Investing in TSLA

The company faces challenges such as slowing EV sales and rising competition, but it remains optimistic about the overall strength of its diversified portfolio — driven by the growing energy business, aggressive AI/autonomy push, and innovations like humanoid robots. The rise of China-based EV makers and their expansion into other regions threatens Tesla’s market share, with legacy automakers adding further pressure. The recent stock recovery underpins investors’ confidence in CEO Elon Musk’s technology-focused strategy, suggesting a potential transition from a car company to an AI/robotics conglomerate.

Key Metrics

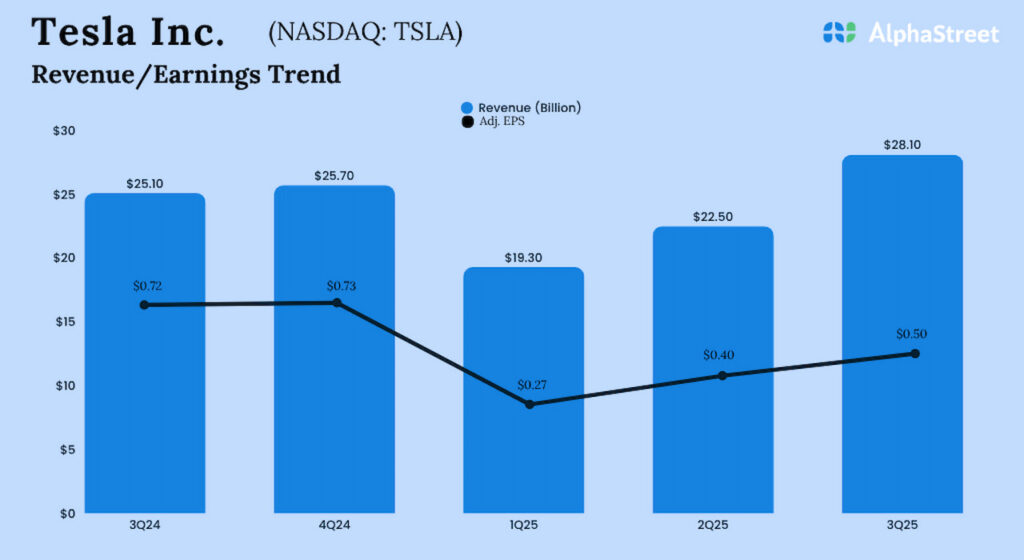

In Q3 2025, Tesla’s revenue increased to $28.1 billion from $25.18 billion in the prior-year quarter, exceeding estimates. The company produced a total of 447,450 vehicles and delivered 497,099 units during the three months. Meanwhile, earnings, excluding special items, dropped to $0.50 per share in the third quarter from $0.72 per share a year earlier. Unadjusted net income was $1.37 billion or $0.39 per share, compared to $2.17 billion or $0.62 per share in the corresponding period of 2024.

“We’re at a critical inflection point for Tesla and our strategy going forward as we bring AI into the real world. I think it’s important to emphasize that Tesla really is the leader in real-world AI. No one can do what we can do with real-world AI. I have pretty good insight into AI in general. I think that Tesla has the highest intelligence density of any AI out there in the car, and that is only going to get better. We’re really just at the beginning of scaling quite massively ‘Full-Self-Driving’ and robotaxi and fundamentally changing the nature of transport,” Musk said in the Q3 earnings call.

Road Ahead

In recent quarters, the company’s sales and profits have often fallen short of analysts’ expectations. The fourth-quarter report is scheduled for release on January 21, after the closing bell. It appears that 2026 will be a pivotal year for the company as it bets big on AI-supported robotics and expands robo-taxi service beyond Austin and the Bay Area into other US cities. Meanwhile, Tesla’s autonomous and robotics initiatives must clear major regulatory hurdles before commercial operation can begin. At the same time, the robo-taxi business faces stiff competition from Google’s Waymo.

On Monday, TSLA had a modest opening and traded lower in the early hours of the session. The stock has lost around 6% since hitting an all-time high in mid-December.