Digital sales

The biggest change the retail industry underwent was the move to online shopping amid the pandemic-related stay-at-home mandates. Many retailers had to accelerate their digital transformation over a couple of months as opposed to a couple of years as they had originally anticipated. The ones who made earlier investments in their digital channels found their strategies paying off.

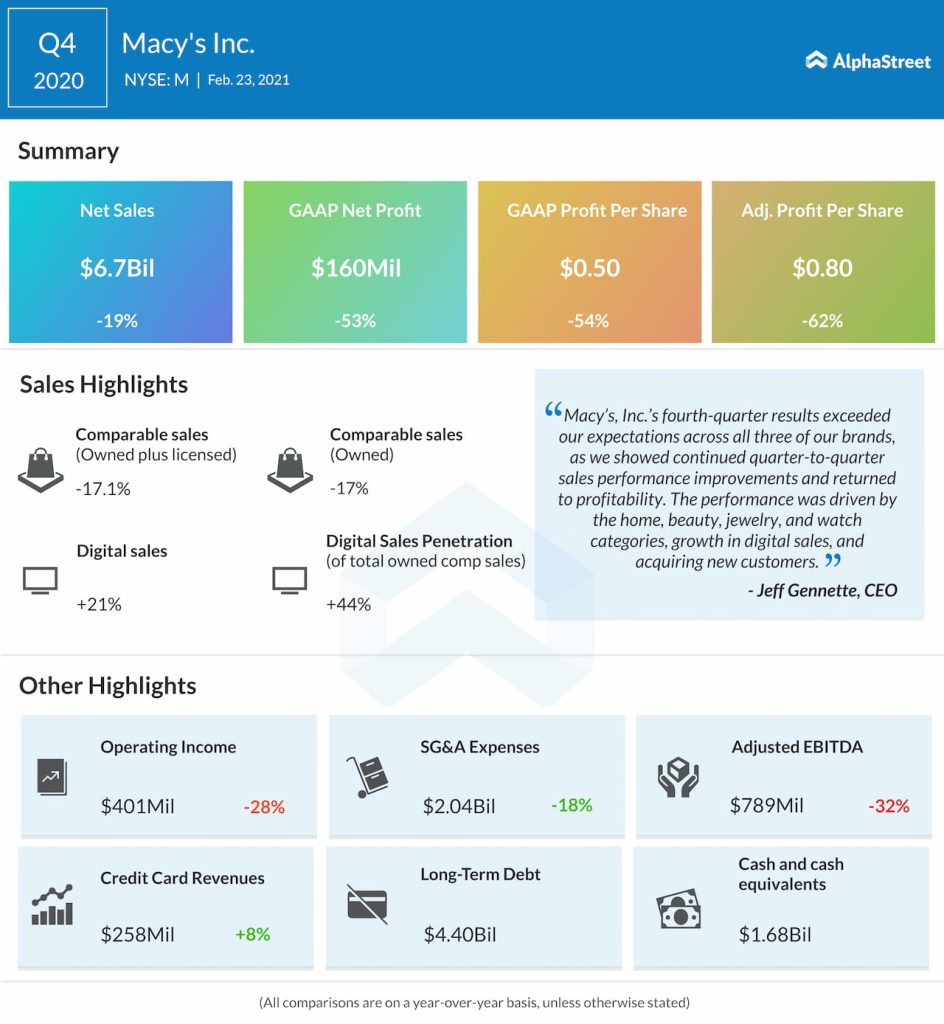

Target Corporation (NYSE: TGT) saw its digital sales grow by nearly $10 billion in 2020 while digital comparable sales rose 145%. Macy’s (NYSE: M) saw its investments in its digital platform pay off during the fourth quarter of 2020 as digital sales increased 21% year-over-year to $3 billion. The company expects its digital channels to generate around $10 billion in sales by 2023. Kohl’s Corp. (NYSE: KSS) saw digital sales grow 22% YoY in Q4 2020, making up 42% of net sales versus 31% last year.

Looking ahead, the digital channel is expected to play a key role in customers’ shopping habits due to the convenience factor. Macy’s expects to see continued double digit growth in digital over the next three years. The company foresees its digital penetration exceeding 40% in the long term. In 2021, Macy’s expects net sales to grow 14-20% YoY to $19.75-20.75 billion. Around 35% of net sales in 2021 is expected to come from the digital channel.

Omnichannel

Stores played a key role in fulfilling digital orders and retailers saw an increased need to improve their omnichannel capabilities. Fulfilment options like curbside pickup gained traction. 95% of Target’s sales in Q4 2020, both online and in-person, were fulfilled by its stores. The company’s same-day services, Order Pick Up, Drive Up and Shipt, grew 212% on a combined basis in the quarter. Approx. 25% of Macy’s digital sales were fulfilled in its stores while Kohl’s stores fulfilled around 45% of its digital sales in the fourth quarter of 2020.

Looking ahead, Target plans to open more stores, including small format and mid-sized ones to serve its different markets. The company aims to drive growth with 30-40 new locations a year, a pace it will keep up for the foreseeable future. Target will also focus on remodelling its existing stores with the goal of completing 150 stores in time for the 2021 holiday season and then increasing this number to over 200 stores in 2022.

Kohl’s believes the Sephora partnership will be a gamechanger for the company going forward. The company will begin the Sephora at Kohl’s store rollout in August 2021 with plans to open 200 stores this year. Kohl’s plans to open 400 stores in 2022 with a focus on increasing this number to at least 850 by 2023.

Assortments

As demand for some categories increased and some decreased, retailers had to revamp their assortments in order to focus on the more profitable ones as well as to meet the changing needs of customers.

From Target’s Q4 transcript:

“In the space of just a few weeks at the outbreak of the pandemic, guests stocked up on food, beverages and essentials. Then they turned to us for help in converting kitchen tables into classroom space and spare bedrooms into home offices and then they looked to Target for fitness gear, games and other entertainment as they settled in for the long haul.”

Kohl’s saw more demand for its athleisure and outdoor categories and the company plans to focus more on these areas in the coming year as well. Kohl’s will extend its assortment in athleisure and outdoor and the company will increase the space for its active category, which has seen strong sales growth, by at least 20% in 2021.

Macy’s saw higher demand in categories such as active, loungewear, home and beauty during 2020. The company will continue to improve its assortment in 2021 and remains ready to shift between categories as demand picks up once things normalize.

Click here to access the transcripts of these companies’ latest earnings conference calls