Strong franchises

Activision Blizzard’s growth is supported by its strong set of franchises that help in driving revenue and bookings. Titles such as Call of Duty: Black Ops Cold War, Call of Duty Mobile and Warzone helped drive a 72% growth in revenue within the Activision segment during the first quarter compared to the same period a year ago. Call of Duty in-game net bookings on console and PC grew over 60% YoY.

Warcraft and Hearthstone helped drive a 7% YoY growth in revenue within the Blizzard segment. The expansion of World of Warcraft’s Shadowlands and Forged in the Barrens helped boost net bookings growth during the quarter.

Within the King segment, the Candy Crush and Farm Heroes franchises drove revenue growth of 22% along with in-game net bookings growth in the high-teens percentage on a year-over-year basis during the first quarter. The growth in in-game net bookings has remained strong going into the second quarter.

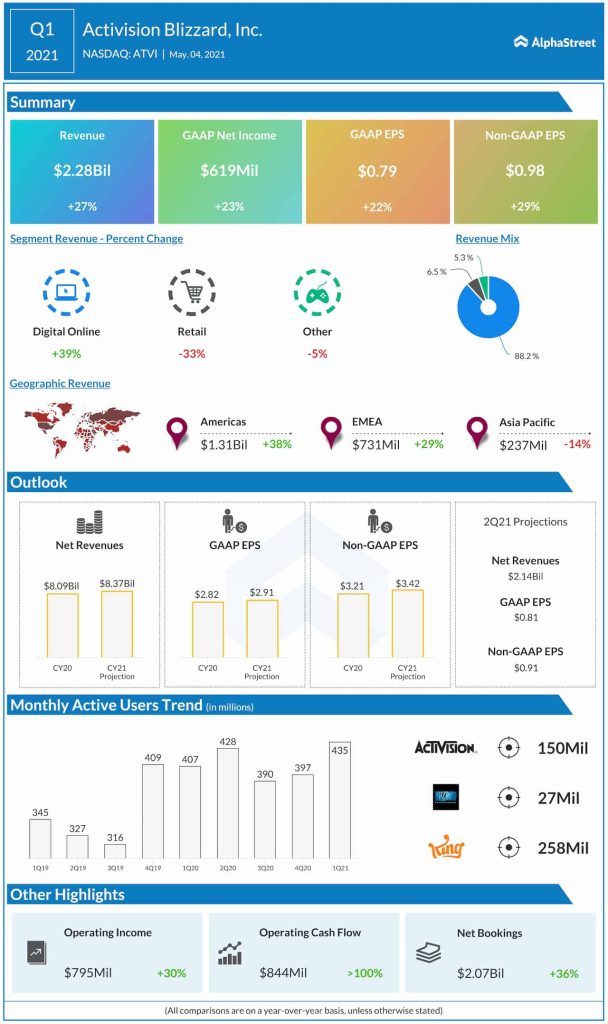

The strong performances of the Call of Duty, Warcraft and Candy Crush franchises helped drive a 27% growth in total revenue and 36% growth in net bookings during the first quarter. The company expects net bookings of $1.85 billion for the second quarter and $8.60 billion for the full year of 2021.

User growth and engagement

The investments made by the company in improving its franchises have helped drive growth in users and engagement. The addition of free-to-play and mobile experiences to Call of Duty more than tripled the monthly active users in the franchise over the last two years and helped the Activision segment reach 150 million users during the first quarter. The company is looking to apply this strategy to its other brands as it aims to reach 1 billion users.

The Blizzard and King segments had 27 million and 258 million users, respectively, in Q1. Within King, the company has been working on adding new features to Candy Crush and delivering more seasonal events to drive engagement. Crash Bandicoot: On The Run!, which was launched in March, has seen 30 million downloads to-date.

Activision Blizzard continues to invest significantly in content development and as part of these efforts, it plans to hire more than 2,000 developers as well as triple the size of some of its franchise teams compared to 2019.

Exciting pipeline

Activision Blizzard has an exciting pipeline that is expected to drive growth in the coming years. Looking into 2022 and beyond, the company is working on its pipeline which includes Diablo IV, Overwatch 2, and multiple Warcraft mobile titles and these are expected to drive significant growth.

Within Blizzard, the company is planning to roll out Diablo II: Resurrected later this year. It also plans to launch Diablo Immortal on mobile. Diablo Immortal is anticipated to help expand Diablo’s reach before the launch of Diablo IV on PC and mobile. The company will also release WoW: Burning Crusade Classic in the coming months. Activision Blizzard expects to generate revenues of $2.13 billion in Q2 2021 and $8.37 billion for full-year 2021.

The stock has a Strong Buy rating and an average price target of $117.13, which represents a 19% upside from the current level.

Click here to read the full transcript of Activision’s Q1 2021 earnings conference call