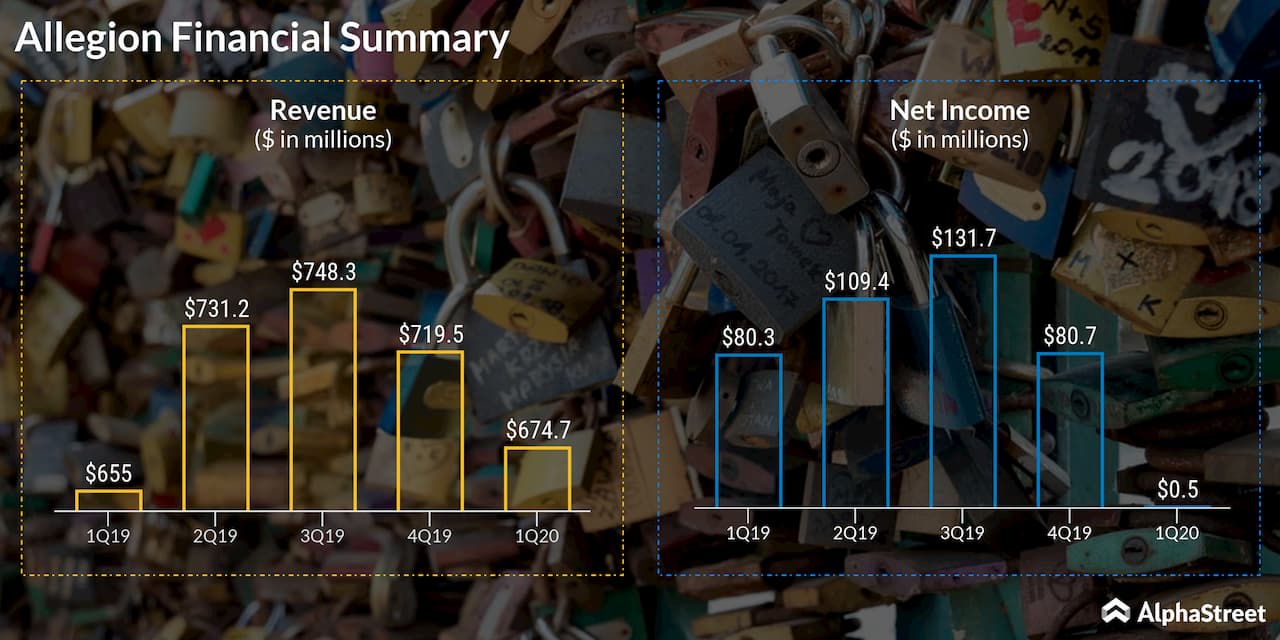

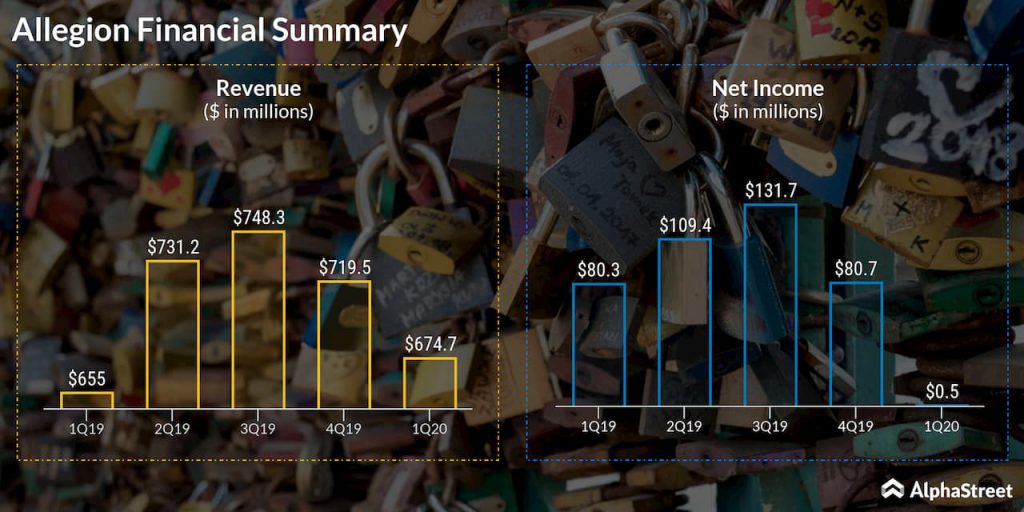

Allegion Plc (NYSE: ALLE) reported a 99% dip in earnings for the first quarter of 2020 due to the charges from goodwill and indefinite-lived trade name impairments.

The company previously withdrew its 2020 outlook for revenue and EPS due to the uncertainty surrounding the COVID-19 pandemic, as well as its impact on demand and the supply chain. The company expects the pandemic will cause near-term negative financial impacts to revenue, income, and cash flow for its business.

The company is taking proactive measures such as reductions in discretionary spending, eliminating non-essential investment spend, implementing a hiring freeze, and temporarily suspending share repurchases. On April 10, the company said it expects to record restructuring charges of $30-35 million in total, of which $20-25 million are expected to be incurred during 2020 with the remainder to be incurred during 2021.