Shares of Alibaba Group Holding Limited (NYSE: BABA) fell 8% on Thursday after the company delivered fourth quarter 2025 earnings results that missed expectations. Revenue and earnings for the quarter increased compared to the same period a year ago but fell short of estimates. Here are a few points to note on the company’s performance in Q4:

Q4 numbers

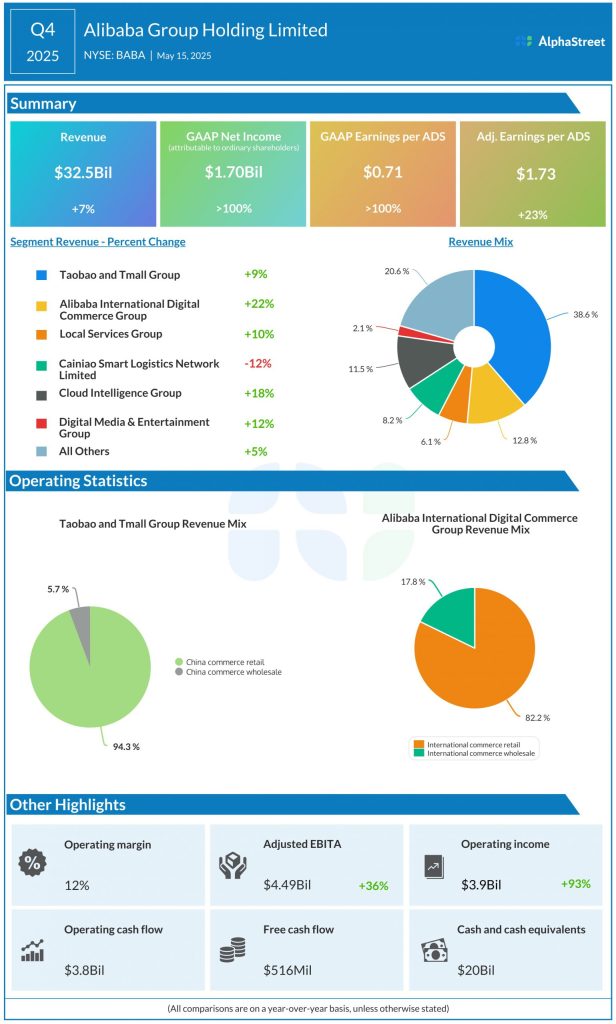

In the fourth quarter of 2025, Alibaba generated revenue of $32.6 billion, which was up 7% year-over-year. Diluted earnings per ADS more than doubled to $0.71 versus last year. Adjusted earnings per ADS grew 23% YoY to $1.73. Despite the YoY growth, the top and bottom line numbers came below expectations.

Ecommerce

In Q4, revenue in the Taobao and Tmall Group segment increased 9% YoY to $13.9 billion. Within this segment, revenues from the China commerce retail business rose 8%, helped by a 12% increase in customer management revenue which was fueled by improved take rate. Revenue in the China commerce wholesale business increased 17%, driven by higher revenue from value-added services.

During the quarter, Alibaba saw a double-digit increase in 88VIP members, its highest spending consumer group, which surpassed 50 million.

Revenue in the Alibaba International Digital Commerce Group (AIDC) segment grew 22% YoY to $4.6 billion in the fourth quarter, driven mainly by strength in cross-border business. International commerce retail revenues were up 24% while international commerce wholesale revenue was up 16% in Q4.

AIDC continues to expand its footprint across several key regions including select European markets and the Gulf region. This segment is expected to benefit from its diversification in businesses and product offerings across geographies.

Cloud and AI

In the fourth quarter, the Cloud Intelligence Group saw revenue increase 18% YoY to $4.15 billion. This segment benefited from strong growth in public cloud revenue and the rising adoption of AI-related products.

AI-related product revenue saw triple-digit growth for the seventh quarter in a row, fueled by broader adoption of AI products across industry verticals, and a growing focus on value-added applications. Alibaba’s investments are focused on AI products and services, increasing cloud adoption for AI, and maintaining its leadership position in the market.