Amarin Corporation plc (NASDAQ:AMRN) reported second quarter 2020 earnings results today. The company reported a 34% growth in total revenue to $135.3 million, helped by a 33% growth in net product revenue.

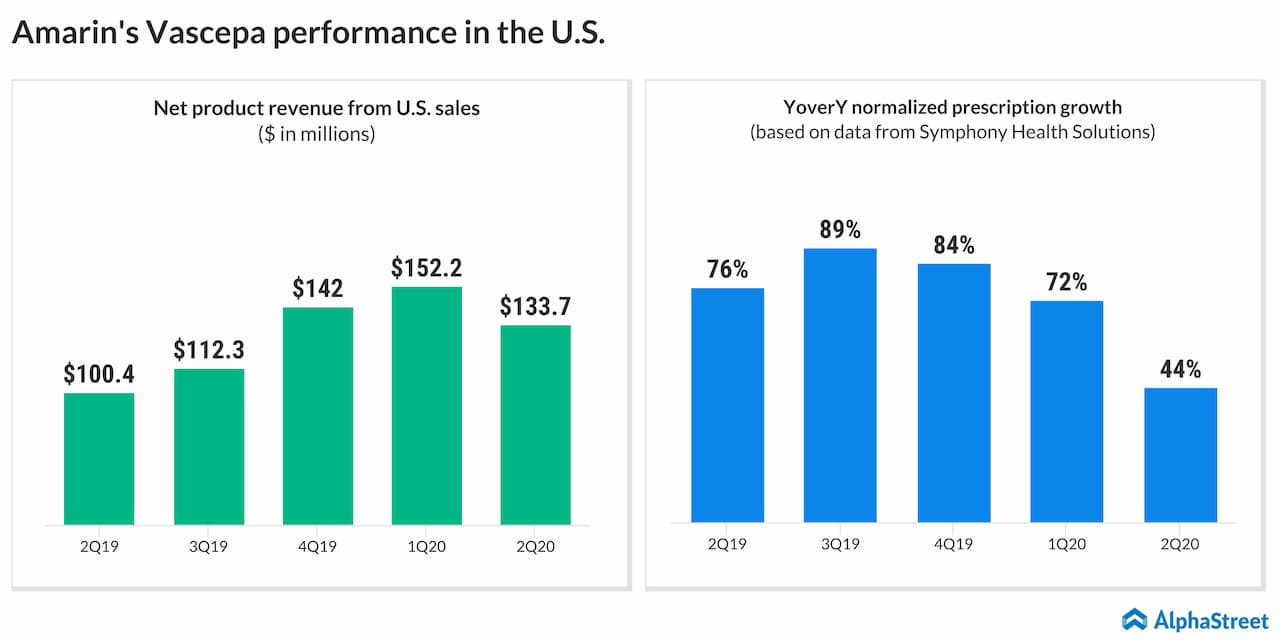

Net product revenues rose to $133.7 million, mainly due to higher VASCEPA sales and an increase in VASCEPA selling price in the US, reflecting various factors like managed care coverage improvements. International sales of VASCEPA totaled $1.8 million in the quarter.

On a GAAP basis, net income totaled $4.4 million, or $0.01 per share, compared to a net loss of $1.8 million, or $0.01 per share, in the same period last year. Adjusted net income was $16.5 million, or $0.04 per share, compared to $6.1 million, or $0.02 per share, last year.

Normalized prescriptions for VASCEPA increased by approx. 44% and 47% year-over-year in the second quarter based on data from Symphony Health and IQVIA, respectively. Estimated normalized VASCEPA prescriptions totaled around 1,090,000 and 1,007,000, based on data from Symphony and IQVIA.

Revenue and prescription growth for VASCEPA were negatively impacted by the restrictions put in place due to the coronavirus pandemic, which led to reductions in patient visits, routine lab tests and interactions between sales personnel and physicians. According to reports from IQVIA, patient visits dropped by around 70% from pre-COVID-19 levels.

In a separate release, Amarin announced its plans to launch VASCEPA in Europe through its own commercial organization for the reduction of cardiovascular risk in high-risk patients. The application is in the late stages of review and is awaiting approval from European regulatory agencies.

The company also expects the results from its VASCEPA clinical trial in China to be reported by its partner before the end of 2020.