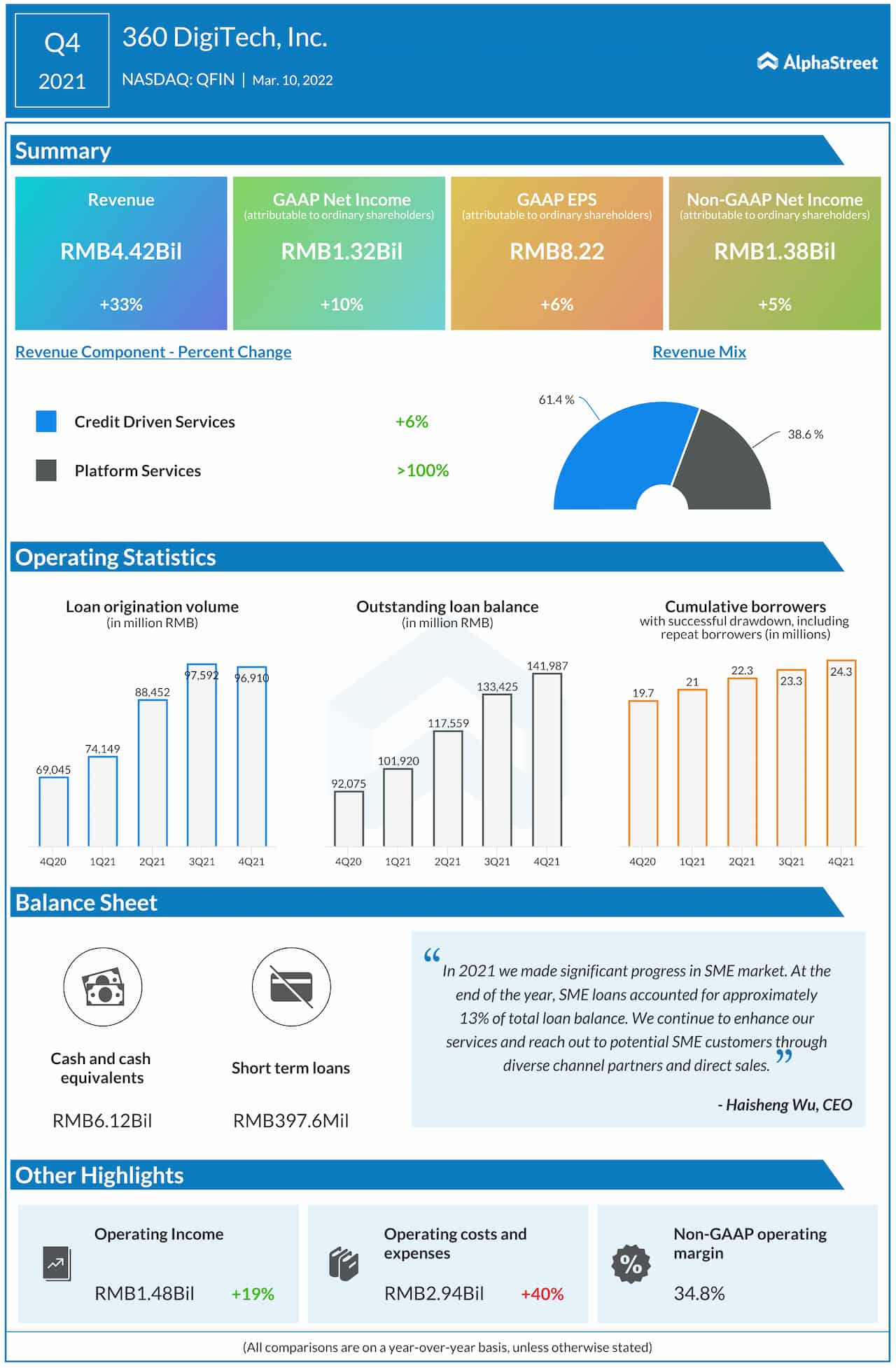

360 DigiTech, Inc. (NASDAQ: QFIN), a dominant player in the Chinese consumer finance market, recently reported strong earnings and revenue growth for the fourth quarter and issued upbeat guidance, forecasting double-digit loan growth for fiscal 2022. The company has stayed resilient to the macroeconomic headwinds, mainly those related to the pandemic, and successfully tackled the growing competition in the online lending market.

In an email interview with AlphaStreet, 360 DigiTech’s chief financial officer Alex Xu provided valuable insights into the company’s recent financial performance and future plans.

Speaking on the bullish loan growth guidance, Xu said that the strong performance — marked by record-setting numbers in the fourth quarter and fiscal 2021 — would continue this year. There has been a healthy demand for consumer credit and improvement in asset quality amid ample funding so far this year, after fluctuating in the fourth quarter primarily due to the seasonal tightening of money supply in the system.

Continued expansion of partnerships with major financial institutions, taking advantage of the company’s technological prowess, helped 360 DigiTech keep optimizing the mix of its financial institution partners and set up a more resilient and balanced partner network. The positive factors include broad regional coverage, superior risk management capabilities of newly added financial institutions, and their diverse business lines. Besides, the Intelligent Credit Engine product gives a competitive advantage when it comes to meeting the compliance requirements of certain financial institutions, said Xu.

Read management/analysts’ comments on 360 DigiTech’s Q4 2021 earnings

According to him, competitive pricing helped improve the overall quality of new customers, and the value of such customers will be gradually released over the life cycle. With higher drawdown ratios and retention rates, customers at lower pricing are expected to generate better loan-to-value going forward.

In the fourth quarter of 2021, the company had ABS insurance of RMB1.1 billion, at a low coupon rate of 5.70%. That contributed to the 282% growth in total ABS insurance for the full fiscal year, to RMB6.5 billion.

On being asked about the future growth prospects of the fast-growing capital-light model, Xu said its contribution to the total volume is expected to keep fluctuating around the current level, at least through the first half of the year. Beyond that transition period, capital-light would become a larger portion of the business in the long run, complementing the company’s long-term strategy of pursuing a tech-driven business model.

The management is optimistic about building a stronger foundation for future growth by optimizing operations, upgrading the technology platform, and expanding the customer base during the transition period. When it comes to achieving the interest rate reduction target, the 200-bps cut in the most recent quarter was significant and is expected to provide enough flexibility in the first quarter and second quarter as the company seeks to become compliant with the regulatory requirement and meet the mid-year deadline.

In the fourth quarter, the average pricing on the loan portfolio declined by 200 basis points, and average interest rates on the 360 DigiTech platform dropped below 24% by year-end. The management is currently projecting total loan volumes between RMB410 billion and RMB450 billion for fiscal 2022, which is going to be a transitional year for the industry.

360 DigiTech Earnings: Q4 revenues climb 33%; net income rises

Referring to the company’s growth strategy, Xu hinted at making continued investments in research and development, while prioritizing the technology-driven strategy with a focus on pursuing innovative solutions and business models. For the B2B segment, plans are afoot to add more diverse products and services for different financial institutions. For enhancing the sustainability of its services, the company intends to partner with stronger financial institutions, so as to optimize the mix and quality of the partnership network.

Also, more products targeting high-quality B2C borrowers will be introduced this year for achieving better loan-to-value and customer retention rates. Xu expects to capitalize on the marked increase in registered capital of the company’s licensed microlending subsidiary, which according to him is a crucial strategic resource. In what could be a significant step in expanding the SME segment, the company will launch an upgraded application that is different from 360 Jietiao to better serve customers.