Quarterly numbers

Core commerce

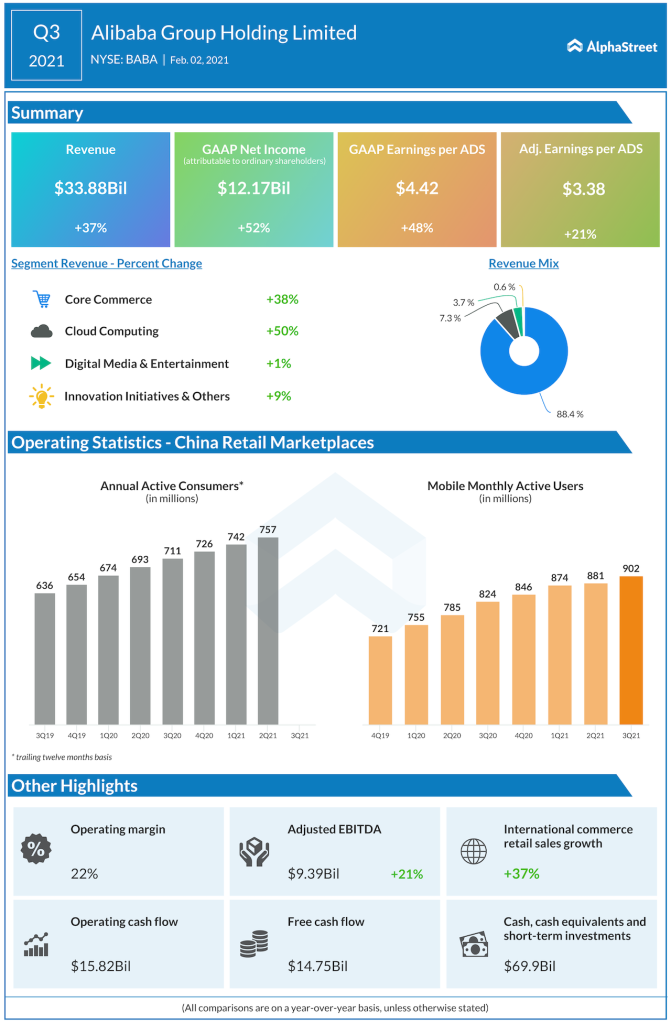

Alibaba saw its China commerce retail and wholesale businesses increase 39% and 14% year-over-year helped by higher customer management revenues and higher revenue from paying members. In December 2020, the company had 902 million mobile MAUs at its China retail marketplaces which was up by 21 million from September.

Annual active customers on Alibaba’s China retail marketplaces totaled 779 million for the 12 months ended December 31, 2020, reflecting a quarterly increase of 22 million. The company witnessed higher purchase frequency from all city tiers which drove growth in wallet share among its users.

Taobao Deals was instrumental in helping the company acquire new users in less developed regions through a broader range of products thereby helping Alibaba increase penetration in these areas. Annual active customers of Taobao Deals reached over 100 million for the 12 months ended Dec. 31, 2020.

Alibaba spread out its 11.11 Global Shopping Festival over 11 days this year to make it easier for merchants and customers. The company saw 30 million new product launches this year along with a 35% year-over-year increase in GMV, excluding unpaid orders, for new products.

Cloud computing

During the third quarter, Alibaba witnessed solid growth in its cloud computing business and maintained a strong position in the market as its technology investments continued to pay off. Revenues in cloud computing rose 50% year-over-year helped by higher revenue from customers in the internet and retail industries.

For the first time, Alibaba achieved profitability in its cloud business on the basis of adjusted EBITA during the quarter. The company continues to see vast potential in China’s cloud computing market and is investing in cloud technologies to drive growth.

Regulatory matters and Ant IPO

Alibaba is facing an investigation from the State Administration for Market Regulation on the matter of monopolistic practices. The company said it is cooperating with the SAMR and has created a special task force to conduct internal reviews.

In November, Ant Group suspended its proposed dual listings and IPO. As the Fintech regulatory environment in China has changed, Ant Group is developing a rectification plan which will need to undergo regulatory procedures. As Ant Group’s IPO plans currently face uncertainties, Alibaba is unable to assess the impacts on its business and plans to provide further updates once the regulatory procedures are completed.

Click here to read the transcript of Alibaba Q3 2021 earnings conference call