AMD a Buy?

However, the high valuation ratios call for caution, given the relatively low margins that weigh on profitability. Moreover, the unimpressive return on assets does not justify the high spending. In short, there are downside risks that cannot be ignored. Currently, analysts’ consensus recommendation for the stock is moderate buy, with a price target of about $38 that represents a 13% downside.

Uptrend

Soon after the last quarterly report, the stock withdrew briefly from the highs, despite the firm posting stronger-than-expected earnings. The market was disappointed by the weak guidance issued by the management for the final months of the fiscal year. After the short-lived selloff, the stock regained strength in the following weeks.

Strong Sales

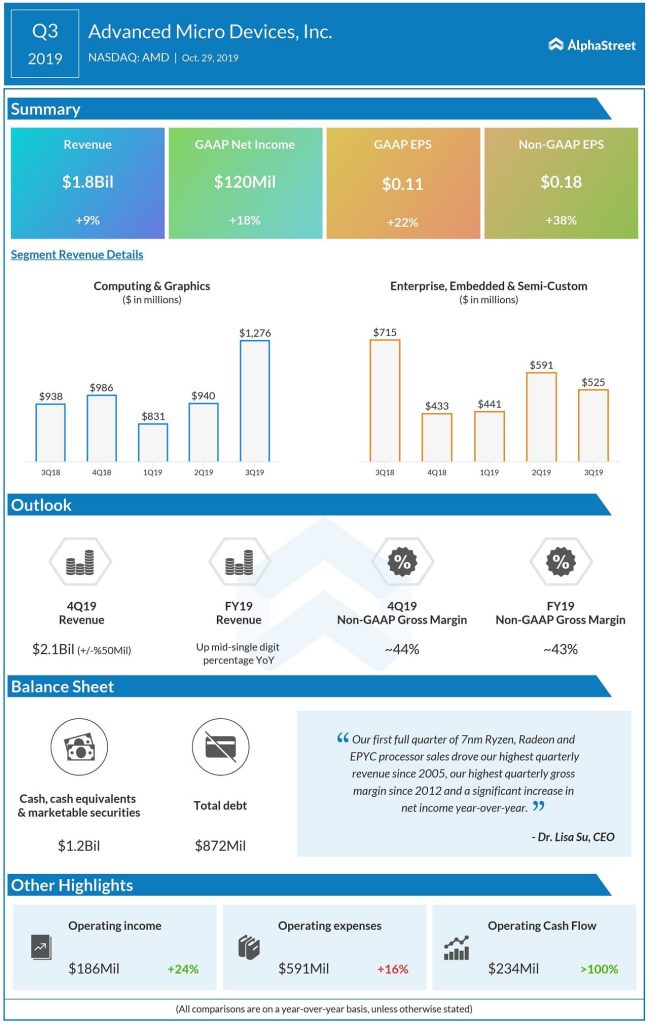

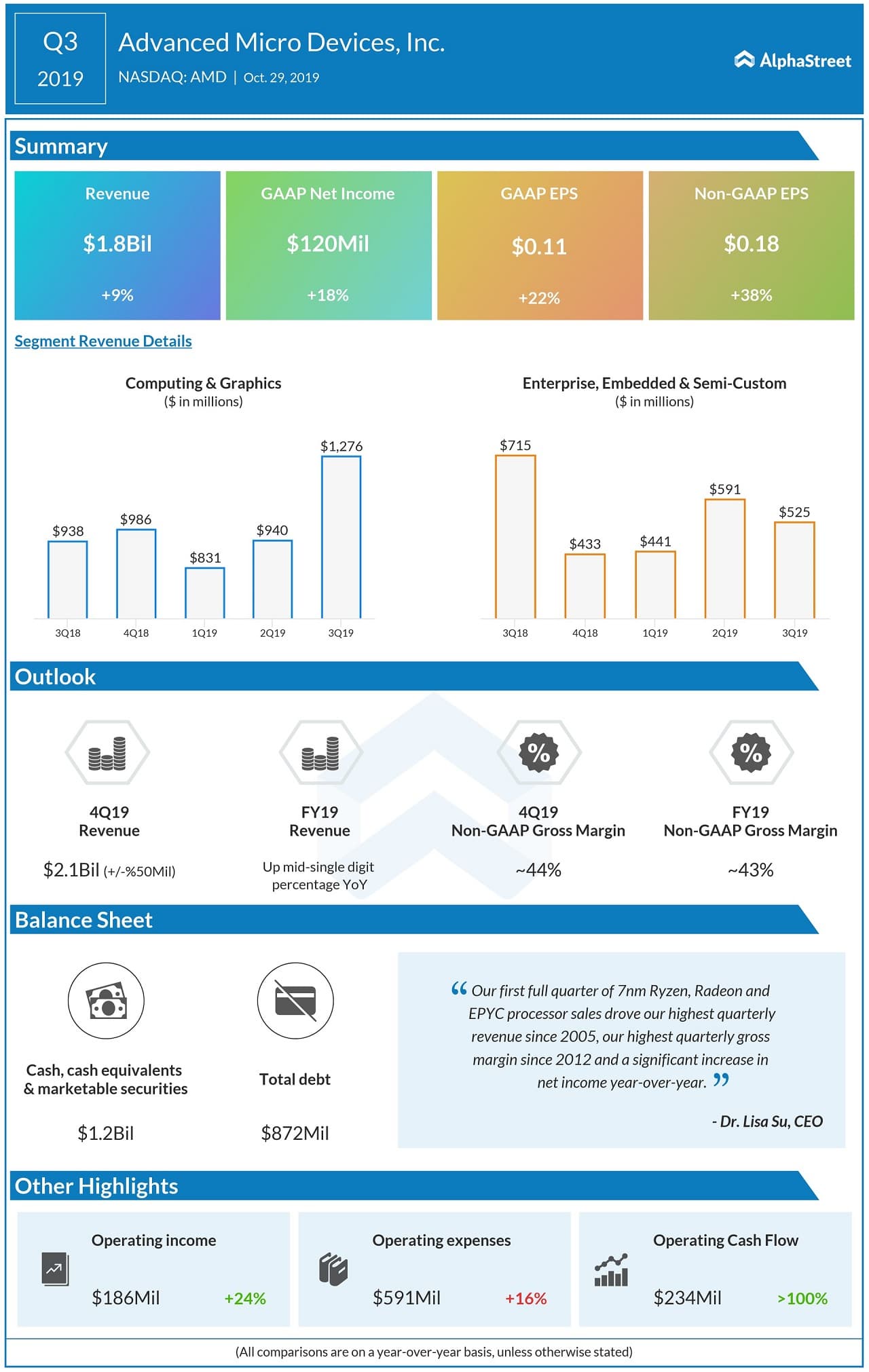

In the third quarter, solid performance by the Computing and Graphics division more than offset weakness in the enterprise segment, driving revenues by 9% to $1.8 billion. As a result, earnings rose in double digits to $0.18 per share. The results also topped the Street view.

Related: AMD Q3 2019 Earnings Conference Call Transcript

Intel, which is on the verge of being dethroned by AMD, slipped to a new low earlier this year when market watchers turned bearish after the company issued disappointing profit guidance. However, the stock recovered after a lot of struggle, while the company continued to lose ground in the data center market.