Alibaba continues to increase its spending and investments in the business, strategic acquisitions, and certain initiatives. The company believes the investments and initiatives are crucial to its future growth, but they will have the effect of increasing its costs and lowering margins and profit, and this effect may be significant in the short term and potentially over longer periods.

In recent years, the company has experienced significant growth in revenue and in its business. This is likely to depend on the growth of its core businesses. The top-line growth is likely to be hurt by decreasing consumer spending, rising competition, and slowing growth of China’s retail industry as well as changes in the political and economic conditions.

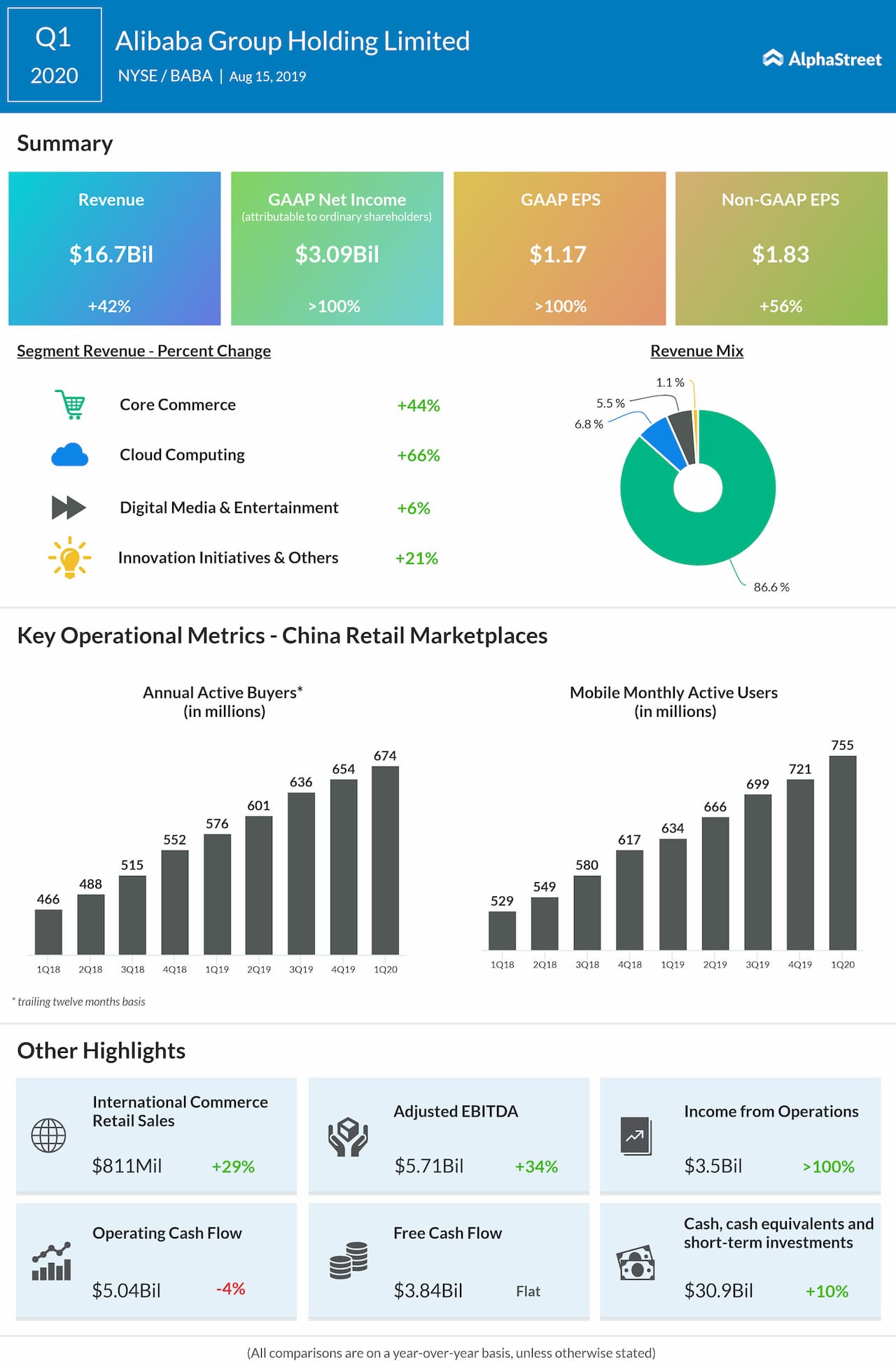

Analysts expect the company’s earnings to jump by 7.10% to $1.50 per share and revenue will soar by 33% to $16.47 billion for the second quarter. The company has surprised investors by beating analysts’ expectations in all of the past four quarters. The majority of the analysts recommended a “buy” rating with an average price target of $222.81 per share.

For the first quarter, Alibaba posted a 145% jump in earnings helped by higher revenues and lower costs and expenses. The company continued to expand its customer base, increase operating efficiency, sustain user engagement and consumer spending across its platforms. The company continues to invest in long-term growth while at the same time gaining cost efficiencies in its investment areas.

Last week, eBay (NASDAQ: EBAY) posted better-than-expected earnings and revenue for the third quarter helped by an increase in the number of active buyers. Meanwhile, Amazon (NASDAQ: AMZN) reported lower-than-expected earnings for the third quarter despite a double-digit rise in revenues.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions