Sales and profits decline but beat expectations

Softness in big-ticket transactions

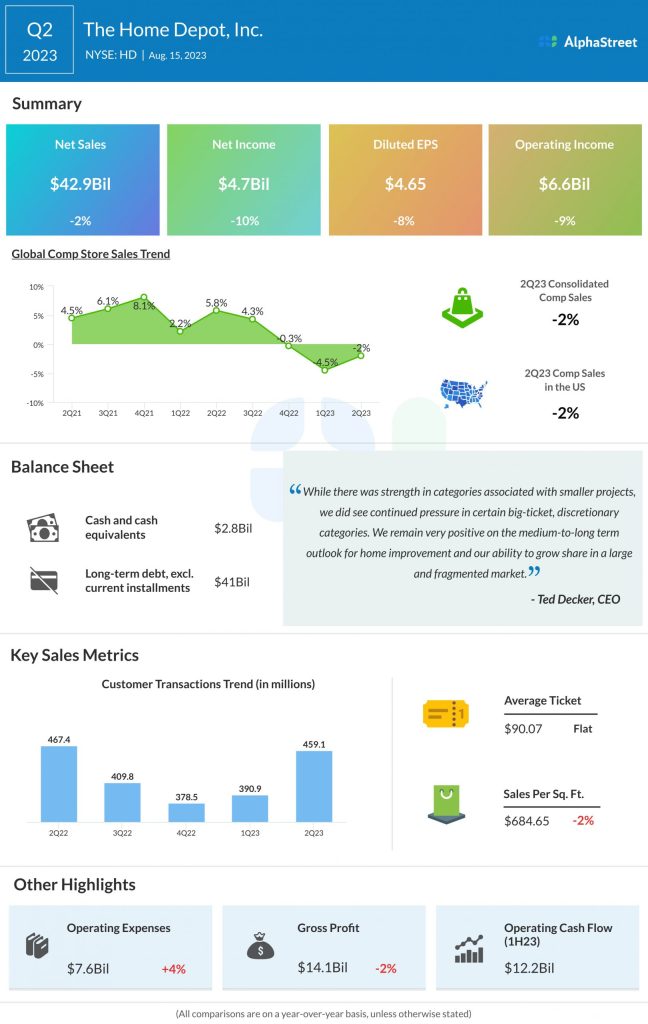

In Q2, Home Depot continued to see softness in big-ticket, discretionary categories. Overall comparable sales and comparable sales in the US were both down 2% in the quarter. Big-ticket comp transactions, or those over $1000, decreased 5.5% YoY in Q2.

On its quarterly conference call, the company said that after three years of strong demand in the home improvement market, it was seeing softness in big-ticket discretionary categories like patio and appliances, which reflects both pull-forward and deferral of these single-item purchases.

Pro and DIY segments

The Pro customer segment delivered a negative sales performance in Q2 but managed to outperform the DIY customer segment. Home Depot is seeing lower backlogs in Pro compared to last year but they still remain at healthy levels. The backlogs also consist of more small-scale projects similar to the trend seen in the first quarter. In Q2, the company saw strength across Pro-heavy categories like gypsum, fasteners and insulation.

Outlook

For the full year of 2023, Home Depot expects sales and comparable sales to decline 2-5% year-over-year. EPS is expected to decline 7-13% YoY. Despite the current environment, the company believes it is well positioned to capture further market share in the large and fragmented $950 billion plus addressable market.