Revenue

Earnings

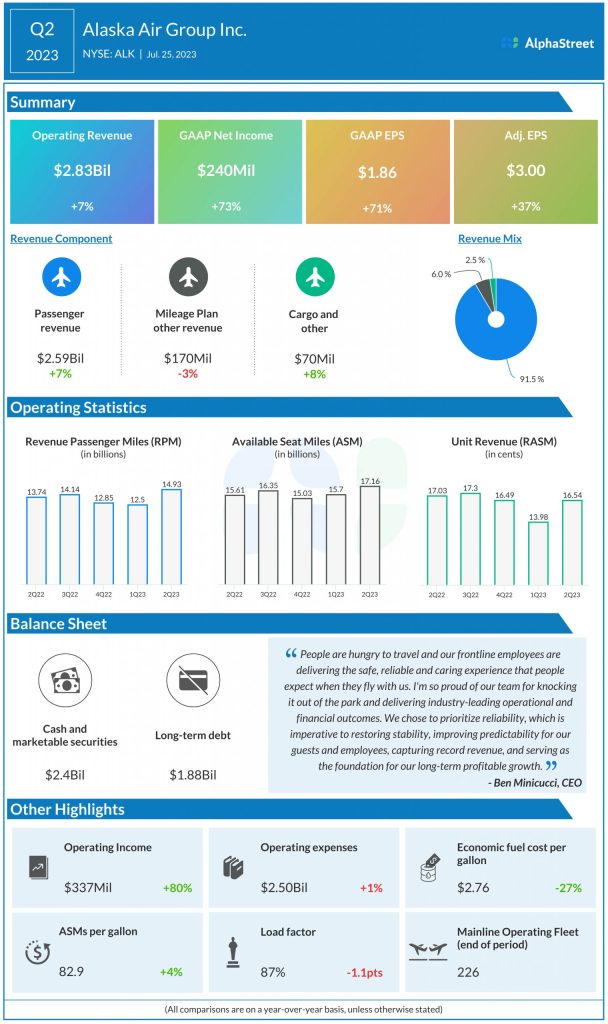

In Q2, Alaska’s GAAP net income grew over 70% to $240 million, or $1.86 per share, compared to last year. Adjusted EPS rose 37% to $3.00, surpassing projections of $2.68. For full-year 2023, EPS is expected to range between $5.50-7.50.

Costs

In Q2 2023, cost per available seat mile, excluding fuel and special items, (CASMex) was up 2% year-over-year. For Q3 2023, CASM-ex is expected to be down 0-2% YoY. For FY2023, CASMex is expected to be down 1-3% YoY. Economic fuel cost per gallon is estimated to be $2.70-2.80 in Q3.

Other metrics

Alaska expects adjusted pre-tax margin to range between 14-16% in Q3 2023 and 9-12% for FY2023. Capacity is estimated to be up 10-13% in Q3 and up 11-13% in FY2023. Capital expenditures are estimated to be around $1.8 billion for FY2023.