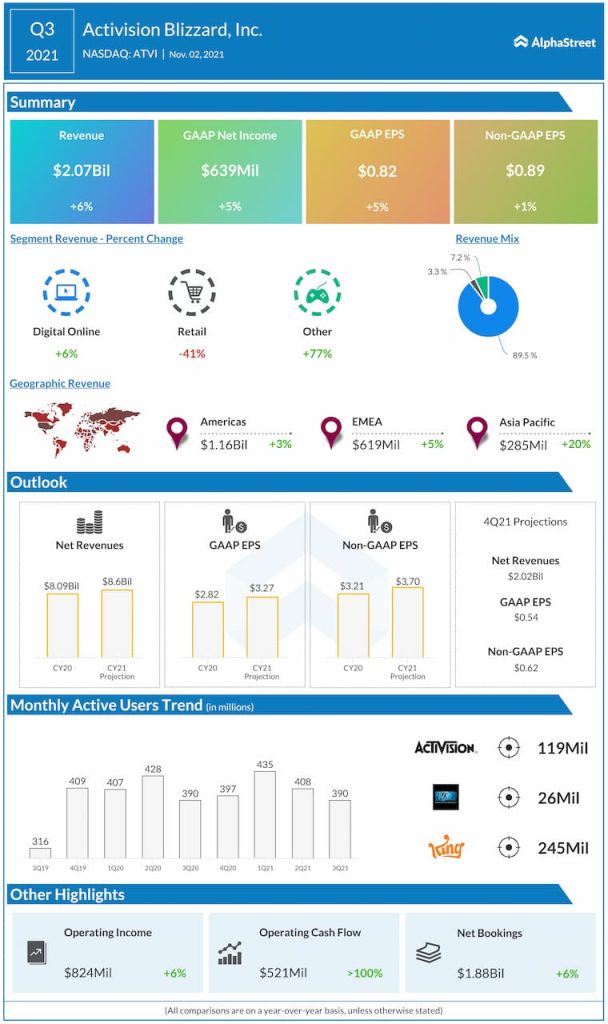

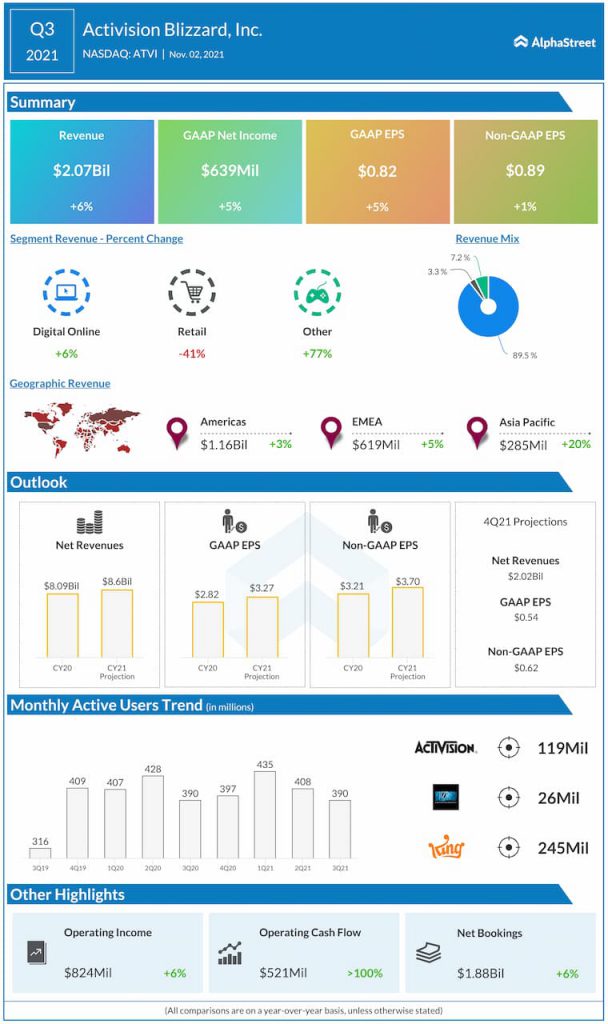

Revenue and earnings beat

User numbers

At the end of Q3 2021, Activision Blizzard had 390 million monthly active users (MAUs), which was unchanged from the same quarter a year ago and down from 408 million in Q2. MAUs in Activision rose to 119 million from 111 million last year but were down from 127 million in Q2. The segment recorded revenue of $641 million which was down YoY.

Blizzard had 26 million MAUs in Q3, down from 30 million a year ago and flat compared to Q2. The segment reported a 20% YoY growth in revenue helped by the successful launch of Diablo II: Resurrected.

King had MAUs of 245 million in Q3, down from 249 million last year and 255 million in Q2. The segment delivered a 22% YoY increase in revenue, driven by a strong quarter for Candy Crush.

Disappointing outlook

Activision Blizzard’s outlook for both the fourth quarter and full year of 2021 failed to impress the Street. The company guided for revenues of $2 billion, adjusted EPS of $0.62, and net bookings of $2.78 billion for the fourth quarter of 2021. Analysts’ projections were for revenue of $2.92 billion and earnings of $1.38 per share.

For the full year of 2021, the company estimates revenue to be $8.66 billion, adjusted EPS to be $3.70 and net bookings to be $8.65 billion. The Street’s estimates were for revenue of $8.8 billion and earnings of $3.83 per share.

Game delays

The biggest setback for Activision Blizzard was the announcement that two of its titles, Overwatch 2 and Diablo IV, would see a delay in their launches.

From the Q3 earnings conference call,

“While we are still planning to deliver a substantial amount of content from Blizzard next year, we are now planning for a later launch for Overwatch 2 and Diablo IV than originally envisaged. These are two of the most eagerly anticipated titles in the industry, and our teams have made great strides towards completion in recent quarters. But we believe giving the teams some extra time to complete production and continue growing their creative resources to support the titles after launch will ensure that these releases delight and engage their communities for many years into the future.”

These delays will push out the financial benefits the company had anticipated to see next year. This did not go down well with investors.

Click here to read the full transcript of Activision Blizzard’s Q3 2021 earnings conference call