Q2 performance

Navigating a dynamic consumer environment

As mentioned on the Q2 earnings call, consumers are facing economic pressures which has led to them prioritizing affordability and seeking maximum value on their purchases. Against this backdrop, many manufacturers are increasing their investments in advertising and promotions. Conagra’s strategy has been to invest in building its brands rather than rely on promotions to drive volume, and this move is paying off.

The company’s brand-building investments have helped drive strong market share performance and volume recovery. In Q2, 67% of CAG’s portfolio held or gained volume share. In the frozen and snacks categories, 87% of the portfolio held or gained volume share during the quarter.

Conagra saw strong frozen consumption in Q2, helped by volume share gains in single-serve meal brands, multi-serve meal brands, and Birds Eye Vegetables. The company is seeing good performance within its snacking portfolio, although high cocoa prices contributed to a decline in Swiss Miss hot chocolate. Excluding Swiss Miss, snacks volume rose 0.6% in Q2. CAG is also seeing encouraging volume trends in its staples category, along with strong performance in its chili business.

Outlook

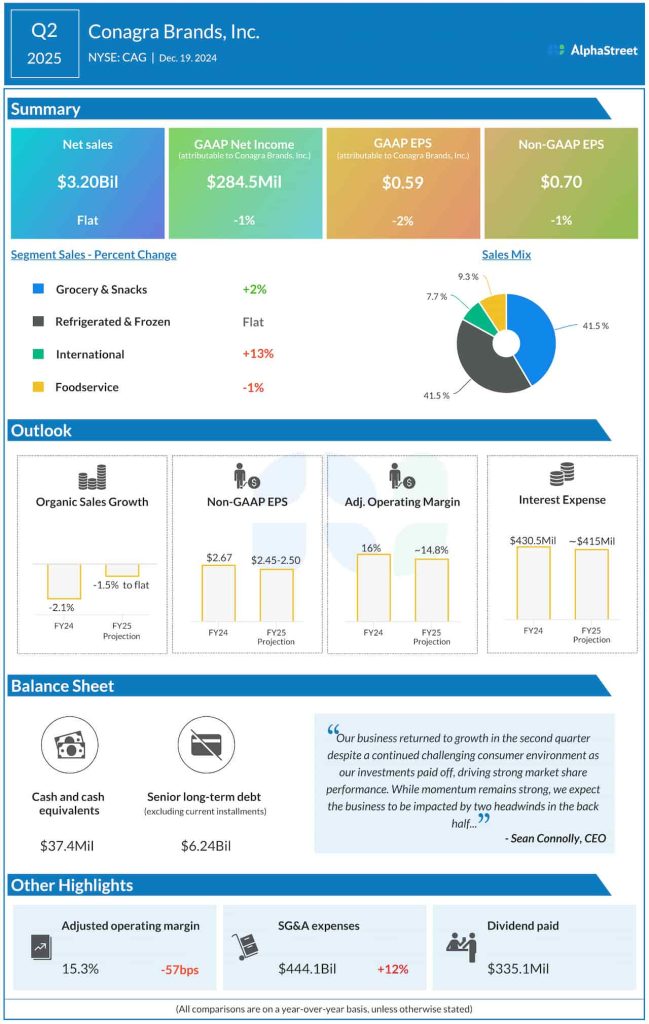

Conagra expects its business to face pressures from higher than expected inflation and unfavorable foreign exchange rates in the second half of fiscal year 2025. The company plans on taking limited pricing actions late in the third quarter of 2025 to offset some inflation in cocoa and sugar, and it expects volumes and organic sales to improve in the second half of the year versus the first half.

Based on these factors, CAG updated its guidance for fiscal year 2025. It now expects organic sales growth for the full year to be near the midpoint of its guidance range of down 1.5% to flat versus FY2024.

Adjusted operating margin is now expected to be approx. 14.8% versus the previous range of 15.6-15.8%, as inflation is now expected to be closer to 4% versus the earlier expectation of around 3%. Adjusted gross margin is expected to contract by approx. 90 basis points versus last year. Adjusted EPS is now expected to range between $2.45-2.50 versus the prior outlook of $2.60-2.65.