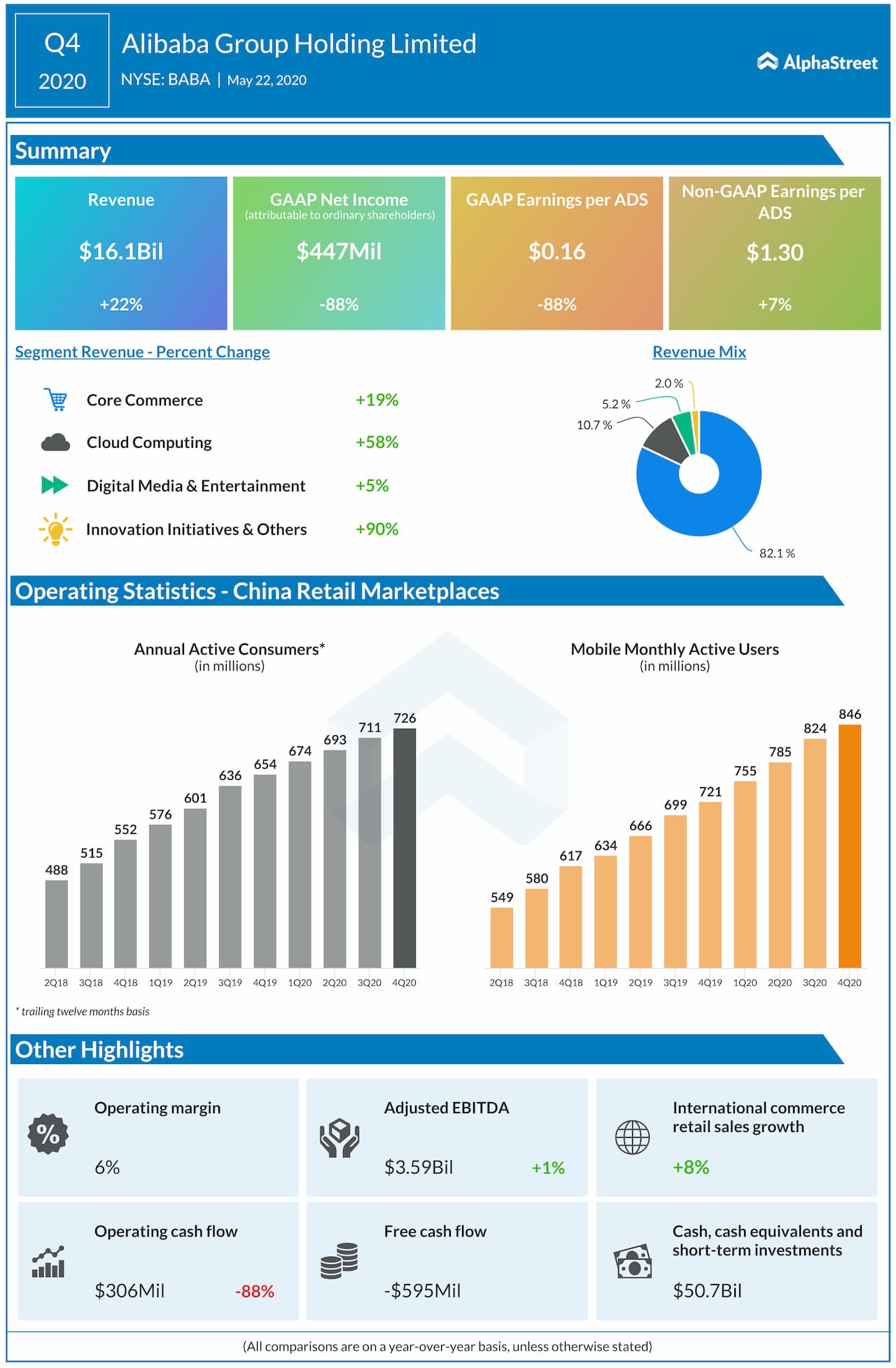

It seems the pandemic-related restrictions brought several new customers to the e-commerce platform in the March quarter, and there was another strong increase in the number of active users. Consequently, revenues grew in all the four business units, with the Core Commerce segment registering a 19% growth. Earnings, on an adjusted basis, moved up 7% annually to $1.30 per American depositary shares. The results also topped the Street view.

“Looking ahead, we will continue the same strategy of delivering robust revenue growth and sustainable profit growth. Although it is difficult to predict the uncertainty of global economic and geopolitical developments. Based on our current view of Chinese domestic consumption and enterprise digitization, we expect to generate over RMB650 billion in total revenue in fiscal year 2021.”

Maggie Wu, chief financial officer, Alibaba

After showing signs of an improvement in the final months of last year, the Sino-US standoff is perhaps getting more complicated after the recent spat between the Chinese president and Trump over the spread of coronavirus. The move to delist Chinese companies that fail to comply with listing norms can have unpleasant consequences for both countries.

[irp posts=”59783″]

Alibaba’s stock lost 9% so far this year, with the downturn gathering steam last week. After making an impressive start to the calendar year 2020, the stock reached an all-time high in early January but retreated in the following weeks. The stock still enjoys strong buy rating as almost all the analysts following it see significant growth prospects in the long term.