Alexion Pharmaceuticals (NASDAQ: ALXN) announced today that it will be acquiring commercial-stage biopharmaceutical company Portola Pharmaceuticals (NASDAQ: PTLA) for an initial consideration of $1.44 billion or $18 per share. While Portola shares jumped more than 130% in the pre-market session, Alexion shares dropped about 5%.

Transaction details

Under the terms of the agreement, Alexion’s subsidiary will initiate a tender offer to acquire all of the outstanding shares of Portola’s common stock at a price of $18 per share in cash. When the tender offer is completed, Alexion will buy back all remaining shares not tendered in the offer at the same price of $18 per share through a merger. Alexion will also be acquiring $215 million of cash on Portola’s balance sheet, net of debt. Alexion will fund this deal, which is targeted to close in the third quarter of 2020, with the cash on hand.

Acquisition rationale

Portola’s Andexxa drug is used in the major and life-threatening bleeds including gastrointestinal and intracranial hemorrhage and it has got a strong patent and regulatory exclusivity through 2030 in the US and 2028 in the European Union. With Alexion’s strong global footprint, Portola expects Andexxa will have stronger utilization, increased penetration, and accelerated adoption.

Alexion’s CEO Ludwig Hantson said:

“The acquisition of Portola represents an important next step in our strategy to diversify beyond C5. Andexxa is a strategic fit with our existing portfolio of transformative medicines and is well-aligned with our demonstrated expertise in hematology, neurology and critical care.”

Portola

The South San Francisco, California-based firm develops and markets drugs in the fields of thrombosis and other hematologic conditions. Portola’s two commercialized products are Andexxa, which is marketed in Europe as Ondexxya and Bevyxxa. For the year ended December 31, 2019, sales of Andexxa/Ondexxya amounted to $111.5 million out of the total sales of $116.6 million. The non-GAAP loss for the year narrowed to $198 million or $2.77 per share from the prior year’s loss of $274 million or $4.16 per share.

Portola is scheduled to report its first quarter 2020 results on Monday, May 11, 2020.

Alexion

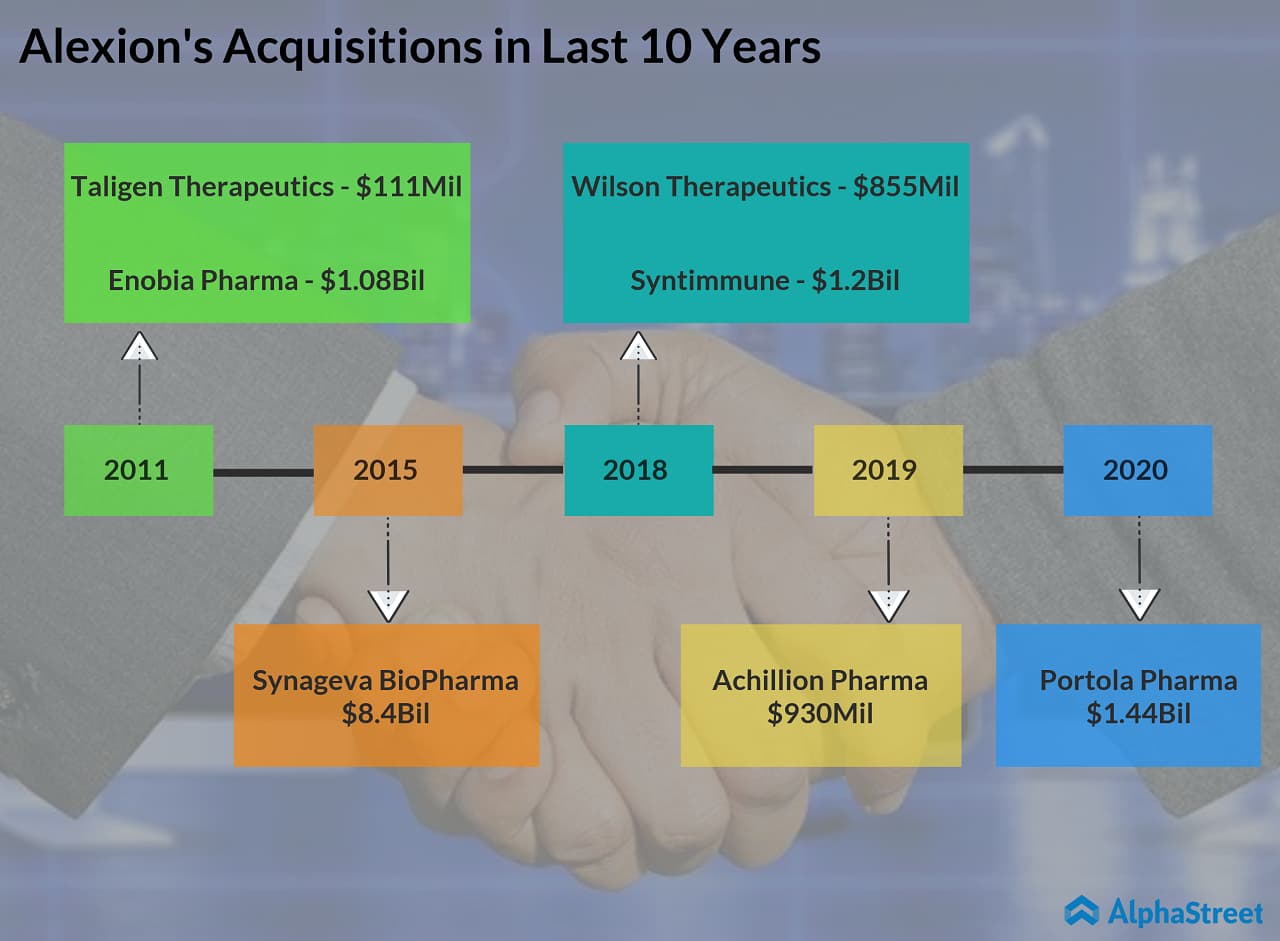

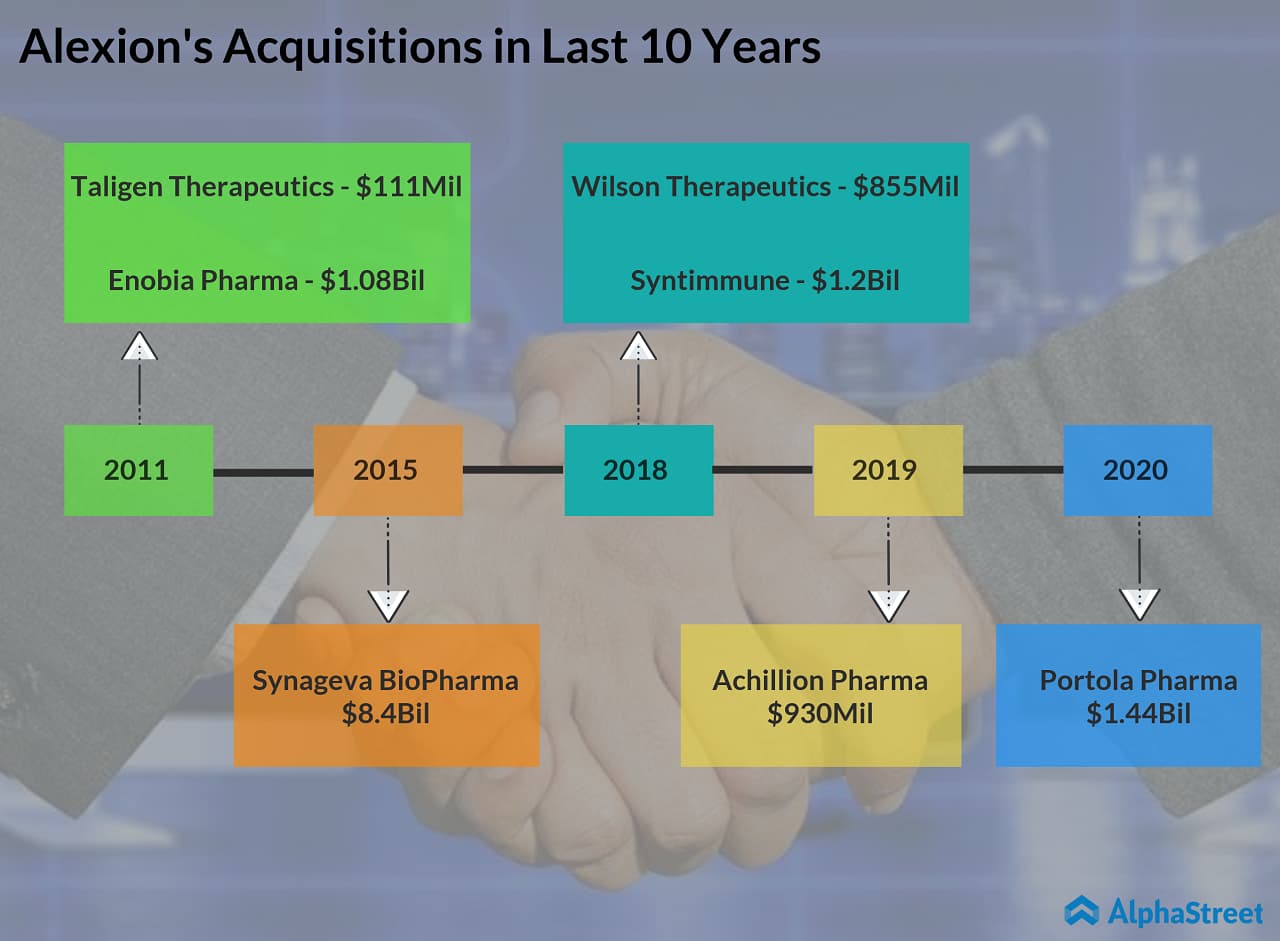

The Boston-based drugmaker is set to report its first quarter 2020 financial results tomorrow before the market opens. Apart from today’s deal, the company is expected to provide updates on the potential impact of COVID-19 on its business. Wall Street expects Alexion to earn $2.71 per share on revenue of $1.36 billion for the to-be-reported quarter. In January 2020, Alexion completed the acquisition of Achillion which was acquired by Alexion for $930 million in the last year.