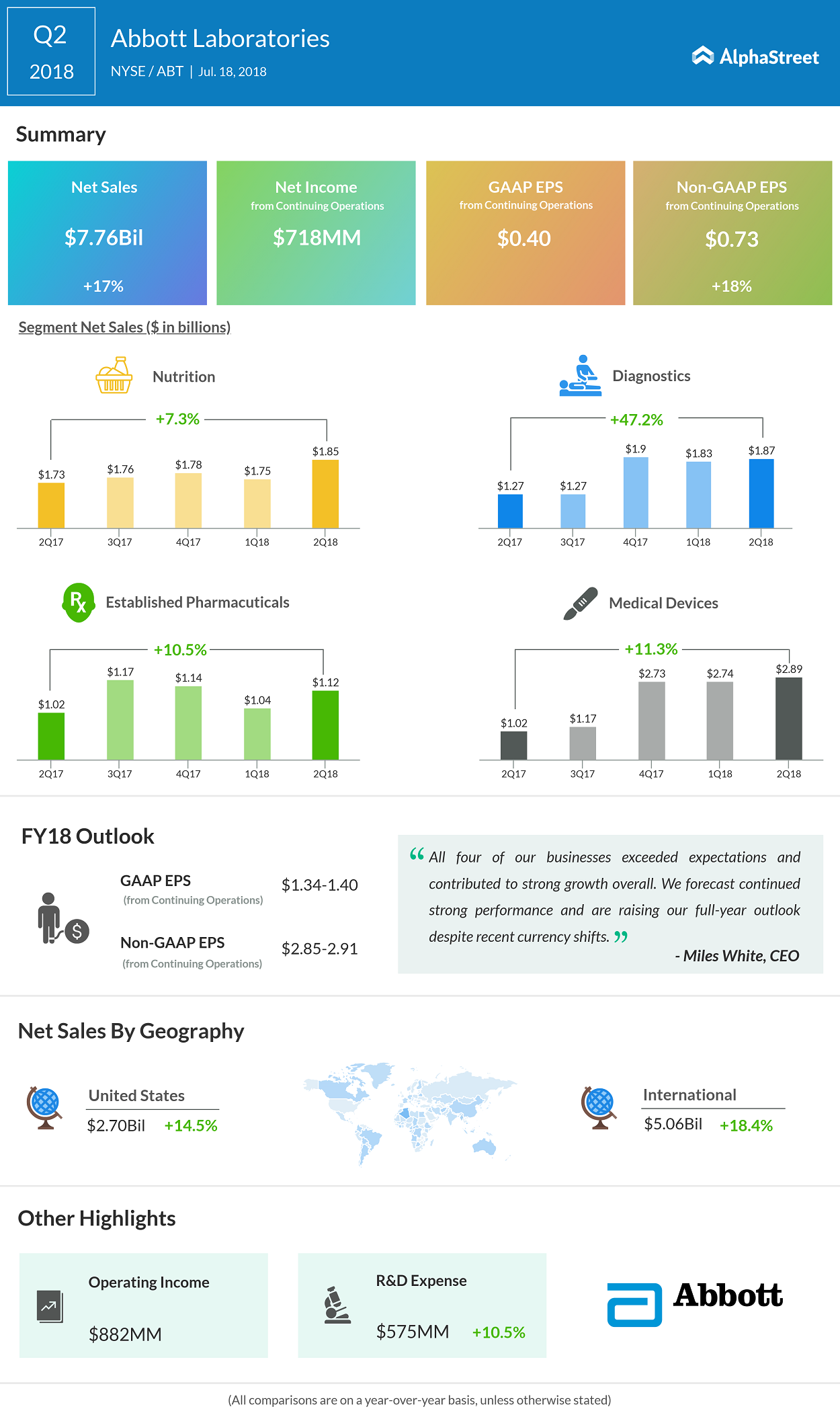

Healthcare giant Abbott Laboratories (ABT) reported its quarterly results for its second quarter of 2018 today before the opening bell. The company posted earnings of $733 million, or $0.40 per share on worldwide sales of $7.8 billion, up 17% year-over-year. On an adjusted basis, the company reported earnings of $0.73 per share, beating estimates.

In terms of sales, analysts expected an increase of 16.7% over the prior-year quarter at $7.7 billion. Shares rose more than 1.5% in pre-market trading, post the earnings release.

“All four of our businesses exceeded expectations and contributed to strong growth overall. We forecast continued strong performance and are raising our full-year outlook despite recent currency shifts,” said Miles White, CEO.

Yet again, Abbott’s diagnostic business posted strong growth of 47%, driven by the synergies of the Alere acquisition. Medical devices business, the company’s highest sales contributor, saw its sales grow 11%, thanks to the strong demand for the company’s FreeStyle Libre device.

Related: Abbott Q1 earnings

Backing the positive results, Abbott raised its full-year 2018 earnings guidance, with EPS from continuing operations now expected in the range of $1.34 to $1.40, up from the earlier expected range of $1.23 to $1.33 range. On an adjusted basis, EPS from continuing operations for full-year is now expected in the range of $2.85 to $2.91, higher than the earlier expected $2.80 to $2.90 range.

For third quarter of 2018, Abbott sees EPS from continuing operations coming in the range of $0.32 to $0.34, while adjusted EPS from continuing operations is anticipated to be $0.73 to $0.75.

On a regional basis, Abbott saw strong performance across its geographies, led by growth in many regions across Asia, including Greater China, and Latin America.

Related: Strong pharma business aids in Johnson & Johnson’s Q2 beat

The company’s peers Johnson & Johnson (JNJ) reported a sales growth of more than 10% for its last reported quarter yesterday. Additionally, its other competitors to the likes of Boston Scientific (BSX) and Edwards Lifesciences (EW) are expected to post growth of 15% and 9% respectively for their upcoming quarter releases.

For the trailing 12 months, the stock has returned over 28% to the company’s long-term investors, while the returns also remained positive for the short-term, giving a reasonable 6% return for its investors since the beginning of 2018.

Related Infographics: Q1 earnings