Strong Buy

Read management/analysts’ comments on Amazon’s Q1 report

On the growth front, currently the management’s focus on the Amazon Care telemedicine program, which was piloted earlier this year. The company plans to extend the service to all states with a focus on untapped regions. If things go as planned, the initiative could become a game-changer for both the company and the healthcare market. That will add significantly to AMZN’s market value while generating handsome long-term returns for shareholders.

Opportunities Galore

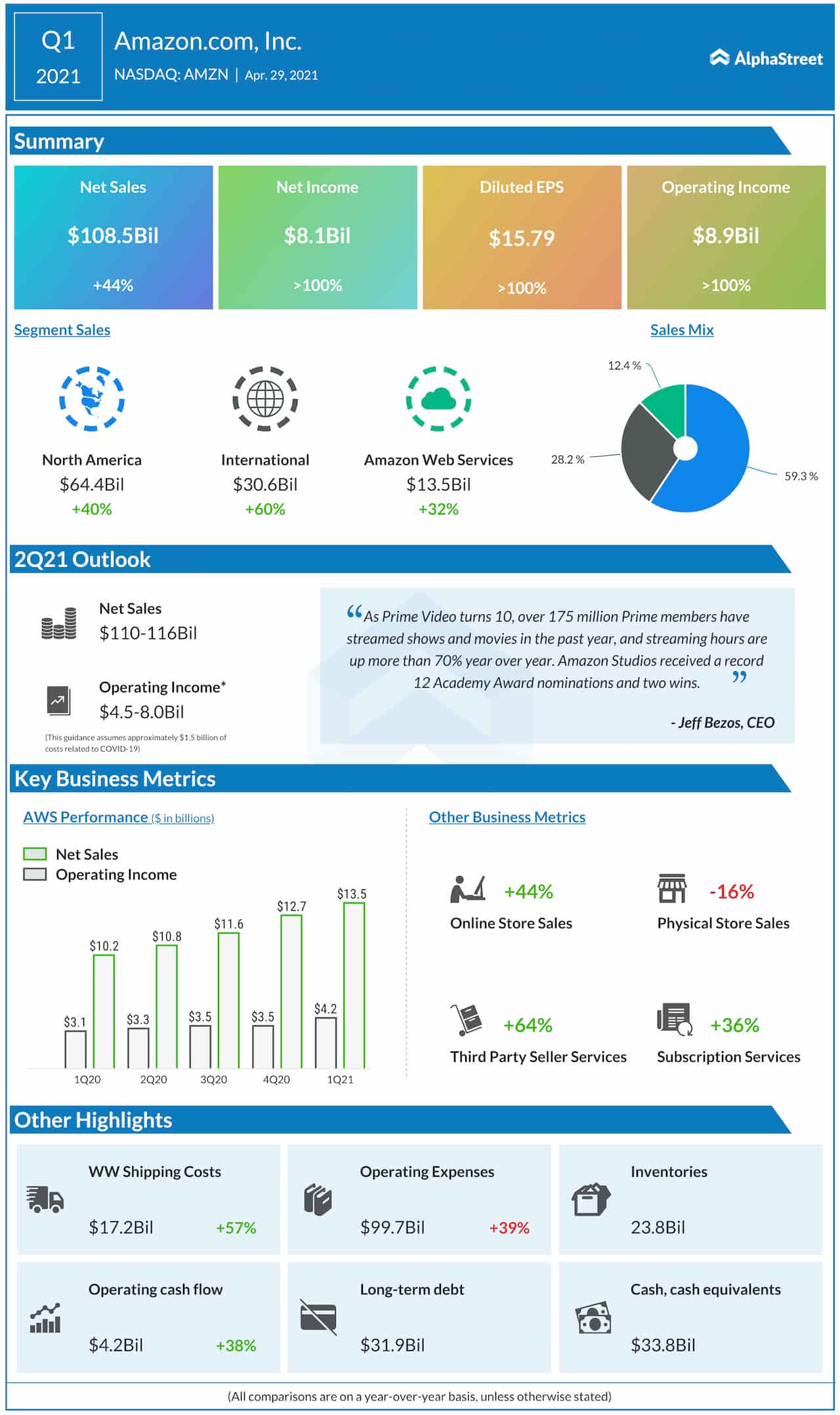

The demand for cloud and service-marketplace, the other key areas of expertise for Amazon after e-commerce, is growing rapidly. Also, Amazon Prime’s prospects got a boost from the virus-related movement restrictions that made people consume more online content, thereby broadening the subscriber base.

In the early months of fiscal 2021, Amazon’s CapEx grew a whopping 80% from last year, with the lion’s share of that being spent on delivery and transportation facilities so as to reduce reliance on third-party service providers like FedEx (FDX) and United Parcel Services (UPS). Armed with a wider fulfillment network and a bigger aircraft fleet, the company looks well-positioned to scale new heights this year.

Broad-based Growth

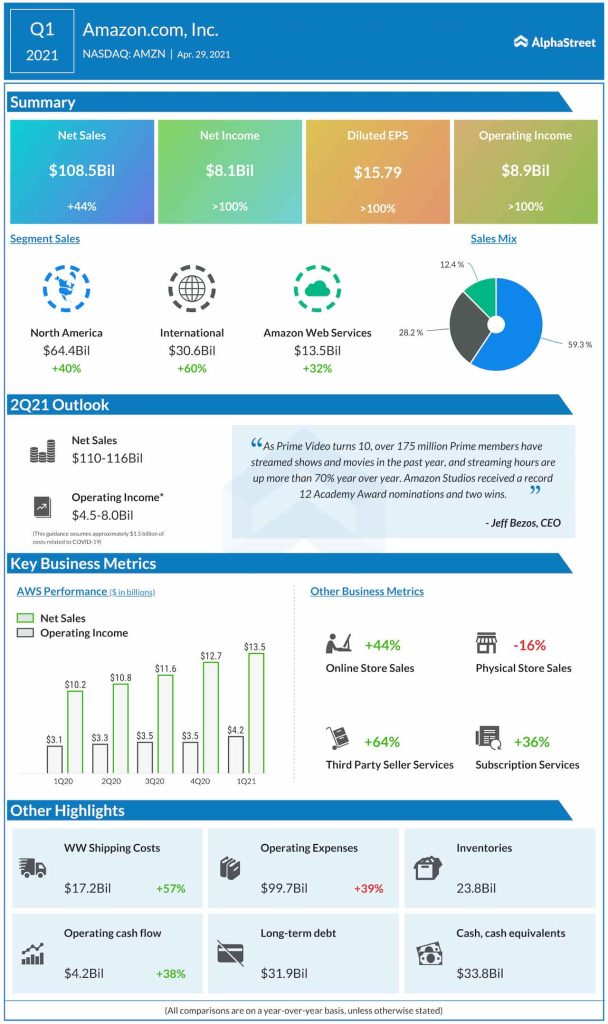

In the first quarter, double-digit growth across all business segments translated into a 44% jump in revenues to about $109 billion. With a 32% annual growth, AWS’s share in the top-line rose further. That drove up earnings to a record high of $15.79, which also topped expectations.

From Amazon’s first quarter 2021 earnings conference call:

“There is always a lot of areas we’re working to improve upon. I think generally the speed of innovation is very quick at Amazon. But we always wanted to be quicker and we always wanted to be globally consistent and we want to take the best practices from one country to make sure we’re doing it the same way everywhere. I think currently on our list right now is that we are in the process of re-getting our one-day shipping percentages back up to where they were pre-pandemic.”

At the Bourses

After gaining 53% in the past twelve months, Amazon’s shares traded slightly above $35,00 on Friday afternoon. That is pretty close to last year’s peak and sharply above the 52-week average. The stock has outperformed most of its peers and the broad market. Analysts see a 14% growth in the next twelve months.