Buy AAP?

The company’s stock traded well below its long-term average this week. The low valuation, combined with encouraging target price, should prompt prospective buyers to go for AAP. For those looking for long-term returns, it is a perfect buy-and-hold stock that is relatively safe. Also, income investors would find the steady increase in dividends attractive – an annual dividend of $6.00 per share with a yield of about 3.5%.

Advance Auto Parts Q2 2022 Earnings Call Transcript

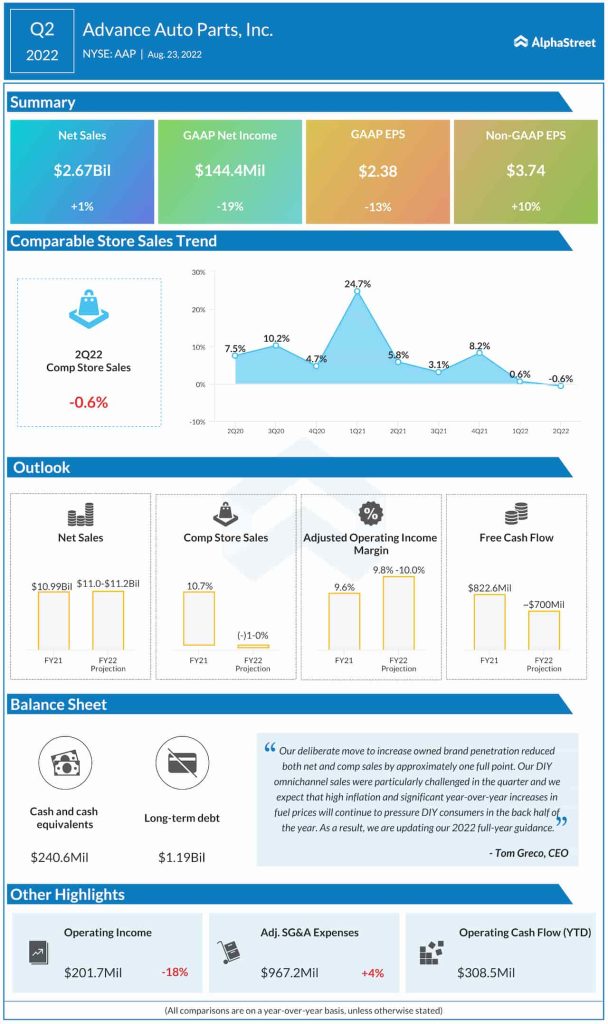

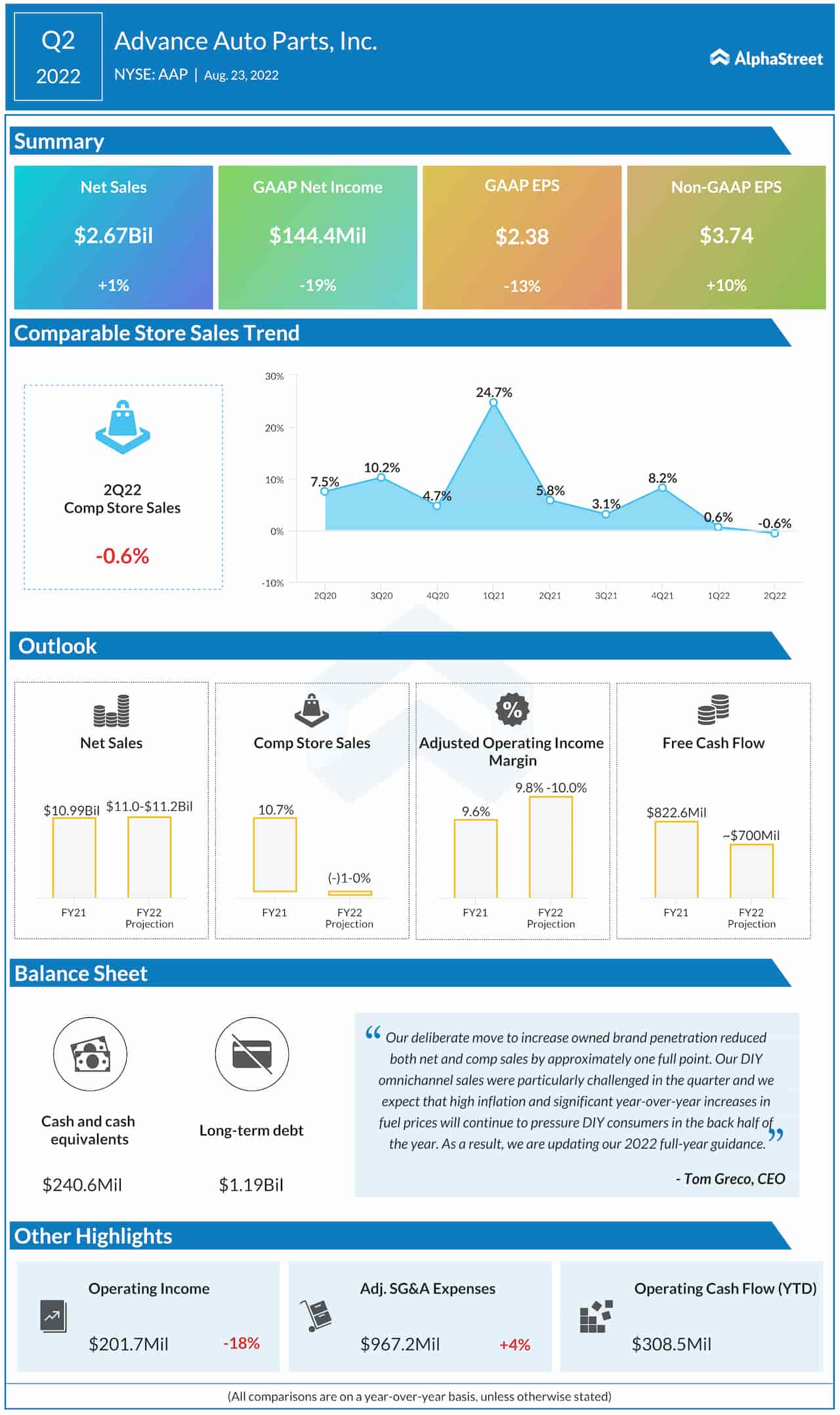

In the first half of the year, earnings increased in both quarters but missed analysts’ forecast, reversing the trend seen last year when the bottom line topped expectations consistently. In the second quarter, sales remained broadly unchanged at $2.7 billion reflecting continued weakness in comparable store sales. At $3.74 per share, adjusted profit was up 10% year-over-year.

Updates

The management’s cautious guidance shows that the comparable sales slump is continuing in the second half, though total sales are seen increasing from last year’s levels. The company recently launched a campaign called Superfan Ed Vance to connect with and attract young and DIY customers. Earlier, it opened 22 new stores in the Los Angeles market as part of the strategy to expand into Western US.

Meanwhile, Advance Auto Parts is doing quite well on the professional installer front, though sales were temporarily hit by the challenging market conditions. As the recovery gathers momentum and the company’s store network expands further, this important business segment is once again taking the lead in revenue generation.

Stable Demand

The prices of new vehicles keep rising amid spiraling input costs and strong pent-up demand. But prospective buyers of new vehicles are likely to postpone their purchases, concerned about the financial uncertainty and macro headwinds, which would in turn drive sales growth for spare parts providers like Advance Auto Parts.

From Advance Auto Parts‘ Q2 2022 earnings conference call:

“As part of category management, our new strategic pricing tools are fully implemented. We’re now leveraging the enhanced capabilities these tools have to offer, which enables us to differentiate pricing by category, region, store, and customer. We’ve also significantly improved visibility into the return on investment surrounding our discounting practices by leveraging Advance analytics to gain insights on the competitive landscape and evaluate our strategic pricing actions.”

Stock Watch: AutoZone stays on the fast track despite cost pressures

The last six months have been a period of high volatility for the stock, which struggled to stay above the $200-mark. Trading slightly above $170, the shares made modest gains early Thursday.